All charts in this post are powered by MarketSmith

I pay close attention to the action in momentum stocks. They are called market leaders for a good reason. This is what I tweeted yesterday:

If momentum stocks are a leading indicator (I believe they are) – 34 SL50 stocks are down > 2% so far today vs only one up more than 2%

— ivanhoff (@ivanhoff2) September 5, 2018

Market averages like $SPY, $IWM, $QQQ while good aggregators, are not leading indicators. By definition they are lagging momentum stocks.

— ivanhoff (@ivanhoff2) September 5, 2018

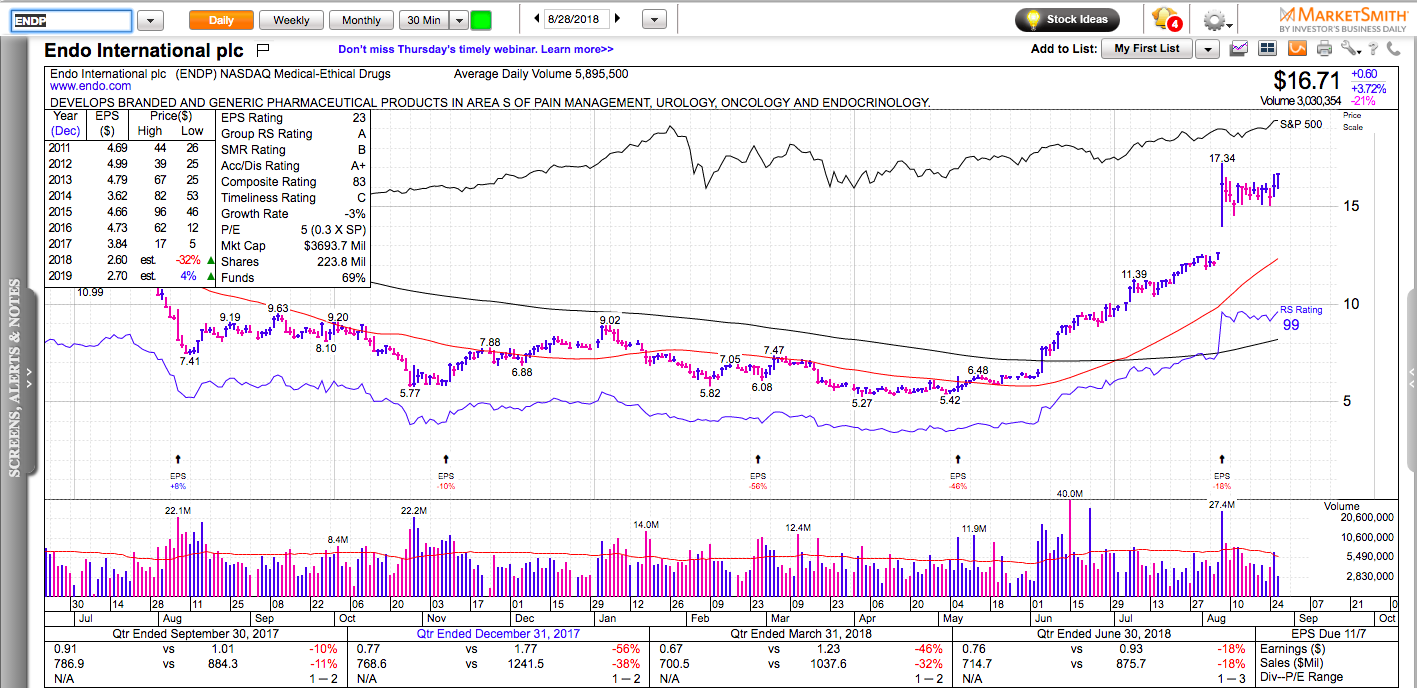

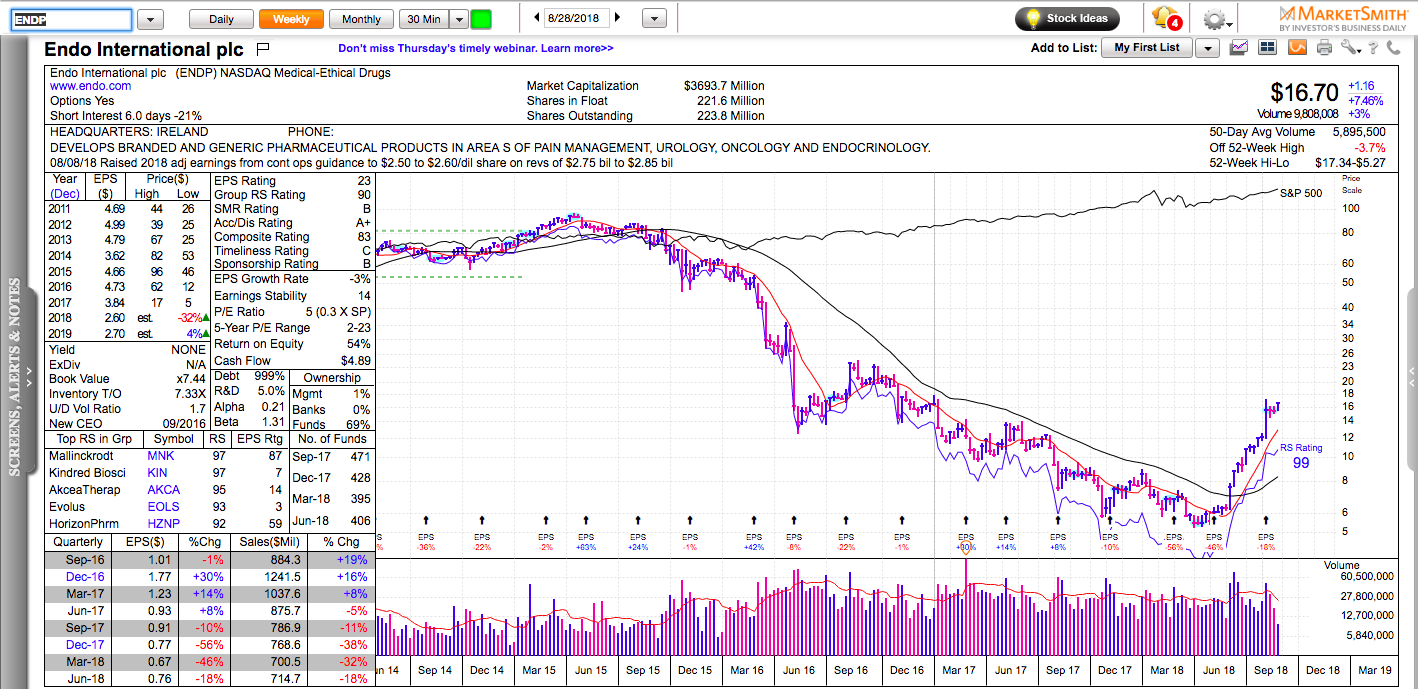

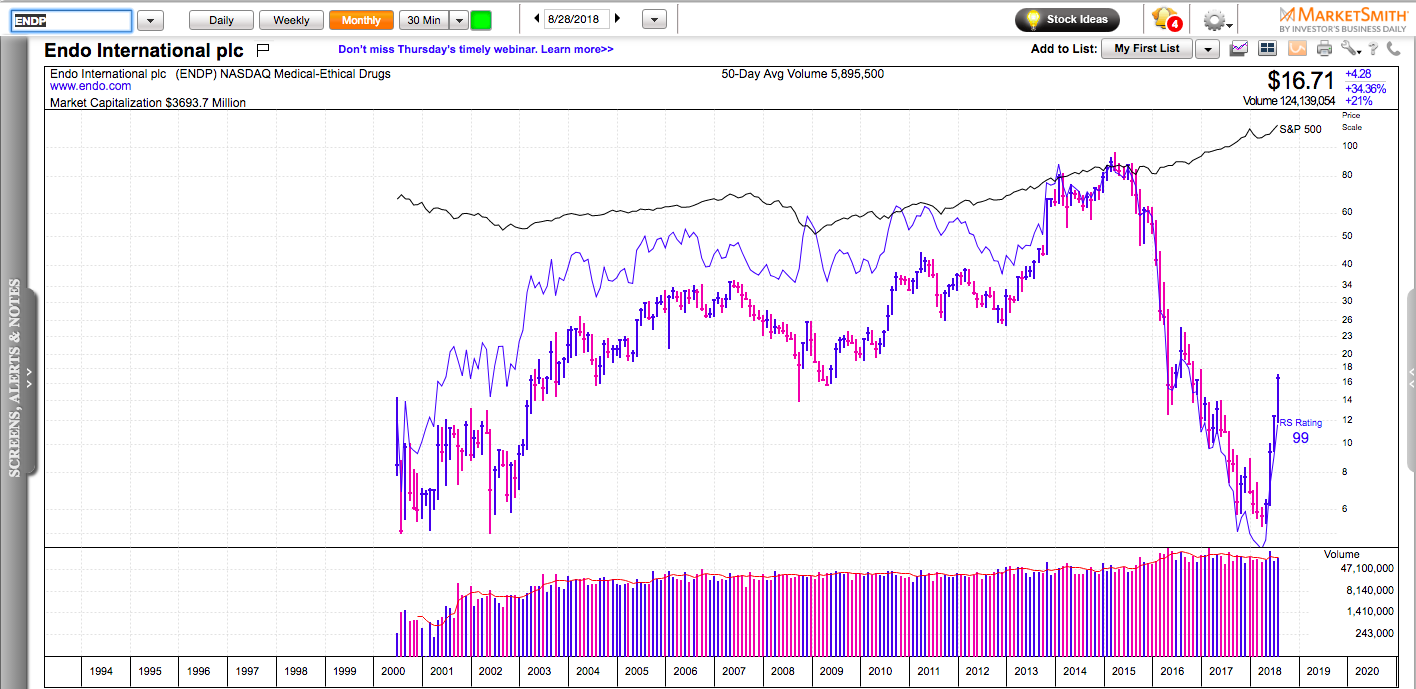

Keep a list of leading momentum stocks and watch how they act. Many of them are likely to get hit just before the market indexes’ selloff accelerates. You can create your own list of momentum stocks by scanning for the top performers on a 6 and 12-month time frames or you can take a shortcut and use established lists like the SL50 from MarketWisdom.com and IBD50 from Investors.com. A list of momentum stocks is a great source of long trading ideas during rising markets, it is a great leading indicator for both rallies and selloffs, and it is a great source of short trading ideas during corrections because most momentum stocks take a hard hit during general market declines.

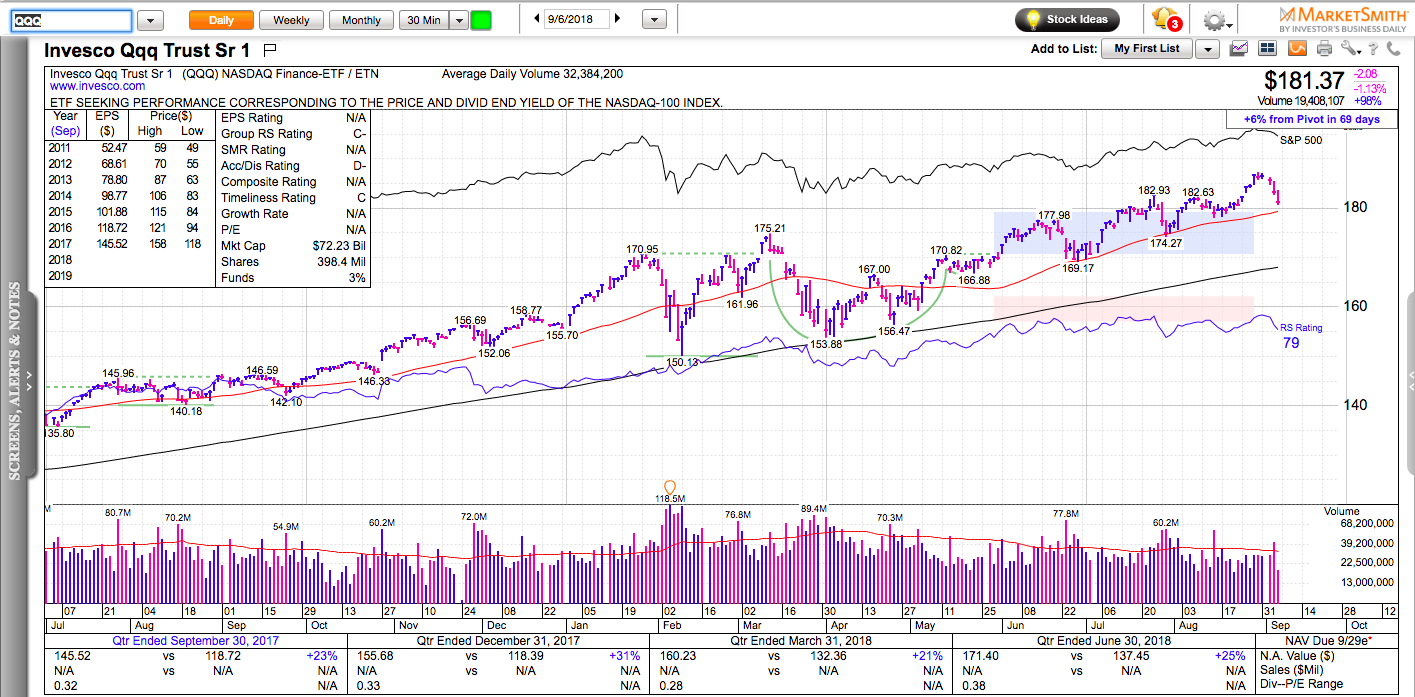

From a big picture perspective, nothing has changed. All major U.S. stock indexes are still in an uptrend. Dip buyers are likely to step up around $180 for the Nasdaq 100 (QQQ). The sustainability of that potential bounce will largely depend on the price action in individual momentum names, because as I mentioned earlier – they tend to lead on the way up and on the way down.