One of the most powerful combinations that cause rapid price appreciation consist of neglected stock, low float, big upside surprise and favorable market conditions. Let’s dissect each of these elements by looking through the lenses of $BTH case:

Between April 9th and 15th, $BTH went up from $32 to $57. (80% appreciation in 5 trading days). The reason:

1) Huge upside surprise: on April 9th, the company reported quarterly EPS of $2.59 vs estimates of $2.00 and same quarter, last year EPS of $1.42. Blyth Inc. also guided FY11 earnings at $3.20-3.50 vs consensus estimate of $2.50.

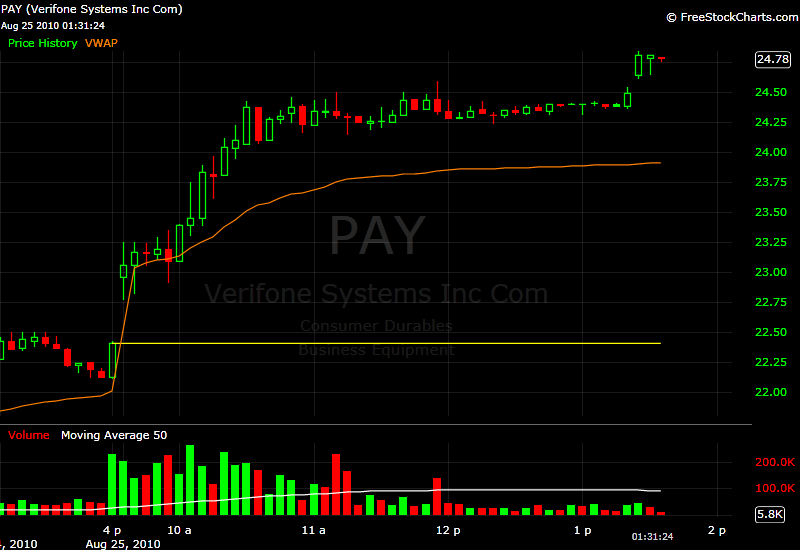

2) Neglect: tiny float of only 5.8m shares. When a catalyst causes an increase in demand for $BTH shares, there is simply not enough supply of them, which naturally results in rapid price move. Other signs of neglect are low ATR and low daily volume. Many are reluctant to look at stocks with average daily volume of under 50k. The truth is that after the appearance of a big catalyst, the price range expands and with it comes the liquidity. If there is a real growth story behind the range expansion, liquidity remains robust and even increases afterwards.

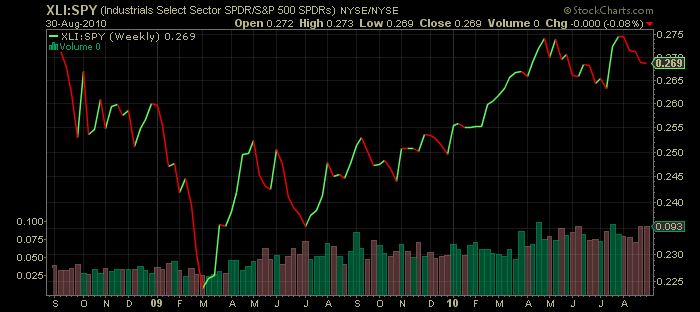

3) In the beginning of April capital markets were still under the influence of relatively high risk appetite. When sentiment is positive, all news is good news and market reaction tends to be favorable.

4) This was the first major positive earnings’ surprise for $BTH after series of consecutive misses.

Only two months after this spectacular 1 week run, $BTH gave back all its gains. The reasons – market went into capital preservation mode in mid May and on top of that $BTH guided lower at the beginning of June.

On Thursday morning I mentioned on StockTwits that I will be paying special attention to $BTH as the company guided higher again and it was close to breaking out from a 2 month range. I noted the 9 days of short interest that could fuel a potential short squeeze. It wasn’t the perfect scenario as the stock was far from its 6 month high, but in the same time risk appetite was gradually turning back into the market. (I prefer to enter stocks that are gapping at new multi-year high as a result of an earnings related catalyst). I don’t expect the stock to repeat its April move – the surprise is not as surprising as it was in April (I hope this makes sense) and sentiment is not at the same level. Nevertheless, $BTH is a typical example of 1-3 days opportunities that earnings’ breakouts bring every quarter.