- The stock market is an opportunity machine. Times change, gas prices change, fashion changes, regulations change, but there are always companies that find a way to monetize on an ongoing social and business trend and make their investors rich. The only things that change on Wall Street are the names of the winning and losing stocks.

- There is always a silver lining. One company’s rising costs are another company’s rising revenues and the market usually does a good job identifying the winners and the losers. Money never sleeps. There is always a trend somewhere.

- Simple is better. Complexity is the enemy of execution, great returns, and good lifestyle.

- Trends exist because people tend to underreact to new information; then fear of missing out kicks in, people get anxious and overreact. This creates fantastic opportunities for both momentum and value investors.

- The stock market tries to be forward-looking. Sometimes, it is spot on in predicting the future. Sometimes, it even impacts the future. Other times, it ends up very wrong and prices events that will never happen.

- Intrinsic value is overrated. In 2018, a rare 1793 penny was auctioned for 300k. You can take this penny and go to the supermarket and you can buy exactly a pennyworth of food there. Or you can tell a good story and auction it for a lot more. Supply and demand, which depend on perceptions and expectations for future gains are often more important than any fundamentals.

- Prices change when expectations and perception change; the latter can change for many reasons, including price action.

- Early adopters (trendsetters) usually sell early and end up making as much or less money than people who hop on already established trends.

- Every trend needs skeptics and doubters; otherwise, there won’t be anyone left to buy.

- Buy and hold forever doesn’t work with most individual stocks. Most trends eventually end. Have an exit strategy.

- In trading and in life, sometimes being wrong is not a choice, but staying wrong always is. Cut your losses, cut your losses, cut your losses, so you live to fight another day.

- There should be a very clear distinction between trading and investing. Long-term investing is essentially a bet on how other people’s perceptions will change over time. It is about answering the question What are the catalysts that will change market’s expectations? Trading is about understanding the constant cycle of range contraction and range expansion, it is about taking asymmetric bets where you risk a little to make a lot, it is about adapting to changing markets.

Stocks Showing Relative Strength – HTGM, UPLD, NUS, QDEL

If a high-beta stock doesn’t correct with the rest of the market, it is because it is under accumulation. Stocks under accumulation tend to do very well when the market pressure is lifted.

If you believe in the notion that relative strength is a great equity selection tool during market pullbacks, consider adding the following stocks to your watchlist: HTGM, UPLD, NUS, QDEL.

The Future of Visa and Mastercard

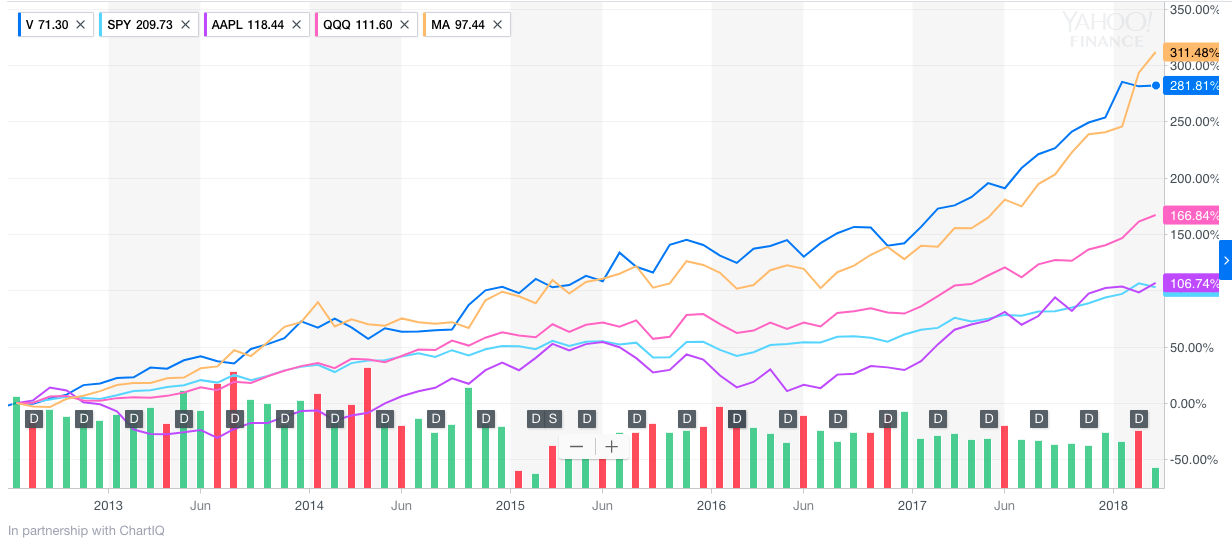

Five and a half years ago, Abnormal Returns asked a bunch of people from the financial blogosphere to share their best pick for the next decade – an asset people would feel comfortable holding. Most chose SPY. There were some calls for Nasdaq, AIG, Apple, Ford, Emerging markets. I chose Visa and/or Mastercard.

Here’s my reasoning in 2012:

“I am not a long-term investor per se.10 years is an eternity and a lot of price cycles will change over that period of time. Nevertheless, for the purposes of this exercise, I would go with Visa ($V) or Mastercard ($MA). They have so many catalysts going for them – rising online sales, digital wallets, emerging markets and are part of the S&P 500 which will likely do well too.”

Sometimes, simple and obvious things in the market work out better than you expect.

I am still bullish on Visa and Mastercard. They continue to ride the wave of massive smartphone adoption and rapidly rising online and cashless transactions around the world. But I also pay attention to the potential threats around the corner. The blockchain technology will likely create many new competitors for Visa and Mastercard. They are not going anywhere. They will continue to grow but their margins are likely to come under pressure. I think we are at least five years away from that happening.

What is to stop Apple and Google from creating a bank? Quite a few of their users would proudly transfer their finances to the Bank of Apple and the bank of Google. More and more people will use their phone as a digital wallet and pay everywhere with it. Services like Venmo will become more popular and share less personal information. All merchants will surely love a transaction that doesn’t involve paying 3% to Visa or MA.