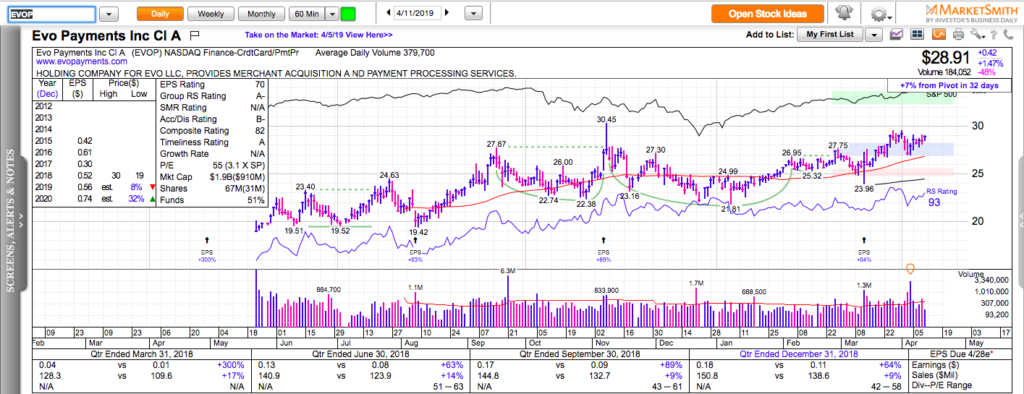

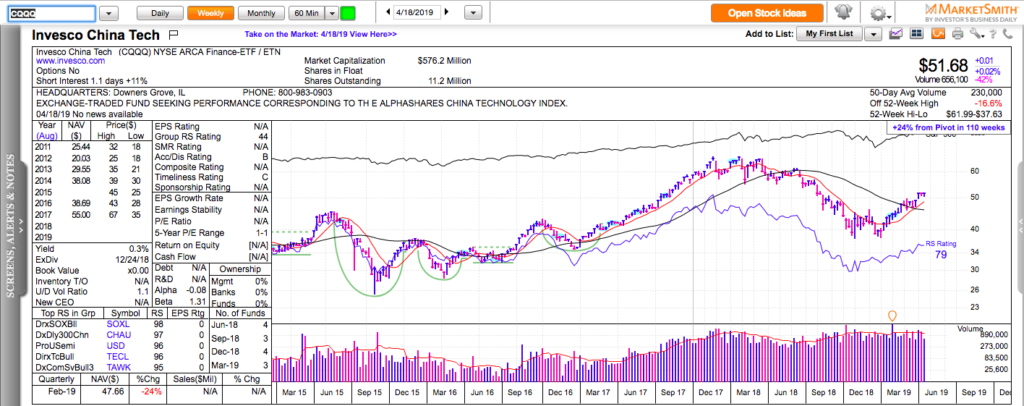

All charts in this post are powered by MarketSmith

The best performing sectors after a deep market correction (like the one we had in the last quarter of 2018) are usually the ones that get hit the worst. Chinese names certainly fit that category. Most had a 50 to 90% drawdown in 2018; therefore, it should not be a big surprise that many Chinese stocks are among the best performing year-to-date.

CQQQ, which an ETF concentrated in Chinese tech stocks, is firmly back above its 50 and 200-day moving averages and with rising relative strength rating. It is setting up in a tight range near its year-to-date highs. If you look under its surface, you will notice quite a few individual Chinese stocks setting up for a potential leg higher. I highlighted a few of them for our members at Market Wisdom.

Check out my two best trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.