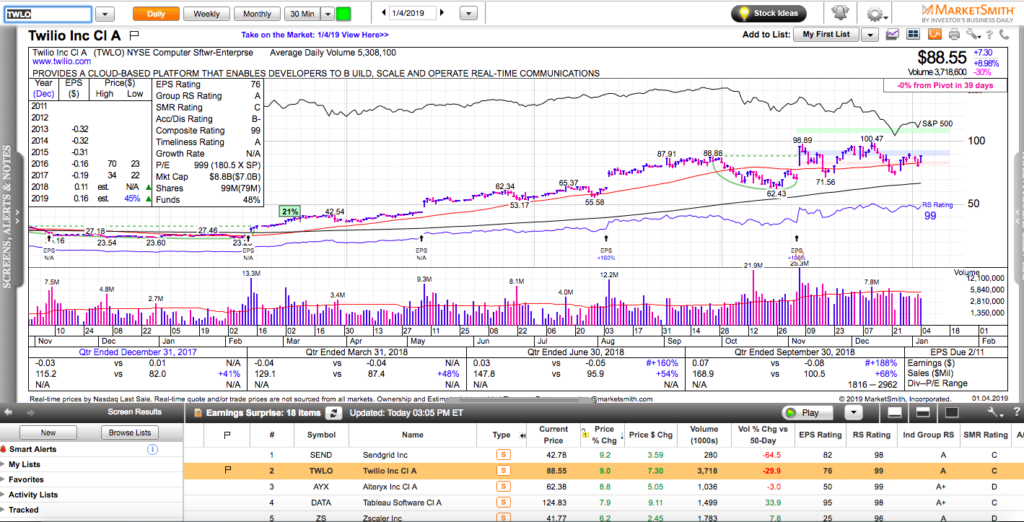

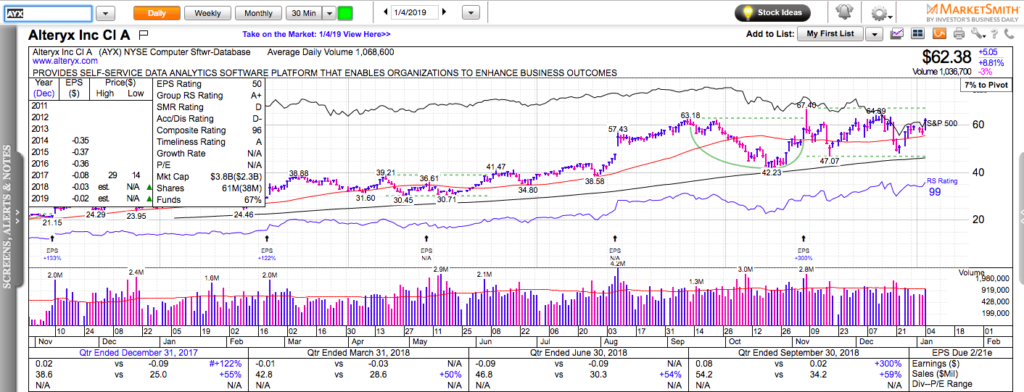

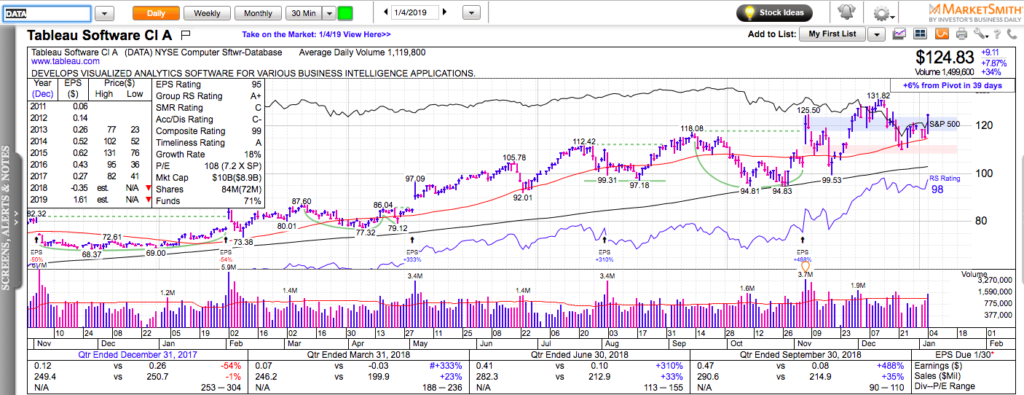

All charts on Momentum Monday are powered by MarketSmith

The oversold bounce continues with full force led by two groups of stocks:

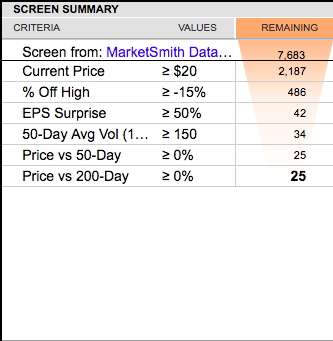

- The ones the held the best during the correction – enterprise software names like TWLO, TEAM, MDB, AYX, SPLK, etc.

- The ones the were hit the hardest during the correction – small-cap biotech. (XBI).

My trading thesis is that all major U.S. stock indexes are now in new ranges. SPY is in 230 to 260. QQQ is between 145 and 160. IWM is between 125 and 145.

As they approach the upper levels of their potential new ranges, it makes sense to take profits if we bought the dip in the past couple of weeks and even think about initiating some small short positions if you are aggressive and skilled.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.