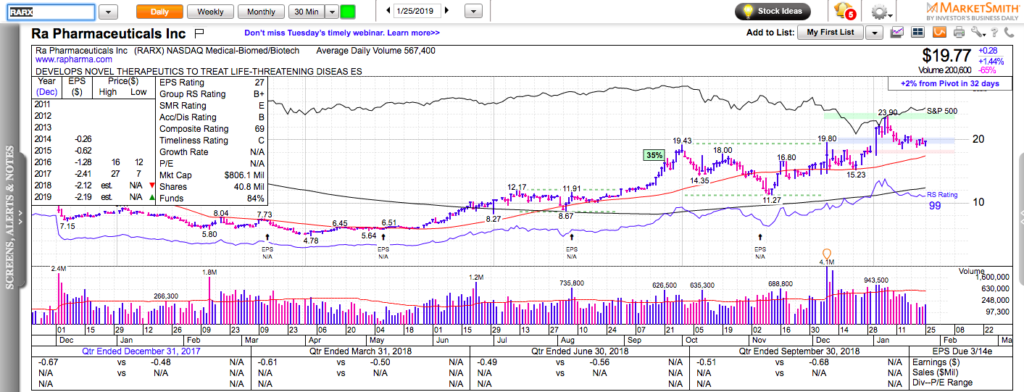

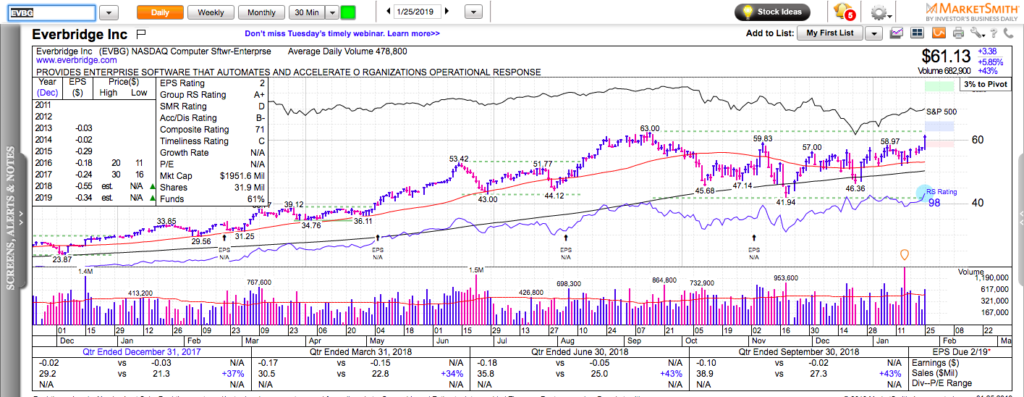

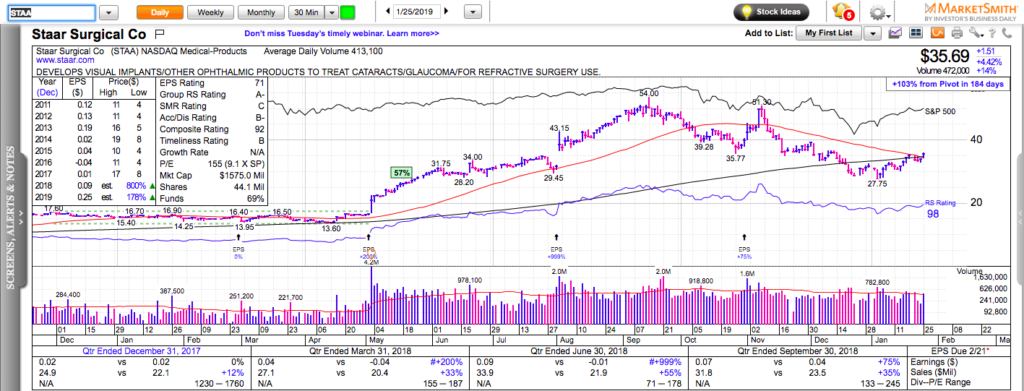

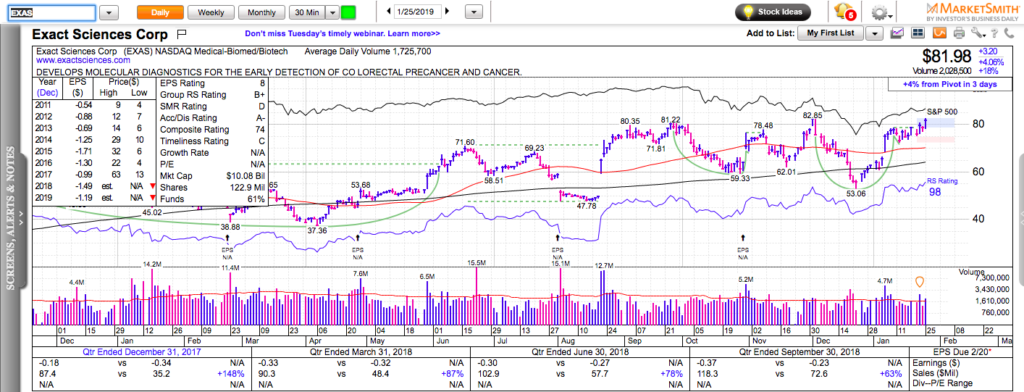

All charts on Momentum Monday are powered by MarketSmith

The rally was tested last week and it passed with flying

We are entering an interesting territory, where those who did not participate in the rally might become complacent and jump back in the market. The joy of missing out might turn into a fear of missing out. Tops are not made out of euphoria. They are not made out of slowing momentum either. They are made out of accelerating selling. There is no evidence of that yet. The 40 and the 50-week moving averages are the next levels of technical resistance.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.