The charts in this video are powered by MarketSmith

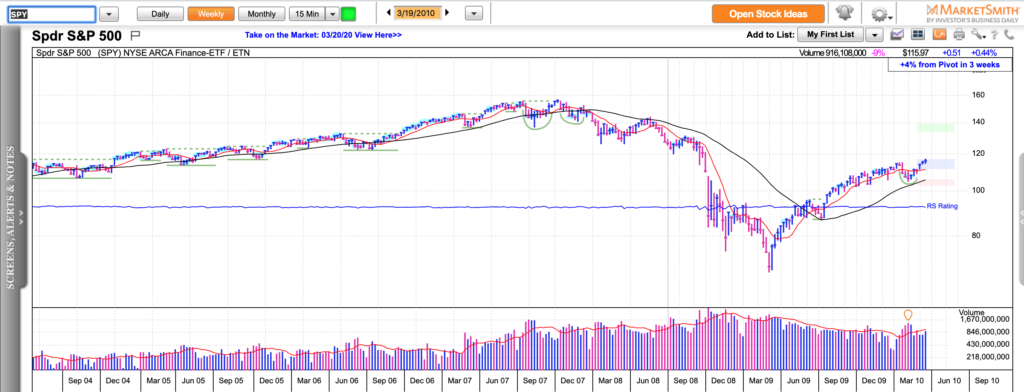

The S&P 500 closed below its December 2018 lows. The next potential level of support is around $200. If that doesn’t hold, we are looking at 170-150. While the indexes finished weak last week, the number of new 52-week lows has been steadily declining. I see some positive momentum divergences in a deeply oversold market but this might not be enough for a relief rally. Maybe, the $2 Trillion stimulus bill will calm the markets down for a bit and lead to a short-term short squeeze.

I continue to stay liquid but I also see good short-term trading opportunities on a daily basis.

Try my new subscription service which includes a private Twitter feed with option and stock ideas, a weekly newsletter with concise market commentary and actionable swing and position trade ideas, the Momentum 50 list of market leaders and much more.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed option and stock ideas shared on my private Twitter stream and weekly email for subscribers.