All charts on Momentum Monday are powered by MarketSmith

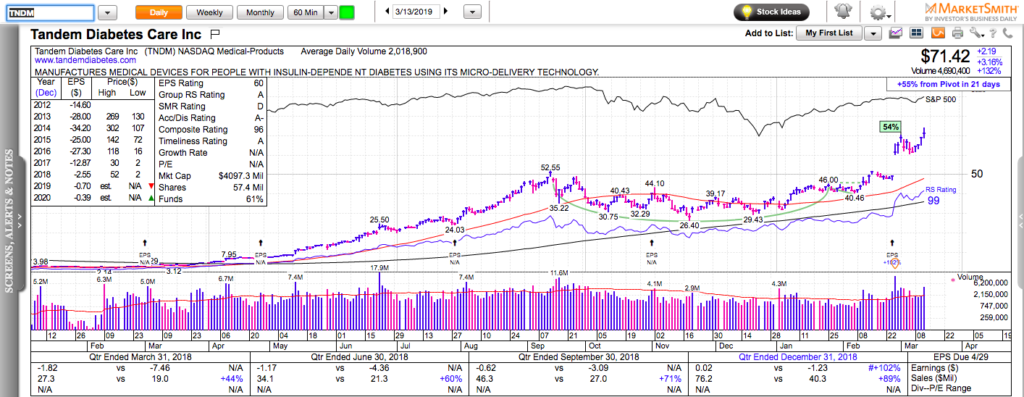

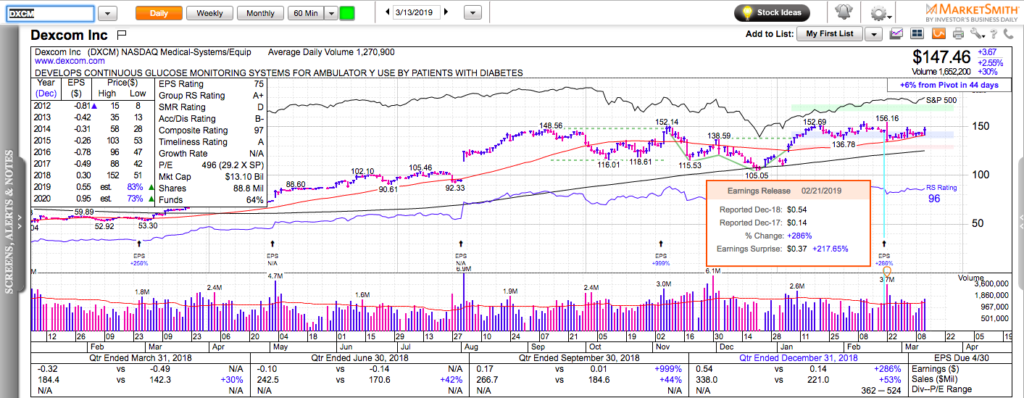

Dip buyers continue to dominate the tape. The tech sector is leading again. Enterprise software, semiconductors, the FANGs are all looking strong, breaking out or setting up for a potential breakout.

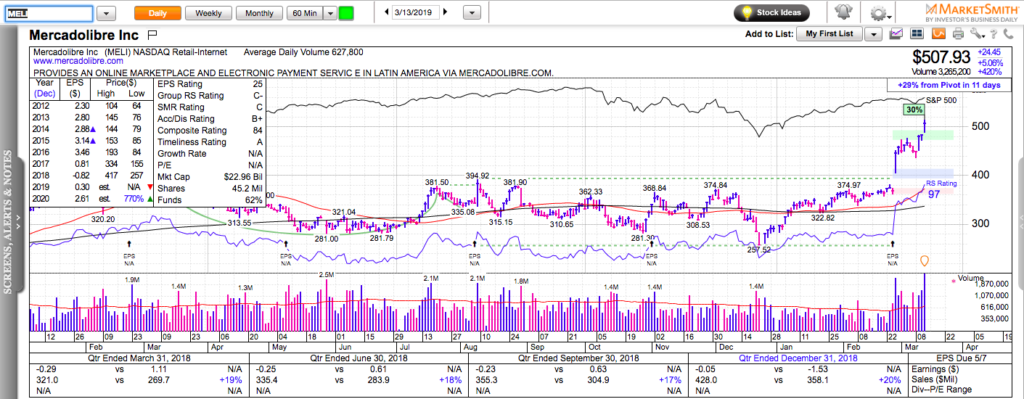

Emerging markets are also starting to wake up. We are seeing notable relative strength in India, select Brazil and Chinese names. It’s usually good news when the more sectors join the market rally.

We continue to trade in a market of stocks environment, where stock picking matters.

Check out my latest book: Swing Trading with Options – How to trade big trends for big returns.