1. Perceptions affect prices and prices affect perceptions

I believe that market prices are always wrong in the sense that they present a biased view of the future. But distortion works in both directions: not only do market participants operate with a bias, but their bias can also influence the course of events.

For instance, the stock market is generally believed to anticipate recessions, it would be more correct to say that it can help to precipitate them. Thus I replace the assertion that markets are always right with two others: I) Markets are always biased in one direction or another; II) Markets can influence the events that they anticipate.

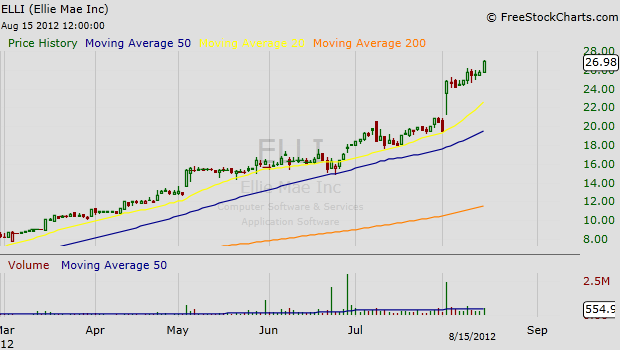

As long as the bias is self-reinforcing, expectations rise even faster than stock prices.

Nowhere is the role of expectations more clearly visible than in financial markets. Buy and sell decisions are based on expectations about future prices, and future prices, in turn are contingent on present buy and sell decisions.

2. On Reflexivity

Fundamental analysis seeks to establish how underlying values are reflected in stock prices, whereas the theory of reflexivity shows how stock prices can influence underlying values. One provides a static picture, the other a dynamic one.

Sometimes prices change before fundamentals change. Sometimes fundamentals change before prices change. Price is what pays and until expectations change, prices don’t change. What causes expectations to change? – it could be change in fundamentals or change in prices. So what I am saying is that sometimes prices could be manipulated to change expectations, which will fuel further price momentum in a self-reinforcing way.

3. “Once a trend is established it tends to persist and to run it’s full course.” – Sentiment changes slowly in trending markets (up or down) and extremely fast in choppy, range-bound markets.

4. “When a long-term trend loses it’s momentum, short-term volatility tends to rise. It is easy to see why that should be so: the trend-following crowd is disoriented.”

A surprising countertrend pop or drop reminds investors of the risks involved and all of a sudden the fear of losing (giving back gains) becomes bigger than the fear of missing out. This is the beginning of the end of the established trend. It doesn’t end here, but it is a damn good spot to consider closing positions and moving to something else. The distribution/accumulation stage is in full force.

5. Markets are not always right. Market is a good discounting mechanism most of the time, but not always. There are times when animal spirits run supreme and emotions overshadow reason. Market constantly discount events that haven’t happened yet. As a result they will often discount events that will never happen.

How good are markets in predicting real-world developments? Reading the record, it is striking how many calamities that I anticipated did not in fact materialise.

Financial markets constantly anticipate events, both on the positive and on the negative side, which fail to materialise exactly because they have been anticipated.

It is an old joke that the stock market has predicted seven of the last two recessions. Markets are often wrong.

Often? How often? Do you have the balls and more importantly the pockets to fade them. Market could remain irrational longer than most people could remain solvent.

6. It doesn’t hurt you what you don’t know, but what you think you know, when it ain’t so

Participants act not on the basis of their best interests but on their perception of their best interests, and the two are not identical.

7. On Bubbles

“Boom-bust processes are asymmetric in shape: a long, gradually accelerating boom is followed by a short and sharp bust. Consequently, most of the credit contraction can be expected to occur in the near term.”

Currency movements tend to overshoot because of trend-following speculation, and we can observe similar trend-following behaviour in stock, commodity and real estate markets, of which Dutch Tulip Mania was the prototype.

8. On Manipulation

I want to buy $300 million of bonds, so start by selling $50 million. I want to see what the market feels like first.

9. On how to be selectively active

The trouble with you, Byron [Byron Wein – Morgan Stanley], is that you go to work every day [and think] you should do something. I don’t, I only go to work on the days that make sense to go to work. And I really do something on that day. But you go to work and you do something every day and you don’t realise when it’s a special day.