1. Distribution in the stock market is non-linear. A small number of stocks account for the majority of profits. For each big winner that remains in market’s folklore, there are many more stocks that do poorly. From the book The Ivy Portfolio, by Meb Faber:

“The Russell 3000 index measures the performance of the largest 3000 U.S. companies, 98% of the investable U.S. equity market. 40% of the stocks had a negative return over their lifetime, 20% of stocks lost nearly all of their value, 10% of stocks recorded huge wins over 500%. 80% of the gains are a function of 20% of the stocks.”

2. It is psychologically impossible to ride a stock for a thousand percent return, because of the huge drawdowns it goes through. Here’s Michael Batnick on one of the best-performing stocks of all times, Disney ($DIS), which is up 128,000% since its IPO.

The hypothetical investor who captured the entire 128,000% return over the last nearly sixty years would have experienced plenty of discomfort along the way. Disney has seen eight separate drawdowns of at least thirty percent. To be clear, what this means is that on eight different occasions, Disney would hit new all-time highs and then fall by at least thirty percent. A few more data points worth mentioning:

1) Disney has been in a 20% drawdown 55% of the time.

2) After gaining 270% in the seven years following its IPO, Disney would decline 80% in under two years.

3) Disney has been in a 50% drawdown 25% of the time.These sobering numbers come from one of the greatest companies of all-time. What does the rest of the stock market look like?

What is the alternative to trying to pick individual stock market winners? Owning an index?

1. Indexes also go through deep 50% drawdowns. Between 2000 nd 2002, Nasdaq Composite went down 80%. The average annual drawdown of the S & P 500 since 1980 has been 14%.

2. Yes, indexes always come back eventually, because they are getting rebalanced every year. Indexing is not as passive as many people think. And yes, some stocks never come back.

3. Overall, indexes have smaller drawdowns than stocks and they tend to come back (those who bought Japan in 1990 are still waiting), but everything comes for a price. The return they provide is lot smaller than what a basket of high-growth stocks could achieve in a bull market.

4. We don’t have to own a stock forever in order to make money in it. Trading and investing, both require having an exit strategy:

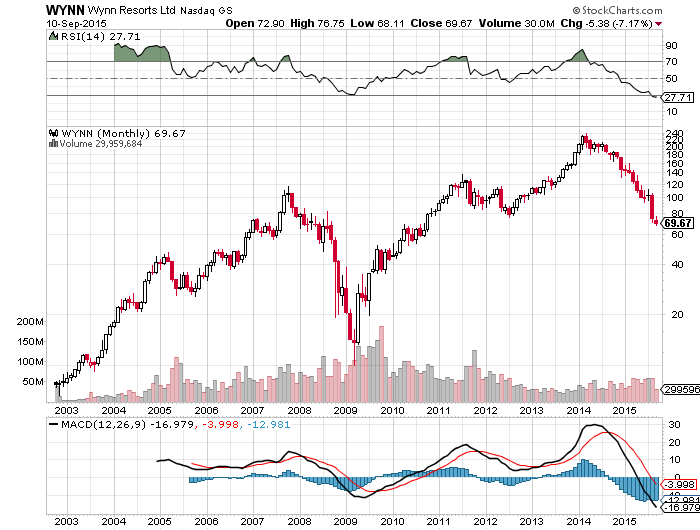

in 2006… Wynn Casino stock was $69. Today’s it’s $69. In between…$160, $18 and $220 …buy and hold FTW

— Howard Lindzon (@howardlindzon) Sep. 10 at 09:24 PM

5. Psychologically, it is a lot easier to catch ten 50% to 100% gainers in a bull market than one 1000%. It is even easier to catch a hundred 10-20% gainers that ten 50% to 100%. And by easier, I mean that we don’t have to go through big drawdowns in order to catch them.