Financial Times reports that there were 1700 new IPOs around the globe in 2017 – an increase of 44% compared to 2016. China has been the clear leader with more than 400 listings. In the U.S. companies raised $49 billion or 2X the amount raised in 2016.

Here are some of the notable movers among new listings in 2017:

The crypto-mania has entered the stock market. The stock of any company with a blockchain press release has been hot in the past couple months. LFIN and VERI are two examples.

Coal is back. Believe it or not, coal stocks are gaining attention again. Is it because of Trump’s administration’s relaxed attitude towards coal or is it because the new crypto-mania has boosted energy demand, no one really knows.

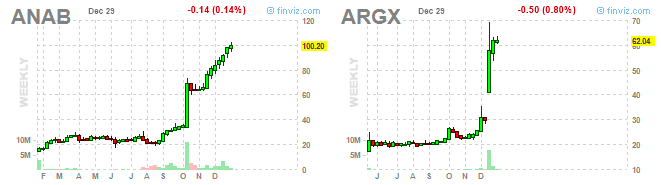

The biotech sector was one of the best performers in 2017. Naturally, select biotech IPOS shined. ANAB and ARGX proved once again why price momentum is one of the most powerful equity selection tools.

Quite a few new Chinese companies started trading in the U.S. in 2017. The Chinese education company, BEDU went from $10 to $30 before it had a sizable pullback.

ROKU staged a massive short squeeze. It went from $20 to $60 in two months.

The Canadian maker of goose-feather jackets, GOOS almost doubled in 2017.

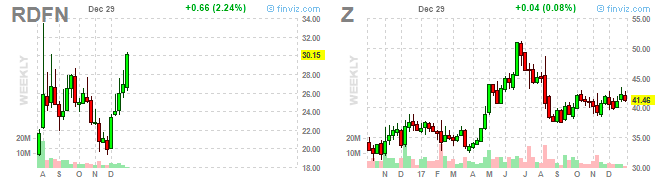

Redfin went public and now Zillow is not the only publicly-traded play in real-estate listings.

Let’s not forget to mention the disappointments in 2017: SNAP, APRN, YOGA, HAIR failed to live up to market’s high expectations: