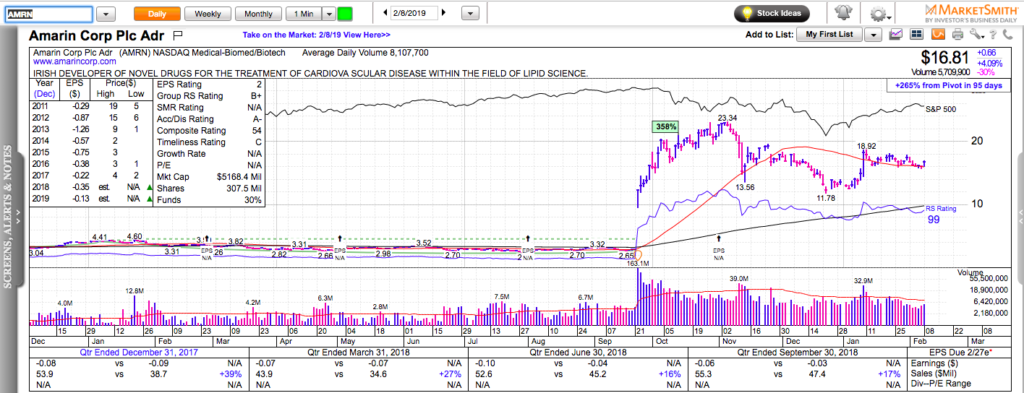

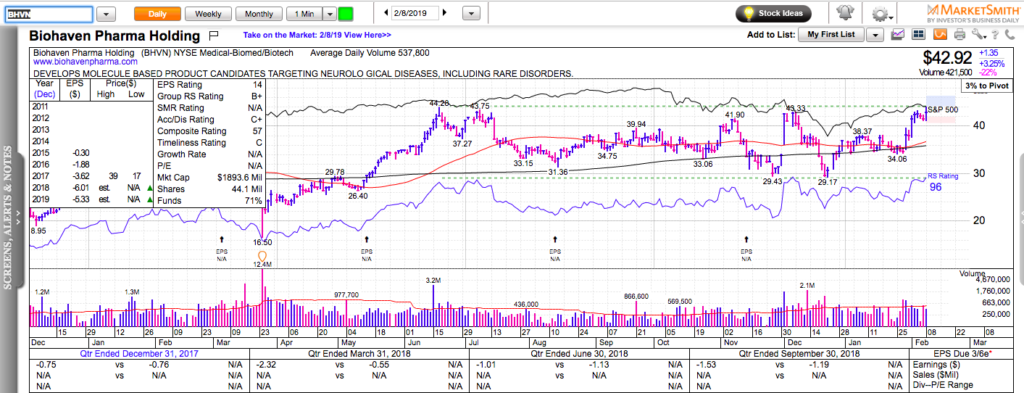

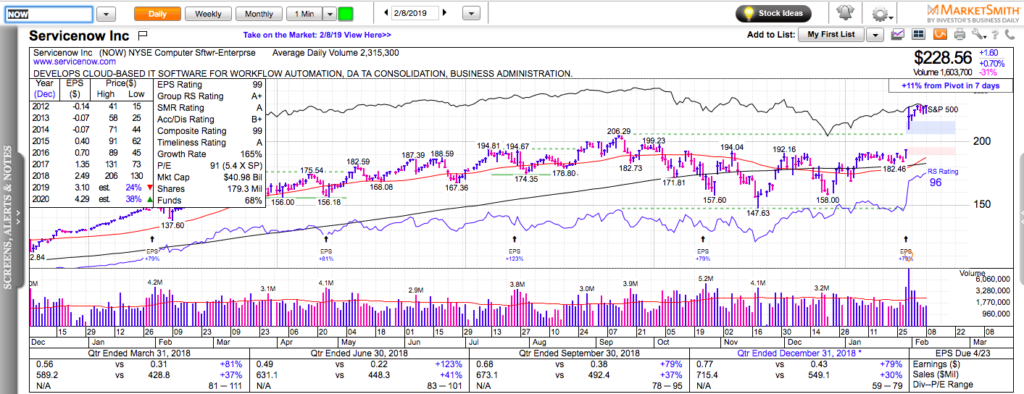

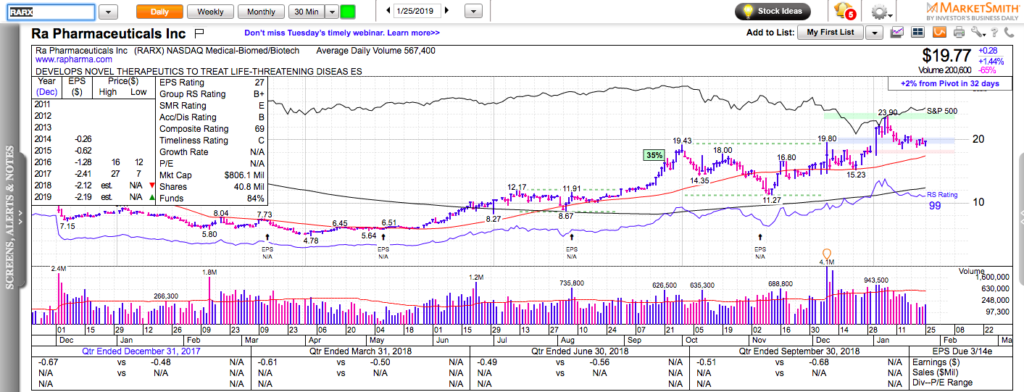

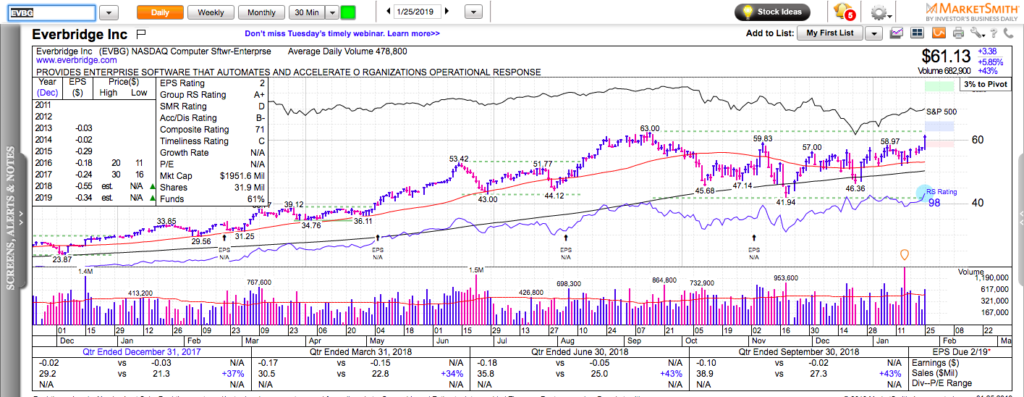

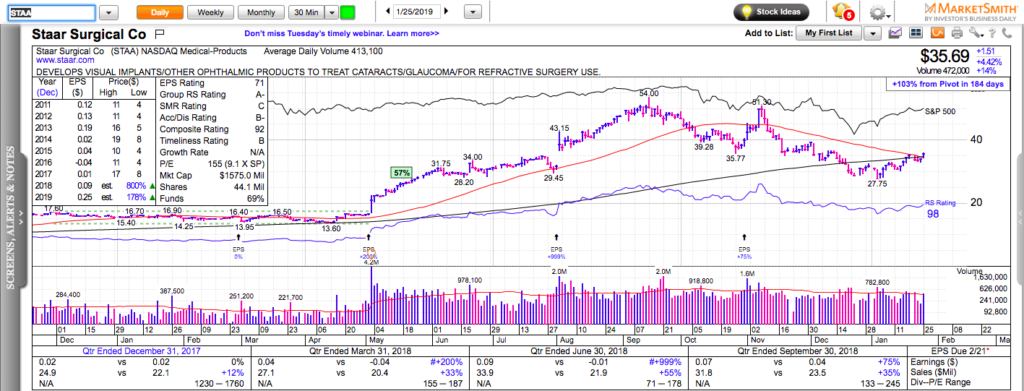

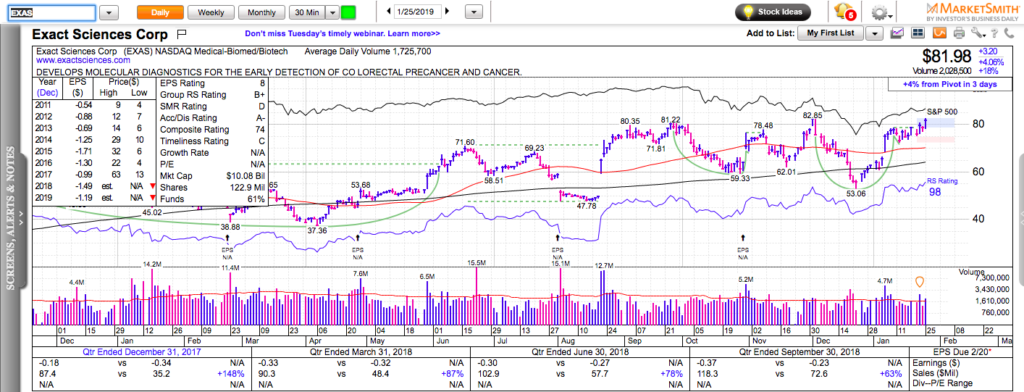

All charts in this post are powered by MarketSmith

SPY and QQQ had a minor pullback once they reached their 200-day moving averages, but under the surface we continue to see mostly positive price action. Dip buyers continue to be firmly in charge. Momentum stocks are still breaking out and holding their earnings gaps.

Here are a few anticipation setups for next week in stocks with very high relative strength: NOW, GHDX, AMRN, BHVN, etc.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.