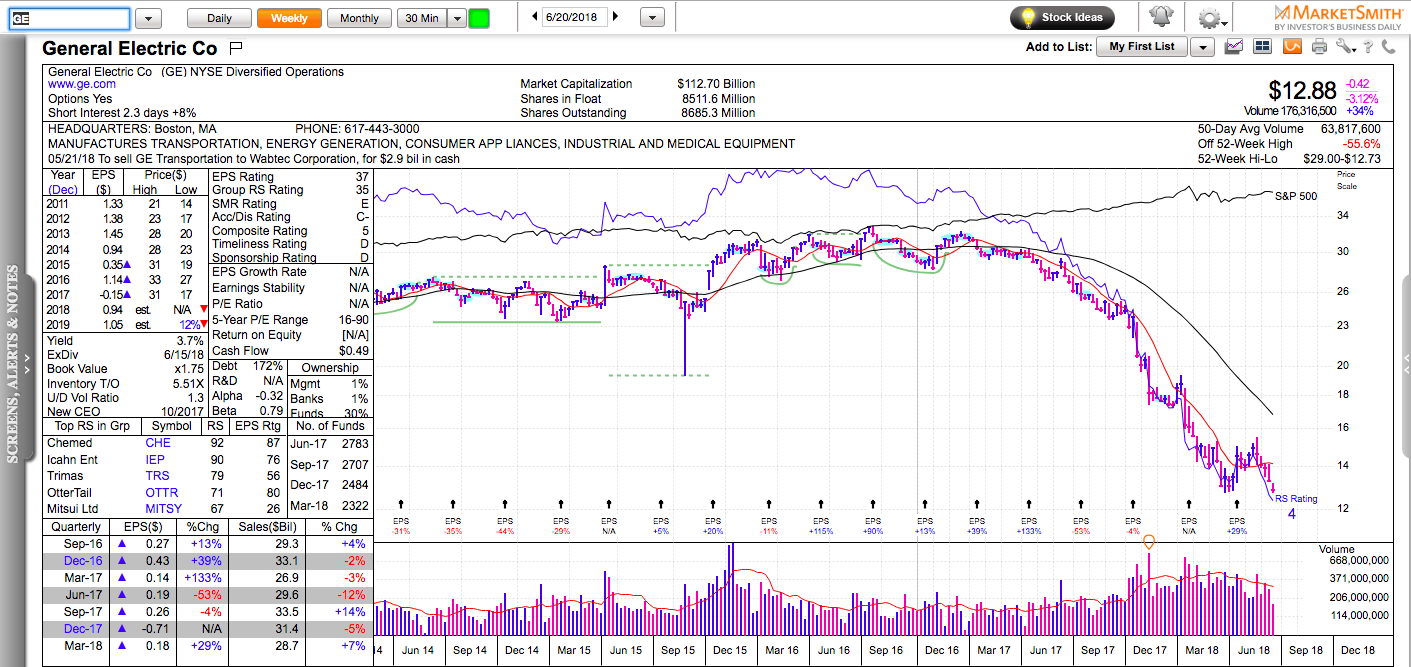

Charts in this post are powered by MarketSmith.

GE has just lost its spot on the Dow 30. Walgreens will replace it. This should not come as a big surprise. Its stock has been in a disarray for quite some time. It is down about 60% for the past 18 months.

You would not believe how many people told me they were buying GE at 25, 20, 18, and 15 because “it has become very cheap and it will come eventually back”. Maybe, it will recover to all-time highs one day. Maybe, it will take many years to do so and you will get tired of waiting.

Not all individual stocks recover from a big drawdown. Many remain dead money for decades to come. There is a big difference between individual stocks and stock indexes.

Indexes usually come back because they are diversified and they cut the losers (remove stocks which market cap has fallen below a threshold level) and add potential winners (add stocks which market cap has risen above certain threshold level). The current minimum threshold for the S&P 500 is $6.1 Billion.

The most popular stock indexes in the U.S. are basically long-term trend following systems in disguise. I sometimes joke with passive investors (indexers) that they are actually trend followers who don’t want to pick stocks.

Buying 52-week lows in a bear market is understandable if you are a value investor. Most stocks take a big hit during market corrections and the good is thrown out with the bad.

Buying stocks making 52-week lows in a raging bull market is a completely different story and it often doesn’t end well. If a stock keeps plunging while the rest of the market is advancing there’s is usually something very wrong with it and it is likely to continue lower. You can save yourself a lof headaches if you ignore the 52-week low list during bull markets.

Most people will be better off waiting for a beaten-up stock to build a new base and break out to new 52-week highs before they enter. A new 52-week high in a crushed stock might still mean 50% below its all-time highs.

When you buy a new 52-week high in a heavily neglected stock, you achieve two things: you have momentum on your side and you have plenty of people who don’t believe in the stock, which is good because those same people are a future source of demand.