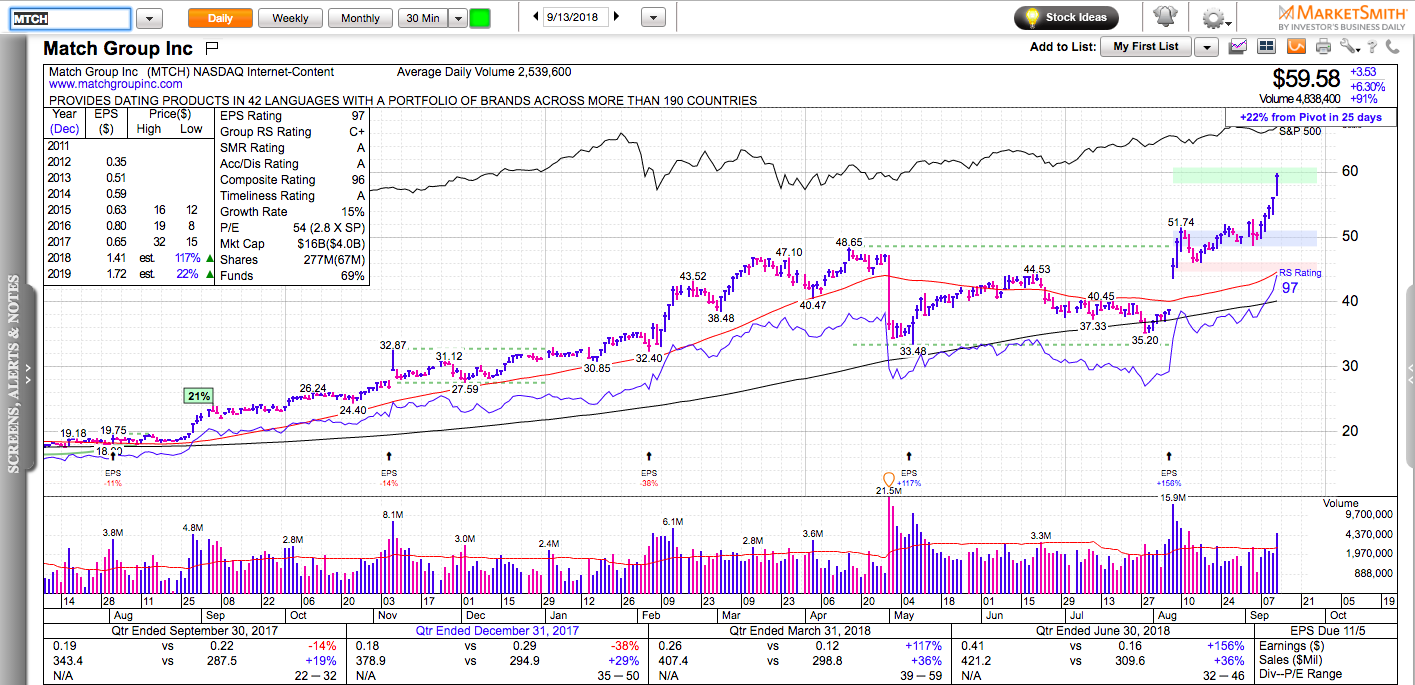

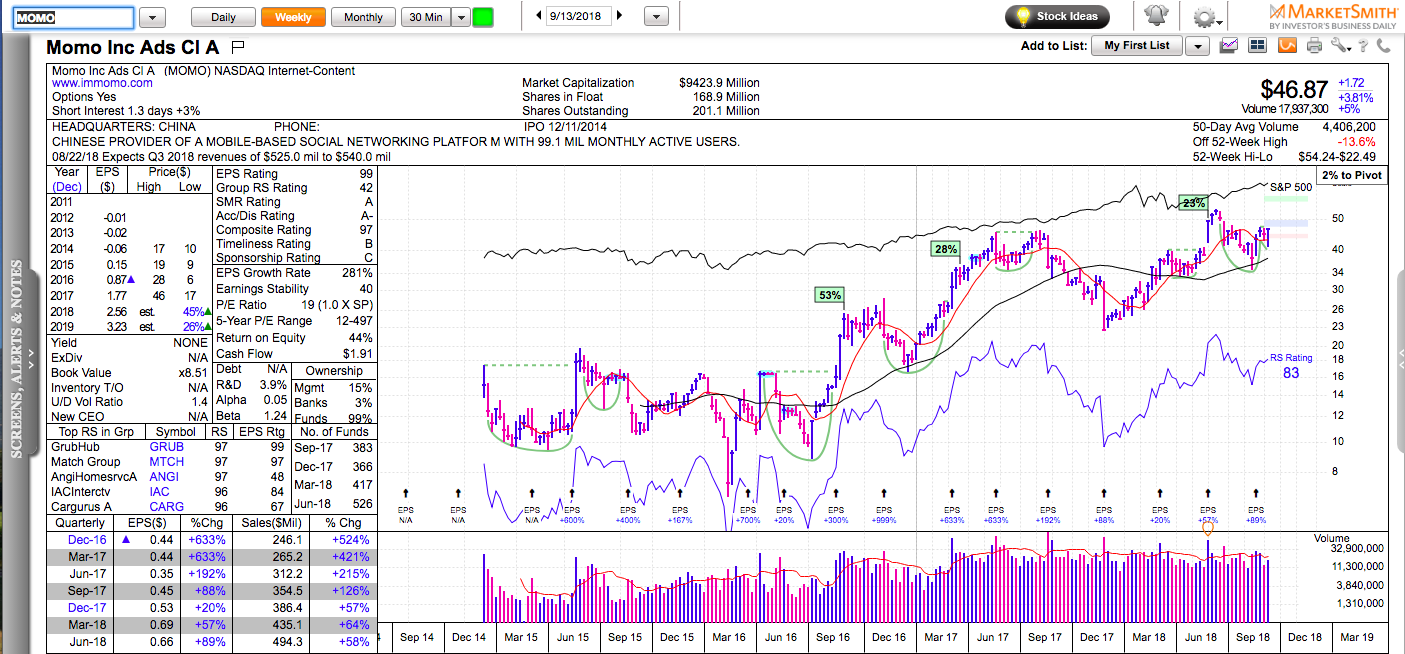

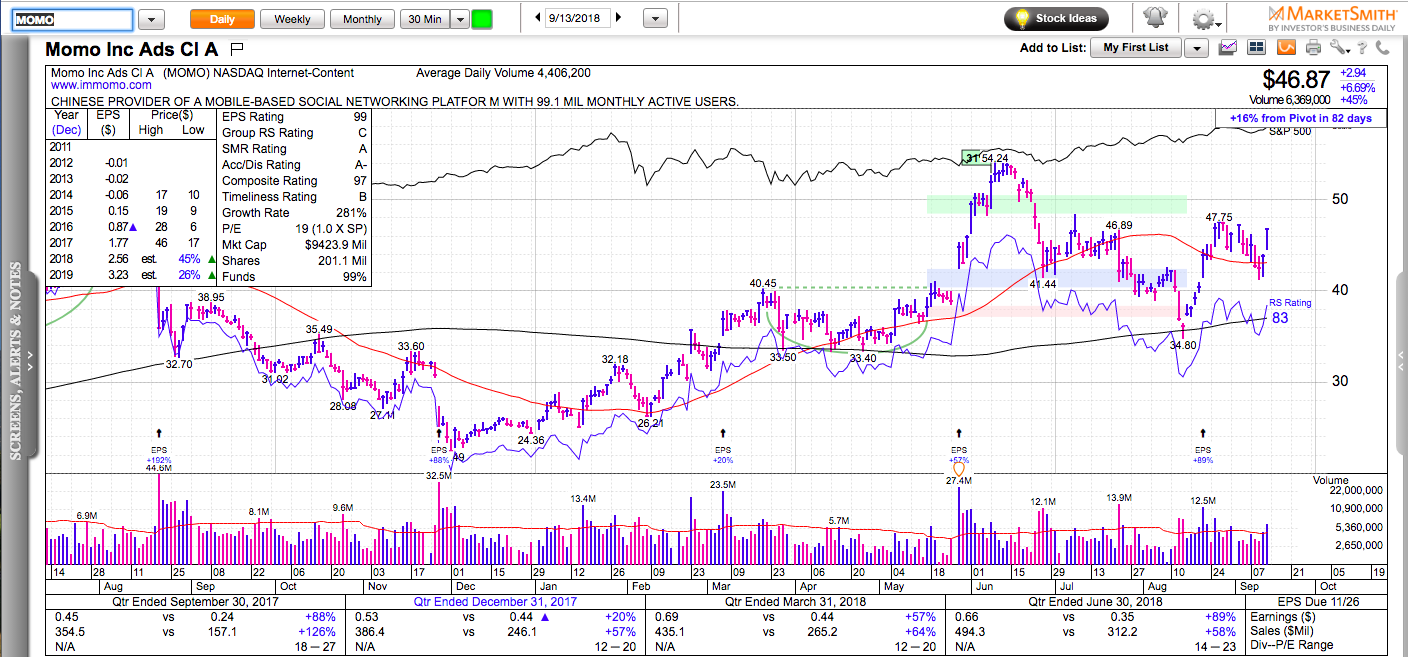

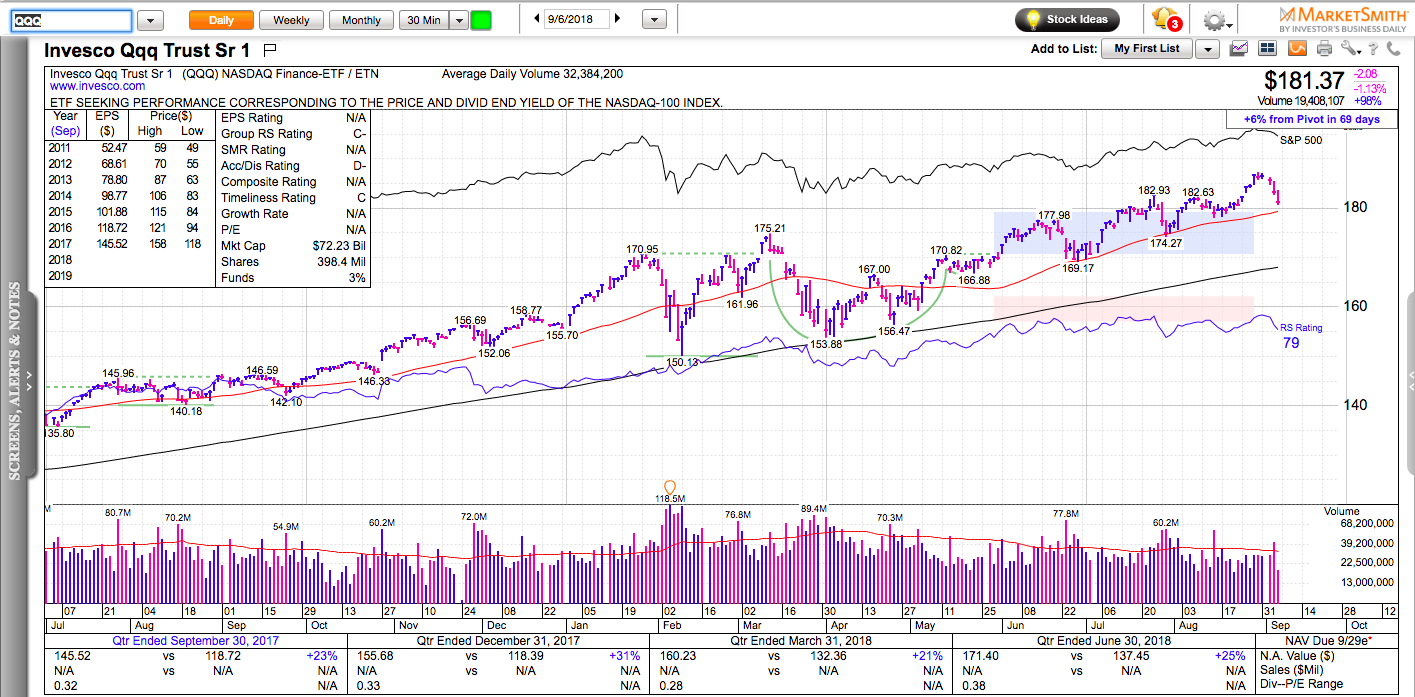

All charts in this post are powered by MarketSmith

The owner of Tinder, MTCH has been on a tear ever since it crushed earnings estimates on August 7th. Almost 50% of its float was short at the time, which certainly contributed to the quick price appreciation in the past month. I wrote about the potential for a short squeeze here.

Now, the so-called “Tinder of China”, MOMO might offer a similar opportunity. MOMO had a 40% correction this summer along with many other Chinese stocks. It the past few weeks, it has managed to recover above its 50-day moving average, where it is setting up again. If it manages to break out above $48, it has a good chance to test its all-time high near $55. A lot will depend on how the U.S. – China trade negotiations go.