The three biggest bear markets in U.S. history:

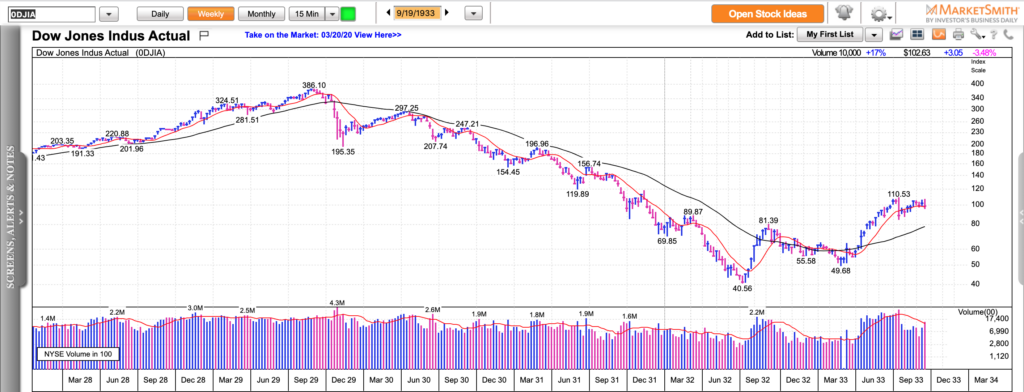

1929-1932: Dow Jones Industrial Average declines 90%;

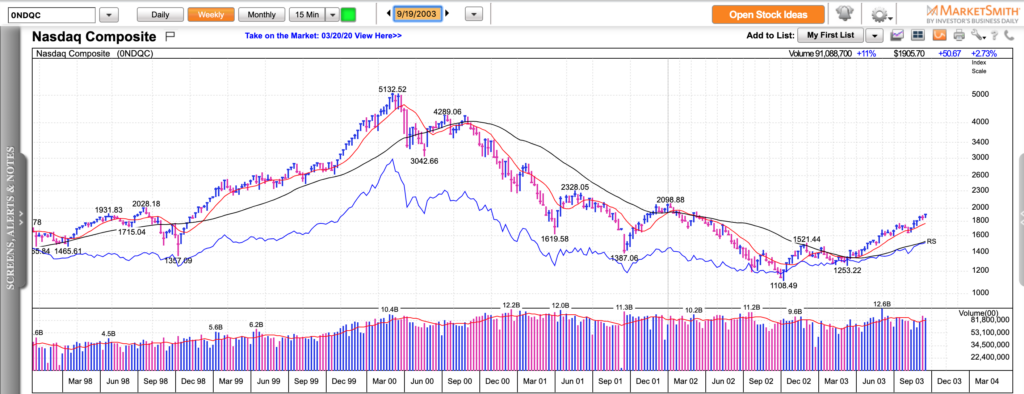

2000-2002: The Nasdaq Composite declines 80%;

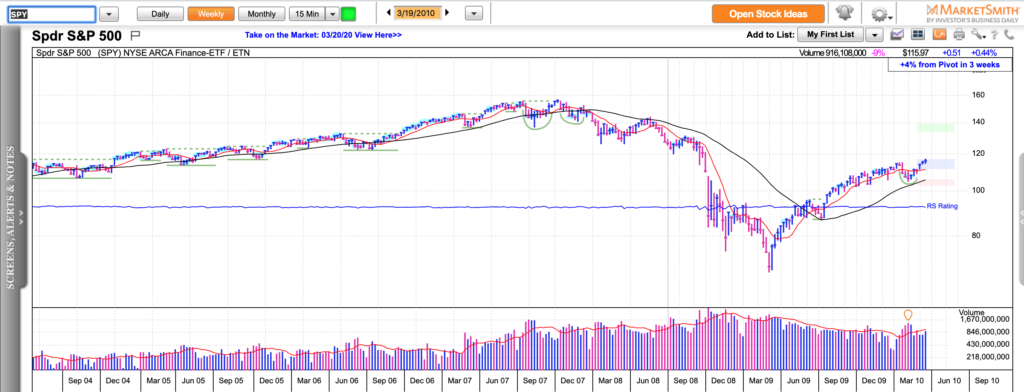

October 2007 – March 2009: S&P 500 declines 58%,

The Nasdaq Composite drops 56%, R2k corrects 60%.

Some lessons from the biggest bear markets in history:

1. There are multiple 20-30% relief rallies which offer great trading opportunities. Protect your profits because most relief rallies don’t last long.

2. The rallies towards declining 50 and 200dma end up being great short opportunities.

3. A relief rally followed by a break below a 50dma is a great short opportunity.

4. Bear markets last longer than most expect. Many long-term investors eventually realize that even the stocks of the strongest companies are not immune to >50% decline. Many get exhausted and sell for big losses because they cannot stomach the drawdowns at some point.

5. Bear markets provide live-changing trading opportunities while they last and live-changing investment opportunities when they end.

6. New bull markets start with a constructive setup in the major stock indexes above their 50-day moving average which is above a flattening 200-day moving average.

7. New market leaders make new 52-week highs ahead of the indexes.

8. Any company that is priced for bankruptcy during a bear market that survives turns into a 20-100x winner during the first 1-5 years of the recovery (new bull market).

9. The stock market is not a place, where for one to win, another has to lose. It is a place driven by cycles – a period when almost everyone is a winner is followed by a period when almost everyone is a loser.

10. Liquidity tends to magically disappear during bear markets when people need it the most to exit.