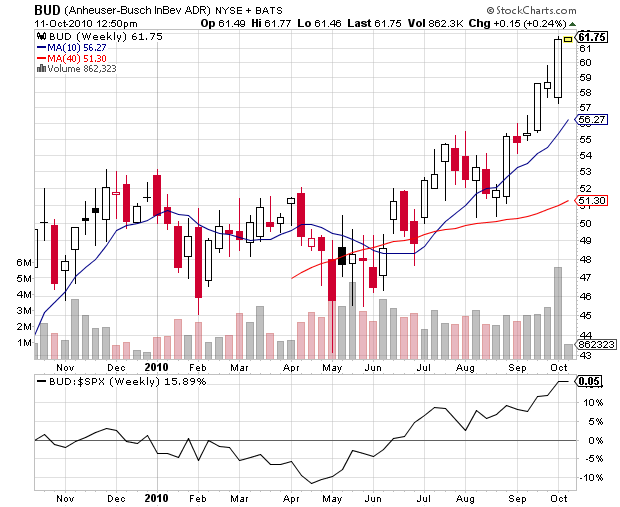

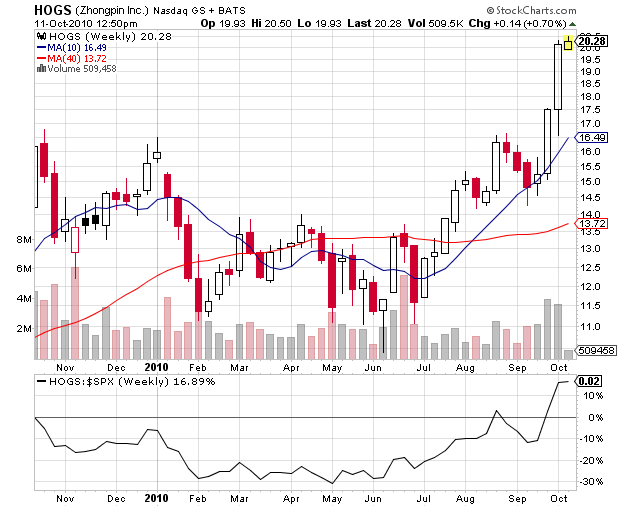

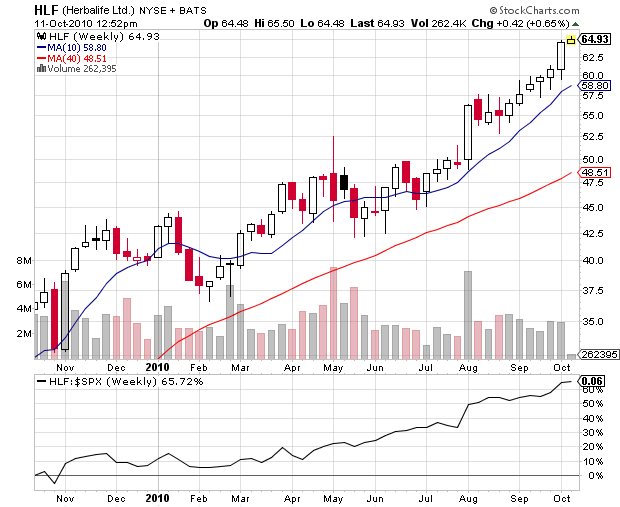

There is a great variety of industries at the all time high list – from discount US retailers to Chinese pork producers. Short-term price trends are fueled by momentum, medium-term price trends are fed by earnings related catalysts, long-term price trends are sustained by social and business trends.

The big variety at the all time high list is a healthy sign for the market. It shows confidence. In the end of the day, risk appetite plays a huge role for the near-term price action. The momentum approach could be extremely profitable if it is combined with proper risk management. A few times a year, the market just wants to go up and momentum stocks appreciate 20-50% in a month on less.

What is important to realize, is that most of the hot momentum stocks are just rented and at some point of time they will be sold. When everyone rushes for the exits at the same time, there is not enough liquidity to meet the supply. The difference between a great momentum investor and a good momentum investor is that the former knows where to sell and he’s willing to turn investments into trades.

One thought on “Beer, Pork and Drugs at the New All Time High List”

Comments are closed.