All charts on Momentum Monday are powered by MarketSmith

Correlations are decreasing, volatility is declining, the market reaction to earnings has been predominantly positive, corrections are happening via sector rotation. In other words, the U.S. stock market is back to a normalized trading environment, where stock picking matters.

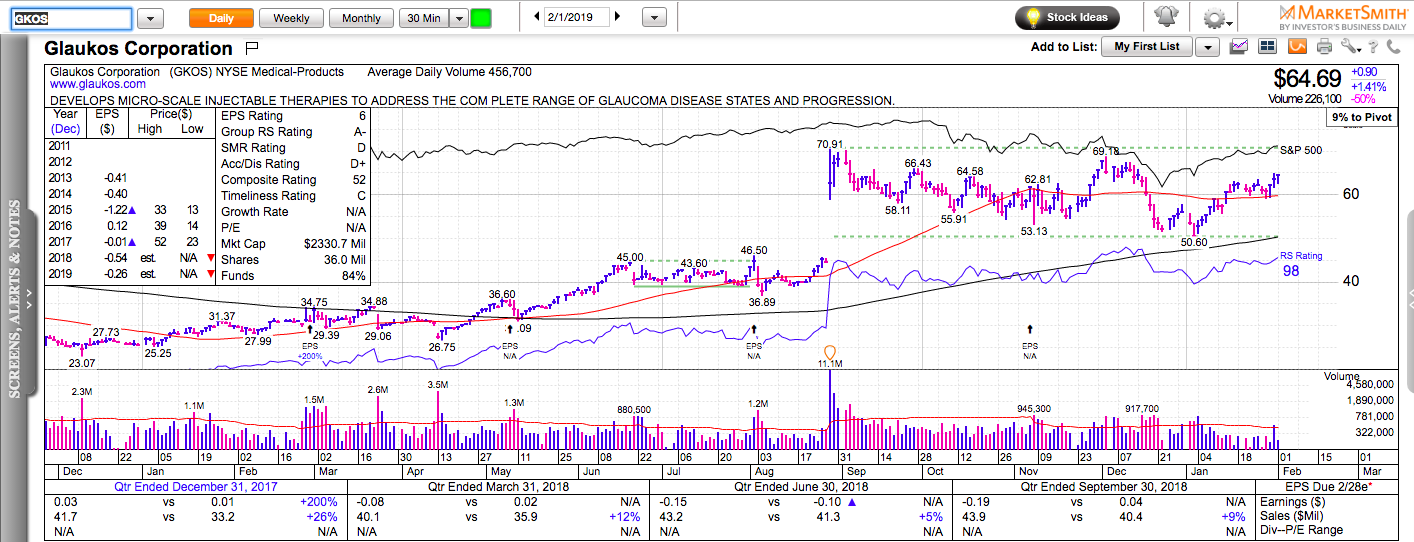

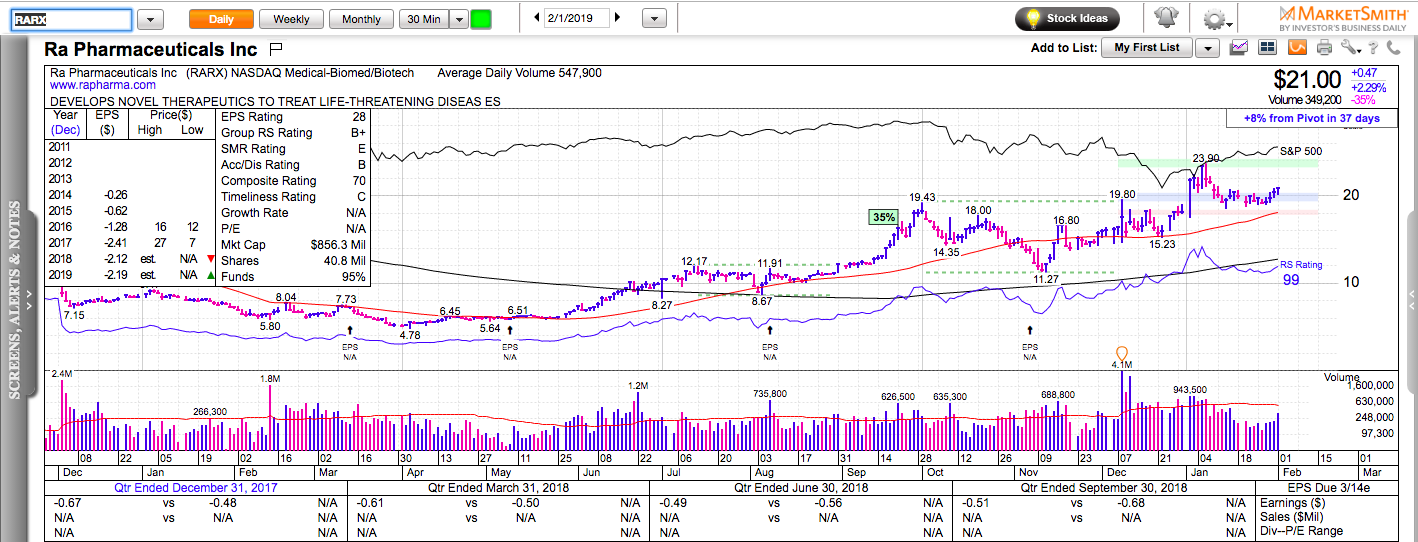

Enterprise software and cannabis-related stocks continue to lead the market higher. We discuss a potential rotation into other sectors ahead. Biotech and medical devices are couple industries that are setting up.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.