MarketSmith powers the charts in this video

I published a new trading book recently. Check it out on Amazon.

Inflation is slowing down but not as fast as estimates which gives the Fed a good reason to continue to raise interest rates. Some Fed officials even opined that a 50bps increase might be needed at the next meeting. The market has done a marvelous job so far this year brushing aside any bad news and pushing higher. Every 4-5% pullback has been bought so far. This is not likely to change unless interest rates and the US Dollar really spike higher.

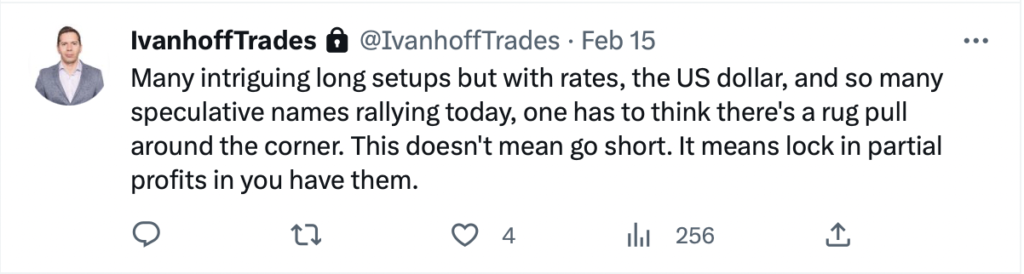

Rug-pulls and shakeouts are normal during rising markets. In fact, you need a pullback for a better risk-to-reward entry. One could feel the FOMO and hubris last week when junk started to make crazy moves on Wednesday. I tweeted the following at the time:

It didn’t take long after that for the indexes to pull back and take most speculative names with them lower.

QQQ and IWM managed to close above their 20-day EMA. They have been riding their 20dEMA since mid-January. If QQQ closes below it, it will likely test its year-to-date volume-weighted-average price of around 290. The YTD VWAP for SPY is around 400.

While tech is consolidating recent gains, we might see a rotation into other sectors. Biotech woke up on Friday and it hasn’t really done much since last summer. After all, bull markets correct through sector rotation. If we are in one, we should see more of those.

Try my subscription service which includes a private Twitter feed with option and stock ideas, emails with concise market commentary and actionable swing, intraday, and position trade ideas, the Momentum 40 list of market leaders, and much more. See some of the recent testimonials.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed options and stock ideas shared on my private Twitter stream and emails for subscribers.

Check out my free weekly email to get an idea of the content I share with members.

Disclaimer: Everything I share is for educational and informational purposes only and it should not be considered financial advice.