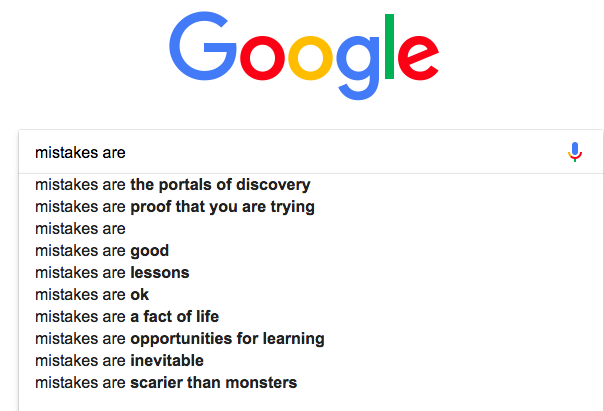

I ran a search on Google for the expression “mistakes are”. The results:

In his first book, Michael Batnick outlines the big investing and trading mistakes of some of the most successful investors and brightest minds that are known to humankind. Most mistakes revolve around the same themes:

– being overleveraged and building too big positions in assets that were illiquid or suddenly became illiquid;

– venturing outside of expert zone when having to manage a much bigger amount of capital;

– overconfidence and hubris;

– normal mistakes that cannot really be prevented; they are part of the investing process;

– fear of missing out.

I enjoyed reading Michael’s book . It is not a how-to book. It is an interesting dive into market history and psychology. Here are some of the more interesting insights I found:

1. Leverage made Livermore his fortune, leverage destroyed him. He knew everything one can possibly know about market psychology and price action but it seems he never learned how to control risk – it was a constant all or nothing betting for him. No wonder he went broke 4 times.

2. Ben Graham understood that no approach works all the time. There are time and place for everything. Markets evolve and some concepts stop working. A margin of safety doesn’t matter during periods of forced liquidation, especially when you are leveraged to the hill.

3. “A high IQ guarantees you nothing! This is one of the hardest things for newer investors to come to grips with, that markets don’t compensate you just for being smart.” and “Intelligence in investing is not absolute; it’s relative. In other words, it doesn’t just matter how smart you are, it matters how smart your competition is.”

4. “Putting too much money into something you don’t fully understand is a good way to lose a lot of money. But what’s more damaging than losing money is the psychological scar tissue that remains after the money vanishes.”

5. “Once something belongs to us, objective thinking flies out the window.”

6. “Professional win points. Amateurs lose points”, therefore professionals should play to win and amateurs should play not to lose (try to make fewer mistakes).

7. “Bad things tend to happen when we compare our portfolios with others, especially if they possess a lesser IQ and extracted a higher return.”

8. On the dangers on concentrated bets: “A single stock leveled one of the most successful funds of all time, you should think twice before putting yourself in the same type of situation.”

9. “The most disciplined investors are intimately aware of how they’ll behave in different market environments, so they hold a portfolio that is suited to their personality. They don’t kill themselves trying to build a perfect portfolio because they know that it doesn’t exist.”

10. “The average intra‐year decline for US stocks is 14%, so a little wind in the bushes is to be expected.2 But saber‐toothed tigers, or backbreaking bear markets, are few and far between. Corrections occur all the time, but rarely do they turn into something worse, so selling every time stocks fall a little and waiting for the dust to settle is a great way to buy high and sell low.”

Source: Batnick, Michael. Big Mistakes: The Best Investors and Their Worst Investments (Bloomberg). Wiley. Kindle Edition.