Stock and ETF charts in this post are powered by MarketSmith.

I keep getting the questions “why are financials so weak” and “shouldn’t bank stocks be outperforming in a rising interest rate environment”?

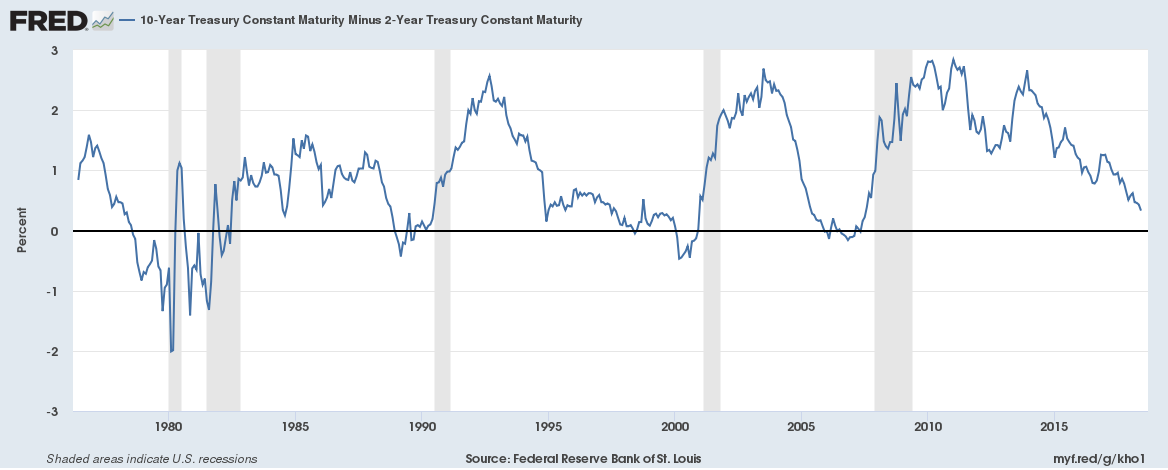

Not all rising interest rate environments are good for financials. Banks tend to borrow on the short-end of the yield curve and lend on the long end. Their margins expand when long-term interest rates rise faster than short-term interest rates. The opposite has been happening in for most of 2018. In fact, the 10-2-year yield spread has been declining since 2014.

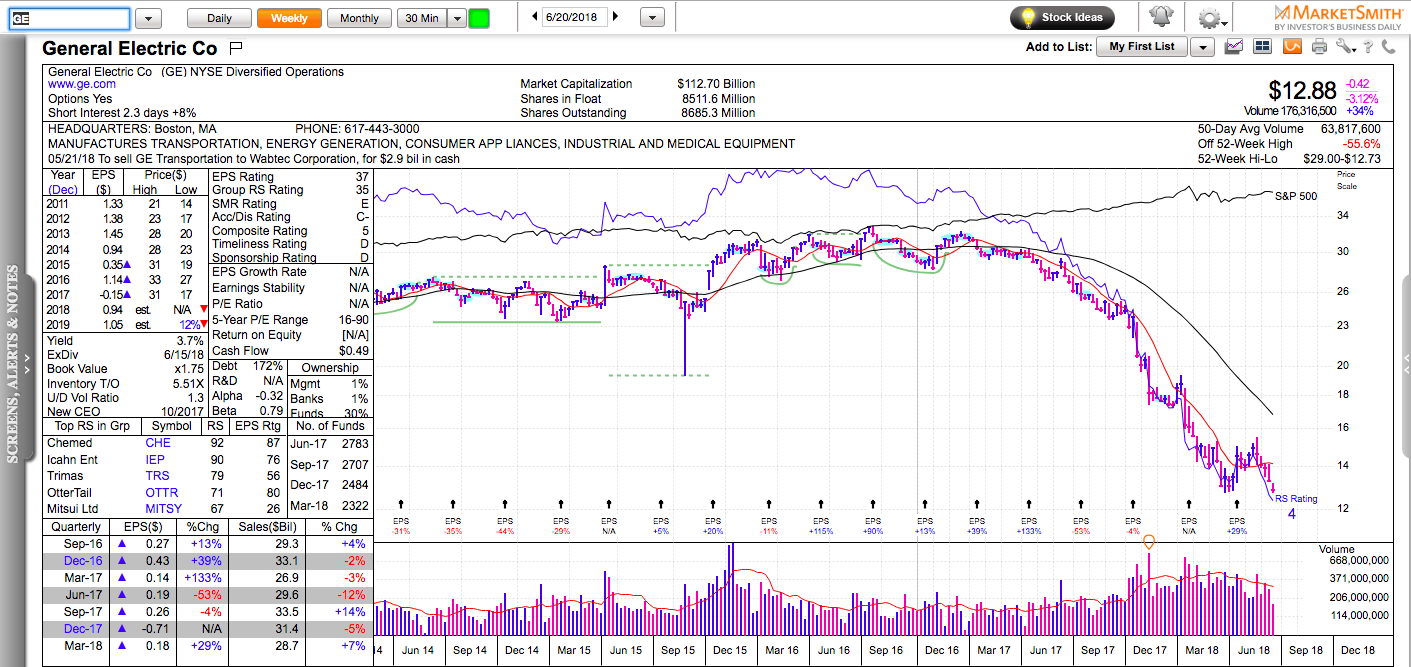

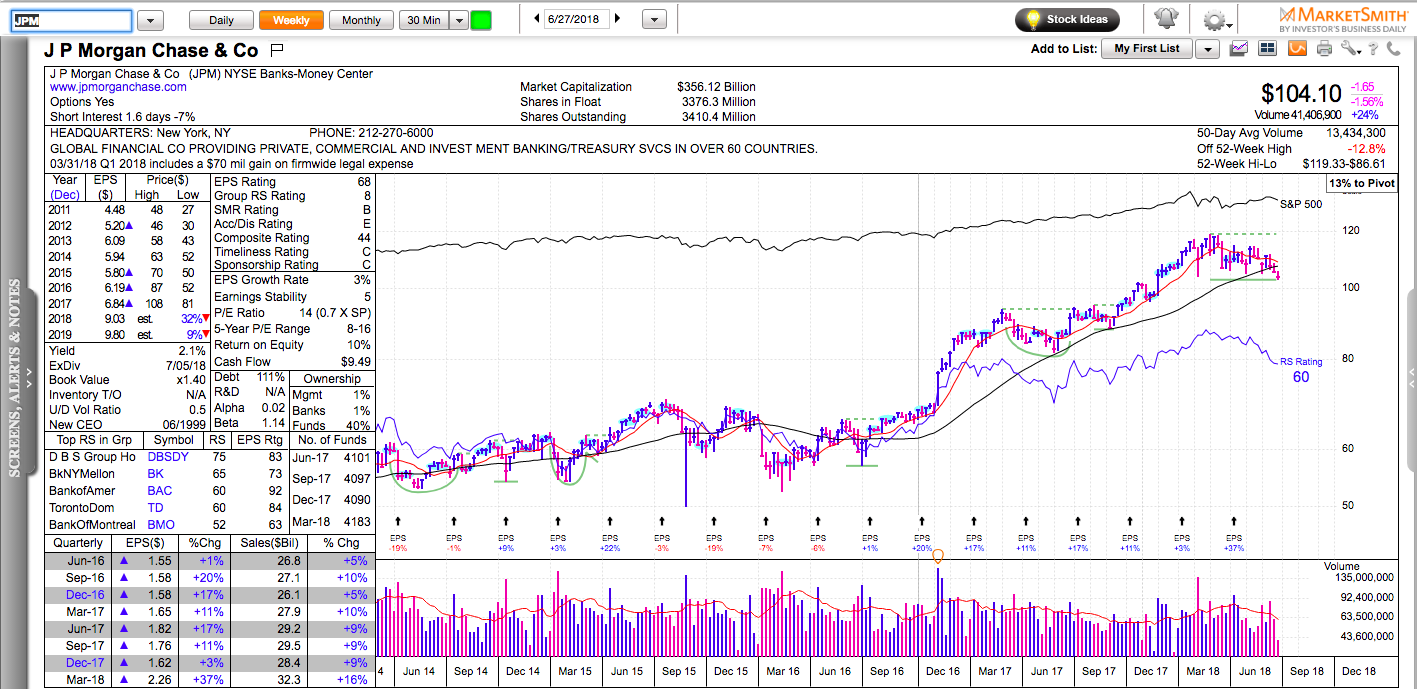

There are many other factors that impact financials’ margins. For example, if you look at JPM’s chart below, you will notice that the decline in the 10-2-year yield spread hasn’t really affected their profitability. JP Morgan’s earnings have increased by 50% since 2014. For the same period, its stock has appreciated 79%, not counting the dividends.

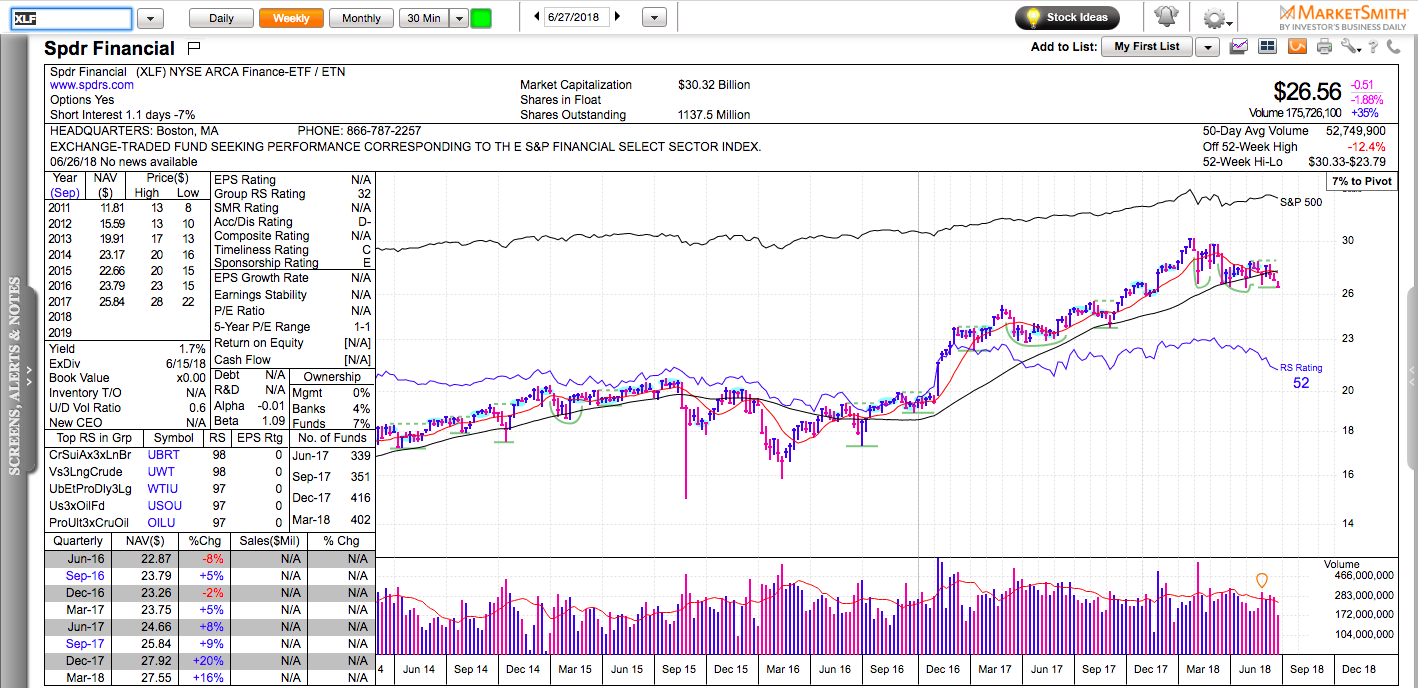

Overall, financials as a group have been showing relative weakness for most of 2018. With a relative strength of 52, the SPdr Financial ETF, XLF is right in the middle of the stack. $24-25 seems like a logical level of potential support. A move above 28.50 would be a bullish development.