A setup is a combination of factors that need to align in time and space in order to produce a buy or sell signal. Look at it as a checklist. I already stressed out on numerous occasions that when it comes to swing setups, the two main equity selection factors are price and industry group momentum. Everything else is secondary. The purpose is to find quick 5 – 30% moves in 2 to 10 trading days.

How are position setups different?

Their purpose is to enter and ride a trend for as long as possible and as bigger gain as possible. What are some of the most important factors that matter for the equity selection process of position trades? Price momentum, Earnings and sales growth momentum, earnings surprise momentum, guidance are among the most important ones. All of them take a central place in the Stocktwits 50 algorithm.

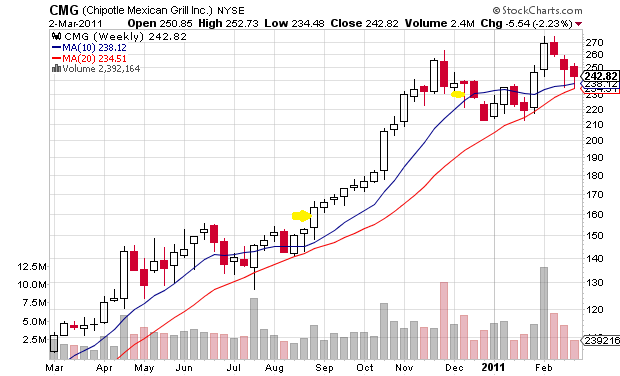

The best way to show what is a position setup and how it could be managed is through example. Let’s take a look at $CMG

Entry:

– Opening new position: One good entry point could be a 5%+ move to a new 6 month high on above the average 50-day volume. Better risk/reward entries typically take into account 3 month price growth. For example being under 30% signifies that the stock is not too extended.

In the case of $CMG, the stock made a 5.7% move to a new all-time high on September 1st 2010. The volume was more than 2 times the 50-day average. The 3-month return of $CMG before that move on September 1st, was 7%.

There are numerous other entry approaches: a 2% to 52-week high; a 2% move to new all-time high…

– When to add to a position: 3% bounces from the relevant moving average is a good risk/reward entry point. In the case of $CMG, the relevant MA since September 1st has been the 20sma.

Exit

– Partial Exit: Momentum stocks often go parabolic in the last 1/3 of their move; therefore it makes sense to take partial profits when they extend too far from their 50-day MA. For example $CMG was 25% above on Oct 22 and Nov 30th.

– Closing the whole position: when the stock closes below its relevant moving average or its50-day MA or if you are really long-term investor – the 100 day MA. Some people use a new 20-day low as an exit signal or some form of ATR (Average True Range).