In the stock market, the real money is made by riding a trend long enough to make a difference, but having an exit strategy is of crucial importance. Sooner or later, all trends end. To protect gains, you have to exit at some point.

Trend change is a process and never an event. Market participants’ expectations change slowly and it takes some time for institutions to distribute their shares. Here are the typical four stages near the end of a momentum move:

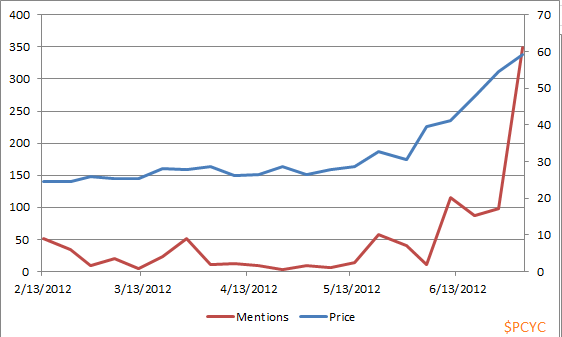

1) Price goes parabolic and extends significantly above its relevant moving average (the average that has proven to be a level of support during the duration of the trend; in this example, this is 20dma for $AE and 50dma for $LQDT). Peeling a bit on strength makes sense in this situation, but keep in mind that you never know how long and how far a stock could go, especially in the late stage of its trend.

2) There is a major, high-volume move in the opposite direction of the trend – quick 5-20% drop that is unusual for the typical price range of the stock. It might last anywhere from a day to two weeks. This is a major tipping point. It changes the prevailing sentiment entirely. All of a sudden, people start to think about the risk involved in holding longer and might take a deeper look into the fundamentals of the company. Fear of giving back profits gradually overwhelms greed for more and fear of missing out.

3) This is not the end of the move. There is a group of market participants that has probably missed the entire move. They have been afraid to jump on the fast moving train and have been watching the stock climbs relentlessly, day after day, week after week, without giving a proper chance for entry. In this case, any major pullback will be considered a buying opportunity by this group of people and they will step up near the 20dma or 50dma. And in many occasions, they will be right. The bounce however will carry very little volume behind it or it will be less than the volume during the pullback.

4) The previous high will not be reached or if it is, it will be on low volume. That snapback bounce is wise to be used to liquidate your positions or at least lighten up substantially. Then there is usually a high-volume move lower.

Keep in mind that these stages are just a rule of thumb, not a bullet-proof rule.