Benjamin Graham doesn’t need an introduction. His sober look at the stock market has built an enormous following and for a good reason.

Here are some of his brilliant quotes and my comments on them:

1. “If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.” – It is true that perfumes come and go out of popularity, but no trend lasts forever. There are trends that last 3 months; there are trends that last 3 years.

2. “Obvious prospects for physical growth in a business do not translate into obvious profits for investors.” – it depends on to what level has the expected growth been already discounted. The truth is that it is really hard to forecast growth in quickly developing businesses. The market always overdiscounts at some point, but in the meantime trend followers could make a killing. You never know how long or how fast a trend could go.

3. The only constants in the markets are change and uncertainty. Not only business environment changes, but also people’s perceptions of stocks change. Look at $GMCR for example. It went from making a new all-time high at $10 back in March 2009 to $115 in September 2011 to $25 today.

Most businesses change in character and quality over the years, sometimes for the better, perhaps more often for the worse. The investor need not watch his companies’ performance like a hawk; but he should give it a good, hard look from time to time.

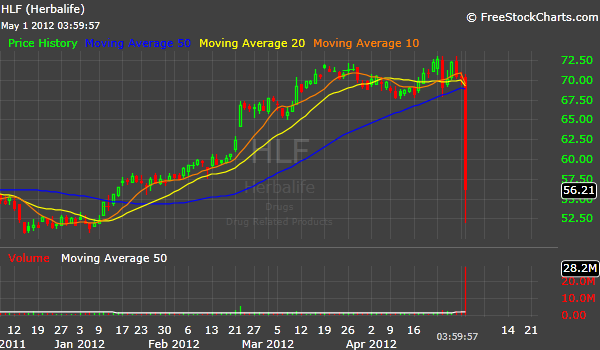

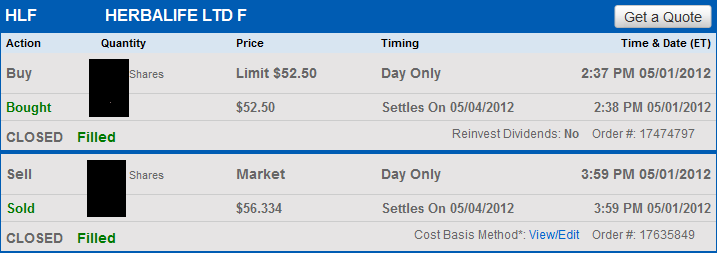

4. Different catalysts matter for the different time frames:

Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies.

5. The difference between a trader and investor

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator’s primary interest lies in anticipating and profiting from market fluctuations. The investor’s primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

6. How to think about risk

The risk of paying too high a price for good-quality stocks – while a real one – is not the chief hazard confronting the average buyer of securities. Observation over many years has taught us that the chief losses to investors come from the purchase of low-quality securities at times of favorable business conditions. The purchasers view the current good earnings as equivalent to “earning power” and assume that prosperity is synonymous with safety.

7. There is nothing guaranteed. The market doesn’t owe you anything. There are no sure things. Equity selection process is important, but risk management discipline should always trump conviction:

Even with a margin [of safety] in the investor’s favor, an individual security may work out badly. For the margin guarantees only that he has a better chance for profit than for loss – not that loss is impossible.

8. “To achieve satisfactory investment results is easier than most people realize; to achieve superior results is harder than it looks.”

9. “Wall Street people learn nothing and forget everything.”

10. “Most of the time stocks are subject to irrational and excessive price fluctuations in both directions as the consequence of the ingrained tendency of most people to speculate or gamble … to give way to hope, fear and greed.”