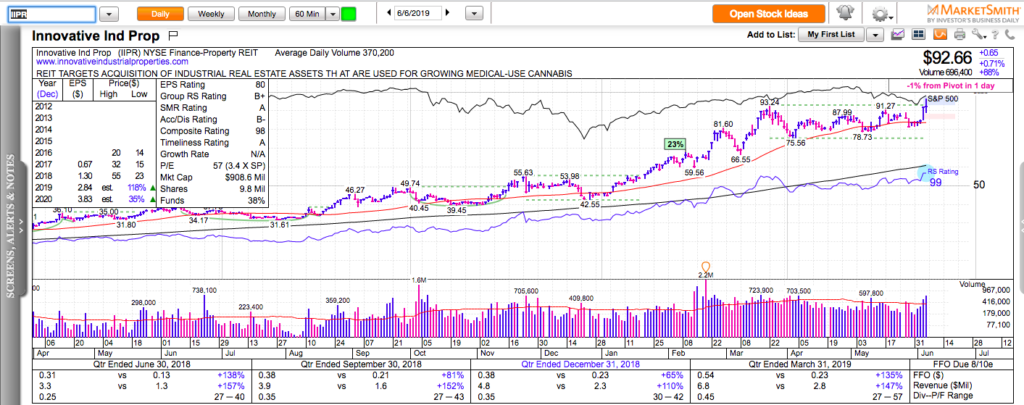

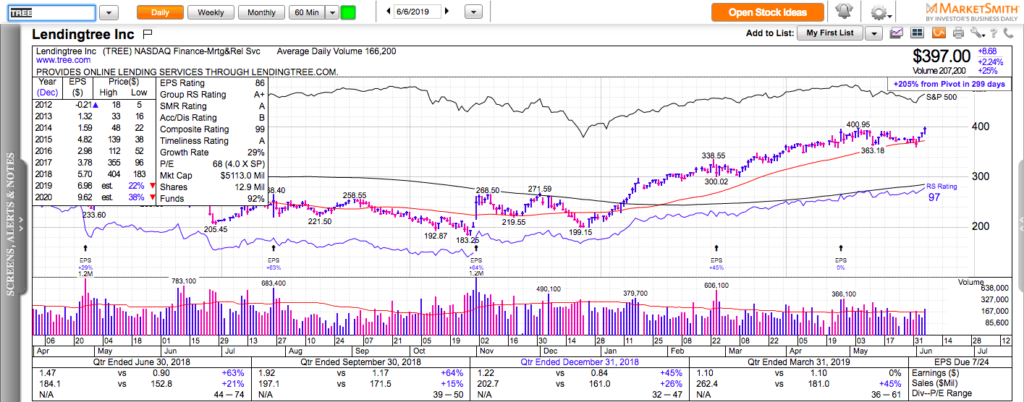

All charts in this post are powered by MarketSmith

A large short interest and a 52-week high can be an explosive combination. Any share that has ever been sold short will eventually be covered. It can be covered voluntarily as the short sellers are taking profits or it can be covered involuntarily as short sellers are forced to cover losses.

Here are three stocks trading near their 52-week highs while more than 20% of their float is short:

IIPR – cannabis-related REIT

TREE – lending services

JKS – solar panels

Bonus: ZM and BYND raised earnings estimates and are trading near their all-time highs while having a large short interest. In addition, both of them are recent IPOs, which means they have a relatively small float. This is an explosive combination. Both are candidates for a short squeeze on Friday.

P.S. Check out my last two trading books. Both are super practical, packed with actionable information that can be put to use right away:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.