No matter how much experience you have in the stock market, you can always learn something new that will make you better and more profitable trader. Last Saturday, I drove to LA to attend Joe Fahmy’s Trading Big Winners seminar and I am happy to report that it was well worth it. Here are 7 things that I learned or was reminded of:

1) The names of the big winners change every few years, but their fundamental and technical characteristics stay the same. Stunning earnings and sales growth have been the common denominator of all long-term big market winners ever since the 1920s. This is still the case today.

2) Howard Lindzon also gave a short speech on his market approach. He highlighted three 3 important elements: Staying in the game; Having a Routine and understanding the catalyst behind the stock of interest. He is hunting for his winners on the all-time high list, but he is further pruning by focusing only on companies “I could be the head of marketing”. Howard also recommended to write down your market thoughts on a publicly visible platform like a blog or StockTwits as this will clarify your thought process and it will keep you accountable, mainly to yourself.

3) The market is moved by the big institutions. If a $10 billion fund wants to allocate 1% of its capital to 1 stock, we are talking $100 million – an investment that will certainly leave a trace for the experienced eye, especially if the float of the stock is relatively small; hence pay attention to stocks that are advancing on high volume.

4) You don’t have to be in the market all the time to achieve significant returns. The market is healthy only a few times a year and this is when you should get aggressive. One simple indicator to gauge for market health is the position of the Nasdaq Composite in relation to its 50dma. When the market is in a correction mode, Joe goes to cash and uses the time to either review old trades or just goes on vacation to take a mental break and prepare for the time when the market is healthy again.

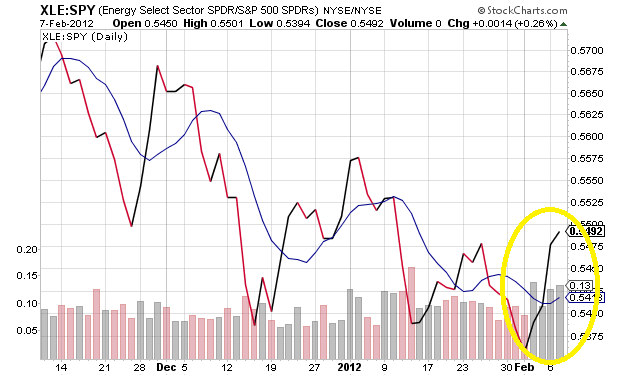

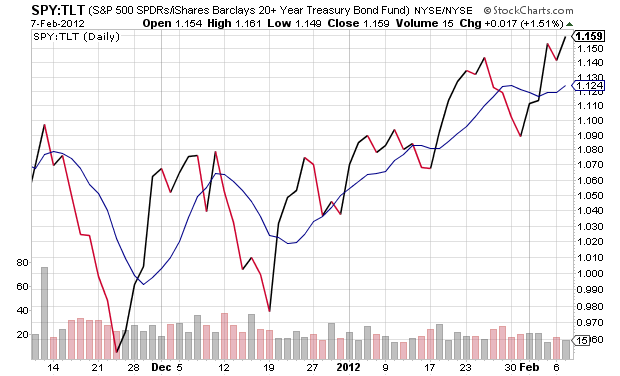

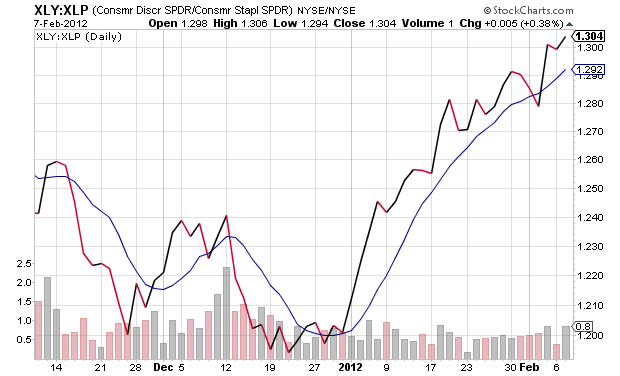

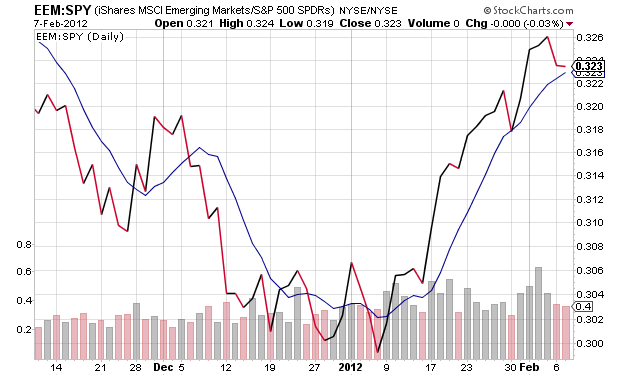

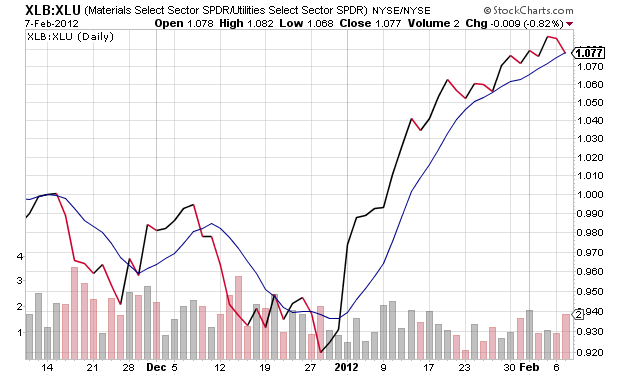

5) Relative strength is among the most powerful stock selection technical indicators. Pay attention to stocks that are advancing and making major news highs while the general market is correcting. Also, if your growth stock is not appreciating while the general market is advancing, there is something wrong with it.

6) Taking great risk/reward trades is of utmost importance. Risking $2 to make $2 is not going to get you far.

7) Joe is looking for certain ranges in his setups to improve the probability of being right immediately.