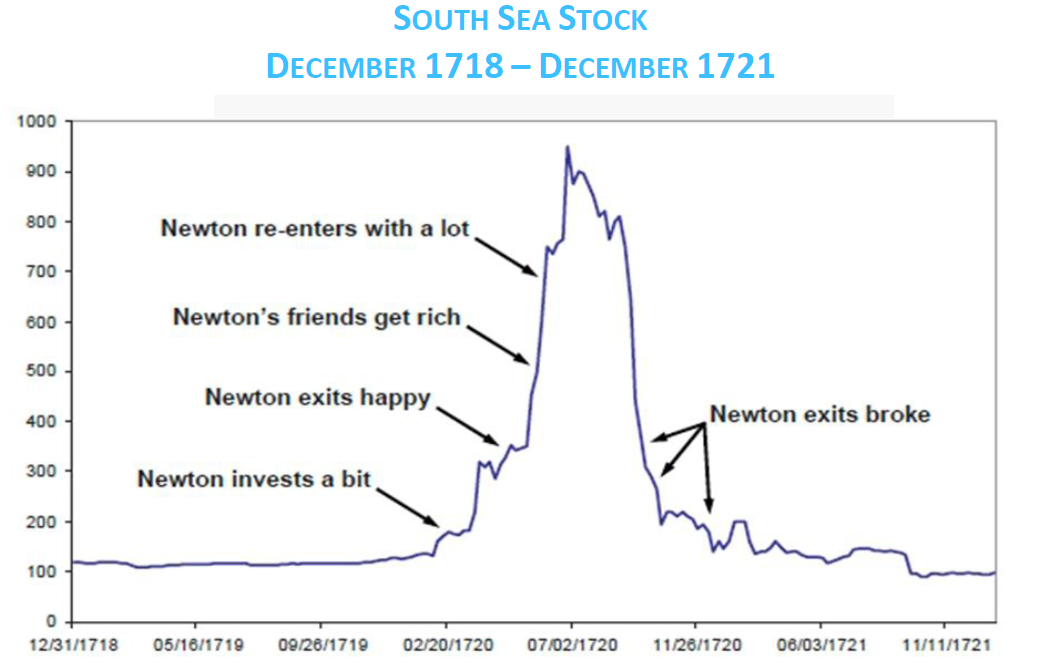

Issac Newton is probably one of the most brilliant men ever lived on this planet, but even he lost a fortune when the so called South Sea Bubble bursted. Shortly after the crash, he reportedly declared that:

“I can calculate the motion of heavenly bodies, but not the madness of people.”

Mebane Faber has an interesting paper on Bubbles that is well worth closer examination:

Across twelve market bubbles we find that a trendfollowing system would have improved return while reducing volatility. Most importantly, it would have reduced drawdowns significantly leading to the most important rule in all of investing – surviving to invest another day.

Bubbles happen much more often that most people expect. They also lasts longer and become bigger than most expect.

A fellow student of bubbles, Jeremy Grantham at Grantham, Mayo, Van Otterloo and Co. (GMO) has collected data on over 330 bubbles in his historical studies. He points out in a recent research piece “Time to Wake Up: Days of Abundant Resources and Falling Prices are Over Forever”, that one of the key difficulties is distinguishing when a bubble is indeed occurring, and when there actually is a paradigm shift. When is this time really different?

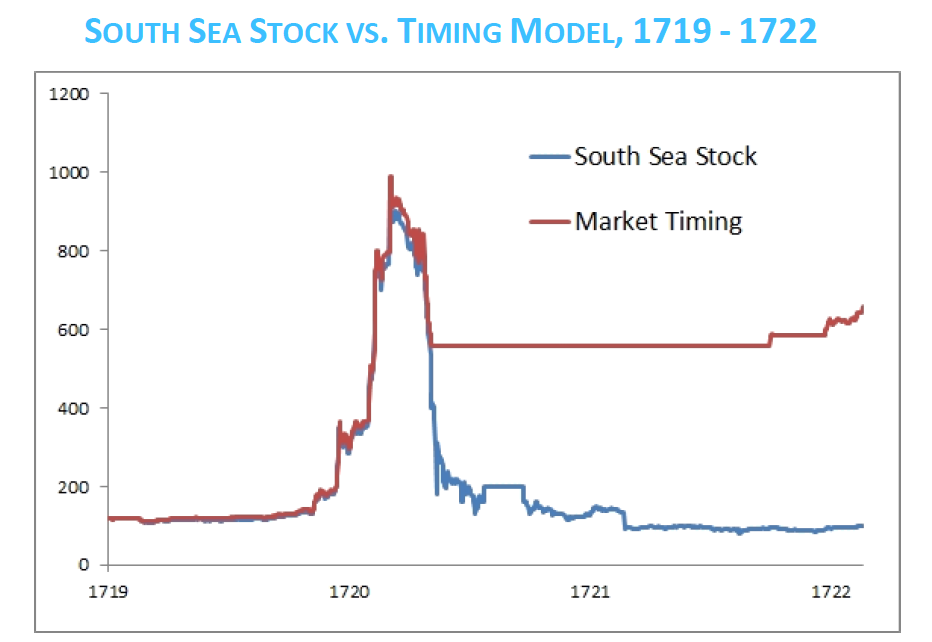

During a typical bubble, an asset appreciates several hundred to several thousand per cent in a short period of time and then it comes all the way back where it started and even below in many cases. If you just buy and hold, you end with no gain at the best case scenario. But what happens, if you apply a simple trend following strategy, which always involves an entry and exit plan based on some derivative of price. In his research, Faber uses 10-month simple moving average as a benchmark.

Our research demonstrates that a trendfollowing approach improved returns in every bubble (except one) and reduced volatility and drawdown in all twelve of them.

There are different derivatives of price that could be used as a trailing stop in trend following – Average True Range, Trend lines, Simple and Exponential Moving Averages. The purpose of a trailing stop is to keep you long enough in a trade, so it could make a difference in your overall performance and also to protect your gains after the trend inevitably ends.

The subject of figuring out where to add to a position and where to take partial profits is way more nuanced and I am not going to elaborate on it here.

Price is not the only entry criteria I use, but price is the only exit criteria I respect.