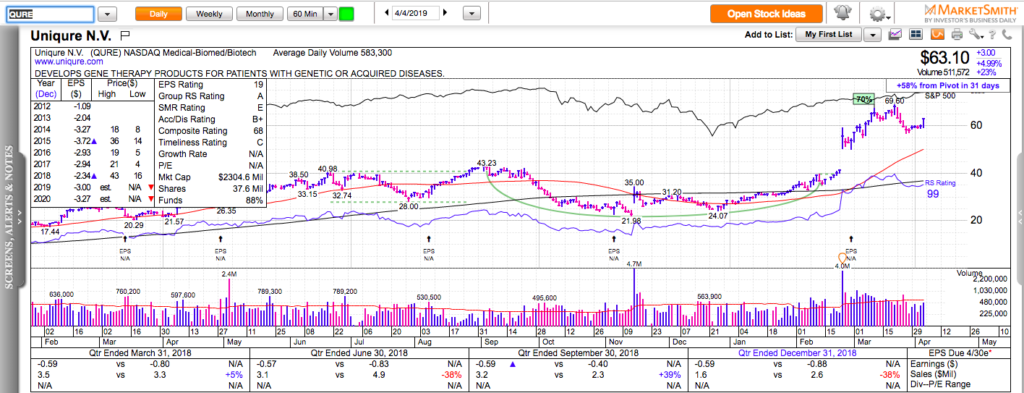

All charts in this post are powered by MarketSmith

In late February, after Roche paid a hefty premium to buy Spark Therapeutics (ONCE) for $4.3 Billion. The acquisition ignited a rally in the entire gene therapy industry.

After the gap, QURE consolidated through time for a few days. Then, it broke out again and it quickly ran to $70, only to retrace back to $60, where buyers are stepping up again today. While most momentum stocks are under pressure today, QURE is up more than 4% and it is perking up from a tight range contraction zone. This is a notable relative strength and a sign of institutional accumulation, which bodes well for higher prices ahead.

Check out my latest trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.