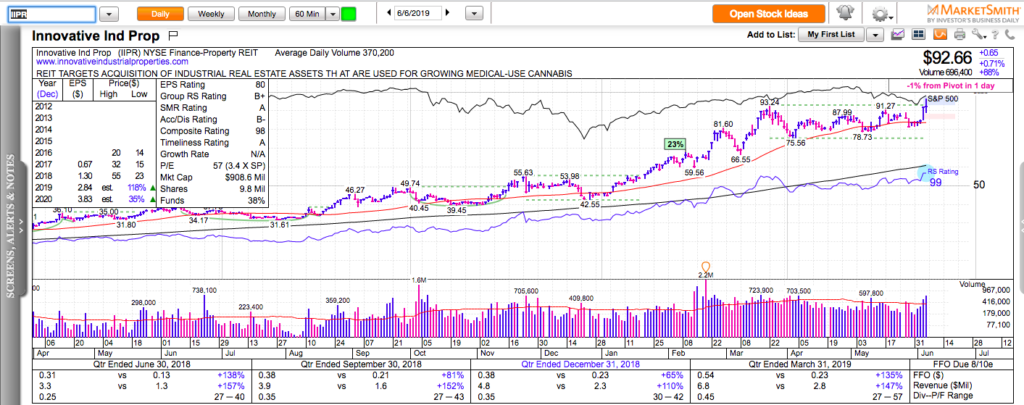

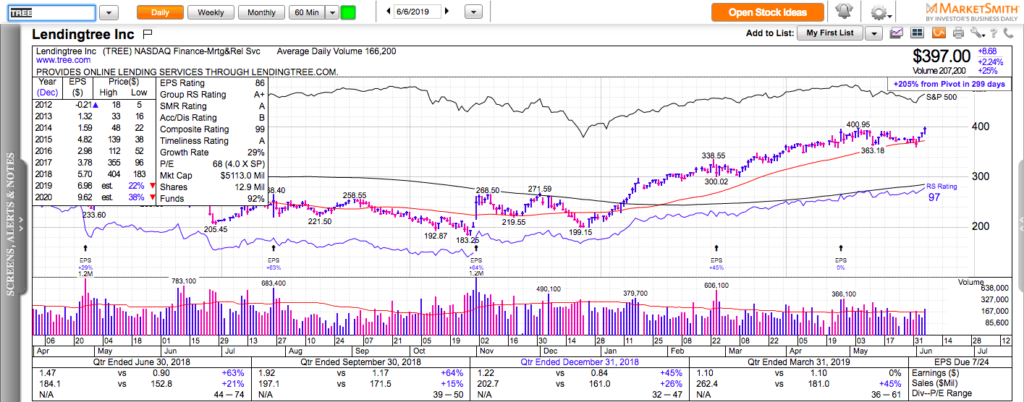

The charts on Momentum Monday are powered by MarketSmith

After an explosive rally in early June, all major U.S. stock market indexes are in consolidation mode. Most software momentum stocks are also either pulling back on light volume or going sideways. This is normal and typically bullish market development.

The IPO market continues to be on fire. Last week, we saw hot action in FVRR, CRWD, even CHUY.

Many biotech stocks are also breaking out or setting up for a potential breakout – VCYT, VYGR, ARRY.

Disney is on the radar of many traders and investors. It has managed to hold its big gap from April and it is now back near its all-time highs.

In the last third of the show, we discussed some of the differences between swing trading and long-term holding and how to pick potential big winners that can be held for years.

P.S. Check out my last two trading books. Both are super practical, packed with actionable information that can be put to use right away:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, how to trade them, how to make money with them.