I judge for the current market sentiment by the way investors react to companies’ earnings’ reports. When risk-aversion is the popular theme of the day, speculators subconsciously look for a reason to sell. The slightest weakness in an earnings’ call will be exaggerated and extrapolated and the stock will be sold. It doesn’t matter if a company beats the analysts’ estimates or if it guides higher for next quarter. It matters how market participants react to the news. When “good” earnings reports are getting sold, market is in defensive mood and you should act accordingly.

The story is different when investors are confident about their own and the economy’ future. During such times, people are looking for a reason to buy. They tend to ignore any weakness and a single ray of hope in an earnings’ report is enough to get them excited and start buying like crazy. You know the spirit of Wall Street is high, when slightly lesser than expected losses are generously rewarded by double digit one day gains.

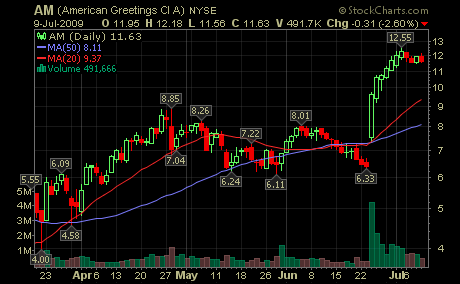

Earnings’ season is here and it will provide hundreds of good trading opportunities. I will illustrate a variation of what I am looking for through one of the good trades I had lately in American Greetings (AM).

1) Reaction to news is more important than news itself. I am looking for 10%+ gains on at least 5 times the average daily trade volume.

2) Stock beats estimates by wide margin and guides higher for next year.

3) The breakout is from relatively tight (preferably flat) range – the longer, the better. It is a sign of a neglected stock. Stocks that run up in front of earnings’ reports, tend to be sold on the news.

4) The stock finishes the day in the upper 1/4 of its daily range. With other words, it forms a nice, long, green candle without too long shades.

5) The low of the first 30 min candle might be used as an initial spot to place your stop. The real winners rarely revisit that point. The best trades are profitable from the moment you enter. Along its way up, the stock will form several bullish flags and wedges and offer opportunities to raise your stops or enter if you missed the initial move.

American Greetings reported a profit after 2 consecutive quarters of losses. The reason behind the sudden green bottom line wasn’t higher sales or margins (typically what I am looking for), but lower expenses. The important part was the market reaction. AM went up 41% on the day it reported it EPS number.

On a side note, the company was paying 48 cents dividend, which before the earnings’ jump accounted for more than 7% annual yield. Dividend is usually the last thing I care about, but in this case it was notably good.

AM earned 25 cents per share compared to a profit of 27 cents for the same quarter, last year. Normally I look for triple digit Q/Q growth, higher margin and at least double digit sales growth, but in this case we had a discontinuation of a losing streak and a promise of higher margins in the future. To be honest, you don’t even have to put so much effort analyzing those details. The important thing was that investors were buying AM’s shares like they’ll run out of fashion.

There was only one analyst, following the company and he expected revenue of 20 cents per share. Is it possible that a tiny 25% earnings’ surprise (25c vs view of 20c) can cause an almost 100% move in a matter of a week? In general, anything is possible, but this was only one side of the story. AM has relatively small float – 36.7 mill. I prefer stocks with float below 25 mill or even below 10 mill shares as they tend to move faster. The evening before AM’s report was announced, it had over 20% of its float sold short and a short interest ratio of over 15. The last figure played an essential role in the AM’s gigantic move.

Tonight I was watching STL Cardinals losing shamelessly against Cincinnati and an interesting thought occurred to me. People go to see a game for entertainment purposes. There are three major ways to offer good quality entertainment to the fans (other than being in nice company and overconsuming beer):

Tonight I was watching STL Cardinals losing shamelessly against Cincinnati and an interesting thought occurred to me. People go to see a game for entertainment purposes. There are three major ways to offer good quality entertainment to the fans (other than being in nice company and overconsuming beer):