All charts on Momentum Monday are powered by MarketSmith

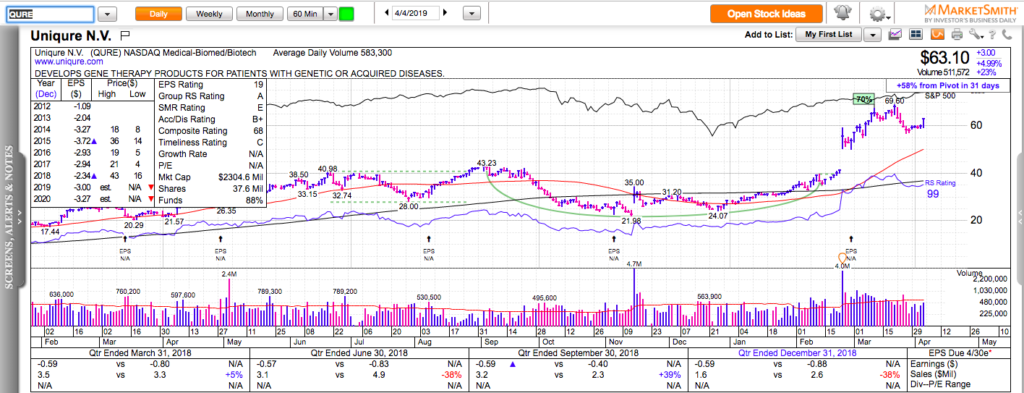

Bull markets often correct through sector rotation. When many leading enterprise software stocks were hit last week, the market averages didn’t skip a beat. The money just rotated into other sectors – semiconductors, energy, financials, retailers, biotech.

The dips are still welcomed as buying opportunities by many. The S&P 500 and the Nasdaq 100 are less than 2% below new all-time highs. The U.S.-China trade deals seems to be priced in. In other words, expectations going into the next earnings season, which starts next week, are high so companies better not disappoint.

Check out my latest two trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.