Some say that there is no such thing as a pure passive investing, just fifty shades of active investing. Even indexing is considered a form of active investing, because of the frequency of rebalancing.

Others point out that passive investing has nothing to do with the frequency of transactions and everything to do with the ability to impact the direction of a company you are investing in. The latter definition makes every form of public investing passive (with the exception of activist investing).

No matter the definition of passive investing you believe in, we can probably all agree that indexing has provided a cost-efficient way to invest in the growth of the world economy.

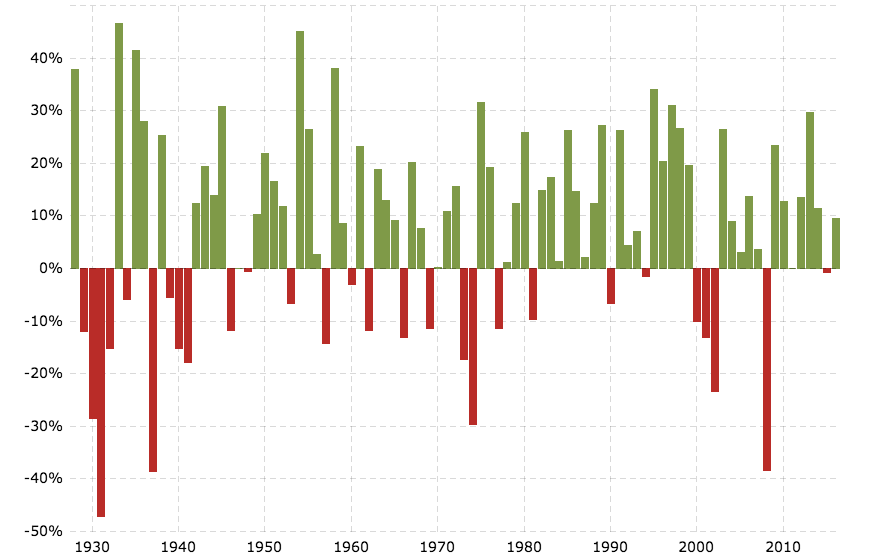

S&P 500 annual return (ex. dividends)

There’s nothing wrong in indexing (buying the S&P 500 for example), but you need to understand what exactly are you buying and decide for yourself if you can do better.

The S&P 500 goes through frequent rebalancing. It replaced ten stocks in the first three months of 2017. Some of the changes are due to acquisitions; others are due to poor stock performance. First Solar is one of the stocks that was recently replaced.

The S&P 500 is essentially a slow trend-following program run by a committee of people. The rebalancing is not based on strict technical rules. A group of people sits and decides which stocks to add and drop based on market capitalization, liquidity, domicile, float, sector classification, financial viability, length of time spent as a public company and the stock exchange it has been listed on.

The selection criteria have produced some odd timing. For example, AMD was recently added to the index, after a 500% move in the past year and a half. Do you think you can find a better entry spot?

While its timing has been often poor, over time the S&P 500 has managed to capture most long-term winners. It has kept the long-term winners and dropped the losers, many of which eventually went out of business.