Volatility tends to remain elevated long after equity indexes bottom. The reasons are several:

1) No one is sure that indexes have really bottomed, options sellers are asking for higher premiums and buyers are willing to pay them in order to hedge underlying long positions.

2) Daily trading ranges remain wider than usual for awhile. The biggest $SPX’s daily gains and losses happen when it is under its 200dma.

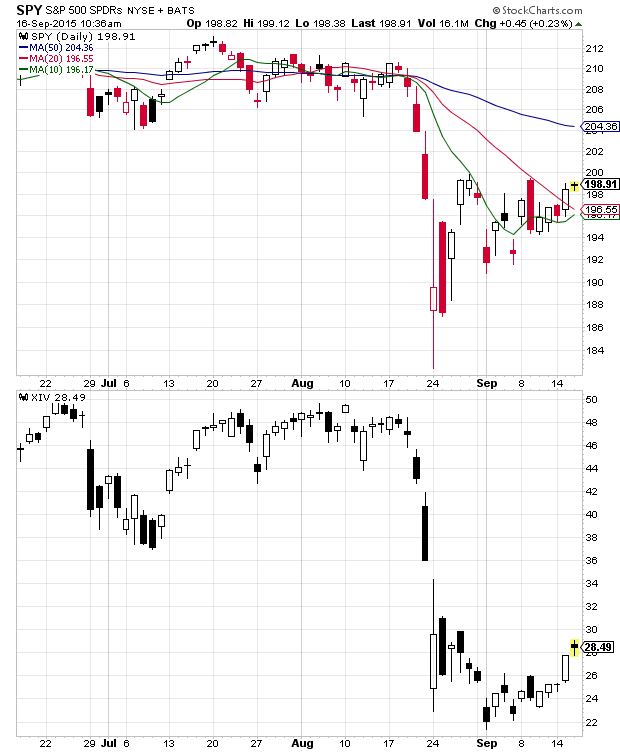

The deeper and the longer the correction, the longer volatility remains elevated. For example, after the bear market of later 2007 – early 2009, the VIX remained above 20 for more than a year. In 2011, $XIV (inverse VIX ETN) bottomed months after $SPY did. In fact, $SPY was already trading above its 50 and 200dma, when XIV started to bottom. Something similar has happened during the most recent market correction. $SPY hit its momentum low on August 24. XIV bottomed days later. Such “delays” in market reactions provide opportunities to gradually build a short volatility position for days and weeks after market indexes have allegedly bottomed.

I cover this subject in a lot more detail in my latest book. It is a crash course on market corrections and the ensuing recoveries with a social media spin.