- The stock market is an opportunity machine. Times change, gas prices change, fashion changes, regulations change, but there are always companies that find a way to monetize on an ongoing social and business trend and make their investors rich. The only things that change on Wall Street are the names of the winning and losing stocks.

- There is always a silver lining. One company’s rising costs are another company’s rising revenues and the market usually does a good job identifying the winners and the losers. Money never sleeps. There is always a trend somewhere.

- Simple is better. Complexity is the enemy of execution, great returns, and good lifestyle.

- Trends exist because people tend to underreact to new information; then fear of missing out kicks in, people get anxious and overreact. This creates fantastic opportunities for both momentum and value investors.

- The stock market tries to be forward-looking. Sometimes, it is spot on in predicting the future. Sometimes, it even impacts the future. Other times, it ends up very wrong and prices events that will never happen.

- Intrinsic value is overrated. In 2018, a rare 1793 penny was auctioned for 300k. You can take this penny and go to the supermarket and you can buy exactly a pennyworth of food there. Or you can tell a good story and auction it for a lot more. Supply and demand, which depend on perceptions and expectations for future gains are often more important than any fundamentals.

- Prices change when expectations and perception change; the latter can change for many reasons, including price action.

- Early adopters (trendsetters) usually sell early and end up making as much or less money than people who hop on already established trends.

- Every trend needs skeptics and doubters; otherwise, there won’t be anyone left to buy.

- Buy and hold forever doesn’t work with most individual stocks. Most trends eventually end. Have an exit strategy.

- In trading and in life, sometimes being wrong is not a choice, but staying wrong always is. Cut your losses, cut your losses, cut your losses, so you live to fight another day.

- There should be a very clear distinction between trading and investing. Long-term investing is essentially a bet on how other people’s perceptions will change over time. It is about answering the question What are the catalysts that will change market’s expectations? Trading is about understanding the constant cycle of range contraction and range expansion, it is about taking asymmetric bets where you risk a little to make a lot, it is about adapting to changing markets.

Category: Best Of

The Only Time to Safely Bottom Fish for a Stock Is …

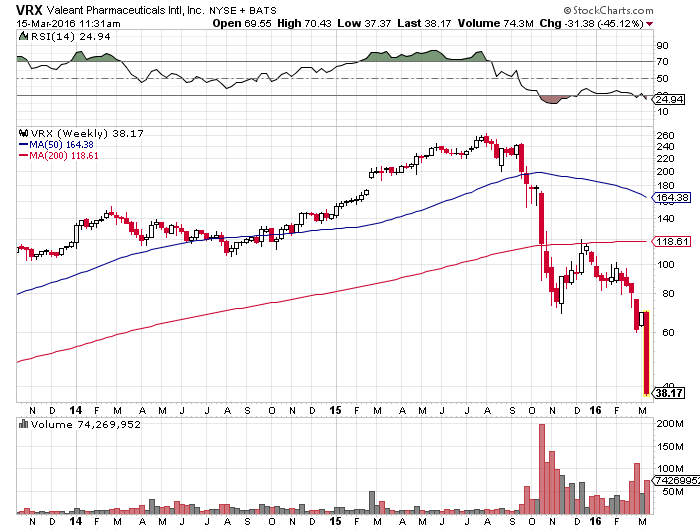

VRX is down another 40% this morning, extending its drawdown to 85% from its 52-week high reached last summer. I am not familiar with VRX’s fundamentals and I am not going to argue about them. My point is strictly about technicals and sentiment.

Over the past few weeks, many have been pointing out to a positive momentum divergence in VRX – its price made new price lows in early March while its RSI didn’t. For some this is enough to put it on their watch list and wait for some signs of strength before entering on the long side. While it is true that momentum often leads price, price is the only thing that actually pays us. The delay between a positive momentum divergence in individual stocks and price reversal could be substantial or longer than most people could remain solvent and sane. Plus, this signal doesn’t always work. No indicator does.

My friend Frank Zorrilla made a really interesting observation this morning:

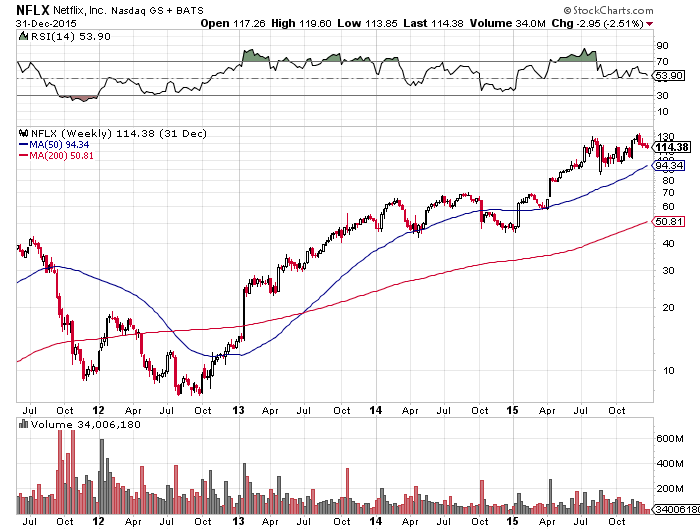

$VRX is the reason why you don’t bottom fish, $NFLX back in 2012 is why you do…that settles it…

— Frank Zorrilla (@ZorTrades) Mar. 15 at 07:35 AM

NFLX also lost 80% of its market cap in 2011/2012. The difference is that then it spent multiple weeks in a tight, low-volume range, which is the ultimate sign of neglect. Then, it made a new 52-week high in early 2013 and it never looked back. It went up more than 400% in the next 3 years. You didn’t have to bottom fish for NFLX. You could have been “late” and wait for a fresh breakout from a consolidation and still achieved a substantial return. The best performing stocks in any given year are usually the ones that surprise the most. This means that they will often come from a place very few expect – they are likely to be widely neglected before and even after their major high-volume breakout to new 52-week highs.

There is a time and place for each market strategy.

Stocks that make new 52-week lows in a bull market are usually there for a good reason. From my perspective, there’s only one market environment where it is relatively safe to try bottom fishing and the potential reward far outweighs the risk taken. It is during market corrections when the general market tests its momentum lows with some form of breadth divergence. In my book CRASH, I describe the five stages that a typical market correction goes through:

- The Guillotine Stage – fast sharp decline that last 1-3 weeks and leads to a 5-10% loss in major indexes and leads to extremely oversold market breadth readings. Volatility spikes through the roof during this stage and it stays there. Indexes close below their 200-day moving average.

- Short-term bounce that gains back 30-50% of the sharp decline in stage one. Such bounces often find resistance and reverse lower at declining 10, 20, 50 or 200-day moving averages.

- Choppy market environment, that gradually whipsaws both bulls and bears as market often changes directions and daily price ranges are extremely wide. During this stage, fear is gradually replaced by apathy and lack of interest in the market.

- A retest of the momentum low achieved in stage 1. There is usually some type of breadth divergence – indexes are piercing below their momentum lows but with improved internals – there’s a smaller percentage of stocks making new 20-day lows than in stage 1. If indexes cannot sustain bounce after this retest, we are probably in the midst of a bear market or a lot longer correction, at least.

- Recovery – correlations are very high at this stage. Indexes quickly reach overbought levels and stay there for a long time. Those who wait for a pullback, miss the boat.

Most stocks tend to top individually, but they bottom together as a group. Fishing for beaten down stocks that are down 80% or even 90% from their 52-week highs only makes sense in stage four of a typical market correction. Here’s a recent example.

The Two Best Performing Stock Groups After A Correction

I don’t know if the current correction is over. What most of us know is that stock indexes hit their momentum lows on January 20th and they have been in an extremely choppy, back-and-forth environment ever since. This is a normal price action after big and fast drops. If past history is a good guidance, we are very likely to see a re-test of the momentum lows at some point. If the test comes with some form of breadth divergence – for example, a smaller number of stocks making new 50-day lows compared to Jan 20 or smaller number of stocks dropping below their 50dma, and we see heavy institutional buying, then we might have a major sign of a bottom. Remember, bottoms are formed by heavy buying, not heavy selling (even though the latter often happens first).

The more interesting question here is, what are the best-performing stocks after a deep market correction?

1. The ones that sold off the most during the correction. Many of them are priced for bankruptcy. The moment the market realizes that it is not likely to happen, we could see some extreme moves in those stocks. And by extreme, I mean 100% to 300% moves in 2-8 weeks. In the current environment, these are oil & gas, steel stocks, emerging markets.

2. Growth stocks that held the best during the correction. Growth stocks are usually high-beta names that get hit pretty hard in times of market panic. If any of them manage to hold above their 50-day moving average, build a new base or even attempt to make a new 52-week high during the correction, they will likely outperform significantly during any bounce attempt. Note that I accentuate Growth. During corrections is normal to see low-beta, high-yield groups like utilities and consumer staples to hold better than the rest of the market, but they are not going to outperform during a market recovery.

Keep in mind that there are different types of corrections. In a garden-variety 5-10% pullback above a rising 200-day moving average, momentum stocks with the highest relative strength during the correction are likely to significantly outperform during a recovery. After a deep >20% correction below a flat or declining 200dma and especially after a long bear market, many of the best performers will come from the most beaten down stocks that were priced for bankruptcy, but managed to survive.

Some corrections turn into bear markets. They are rare, but they happen. Bull markets reward risk-taking, but when the bear puts out honey, he is usually laying a trap. In bear markets, you buy when the fear of losing is very high and you sell when the fear of missing out is very high. As usual, easier said than done.