All charts in this post are powered by MarketSmith

The Unicorns (Uber, Pinterest, Airbnb) are going public and people are talking about IPOs again. My rule of thumb is that if a new IPO is very popular, it will be too hard to extract money in the first few months. LYFT is the most recent example. FB was also a dud in its first few months as a public company. It didn’t start trending before it crushed earnings estimates and gapped near all-time highs. The situation in BABA was similar.

When it comes to recent IPOs is better to stick to companies most people haven’t heard off that are showing constructive price action. Timing is also very important. The two best market environments for trading recent IPOs are:

- Right after a major market correction. Due to their small float, recent IPOs tend to be very volatile. They can easily go down 50% – 90% if the S&P 500 loses 10-15%. They can just as easily double and triple in the initial stages of a market recovery.

- When the general market is in an uptrend and risk appetite is growing.

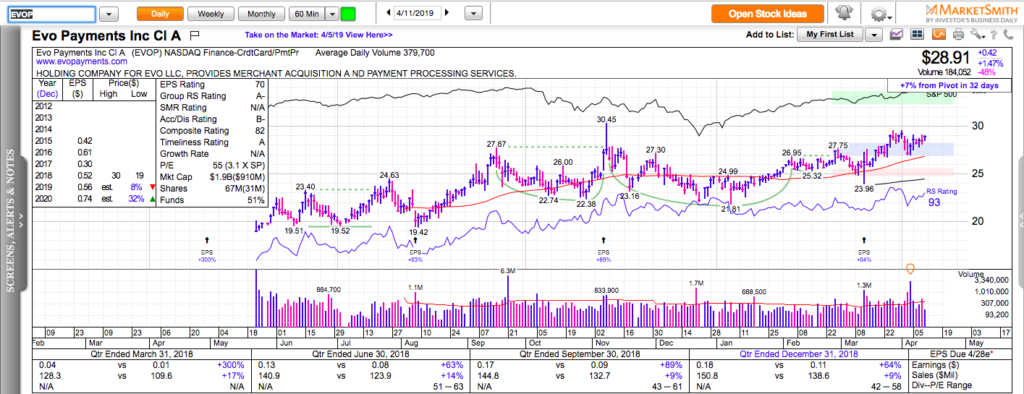

Here are five less-talked-about recent IPOs that are currently showing constructive price action: INSP, TENB, DOMO, EVOP, PS.

Check out my latest two trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.