The charts in this video are powered by MarketSmith

The leaders of 2020 – SPACs, software, clean energy, cannabis, biotech stocks have been under heavy pressure for the past few weeks. Many have already experienced 20-50% correction this year. At some point on Friday, the biotech ETF – XBI was down 27% from its 52-week highs. In other words, part of the market has just experienced a pretty significant pullback which might be enough to reset the bases or we just have a new crop of leaders that no one is used to yet.

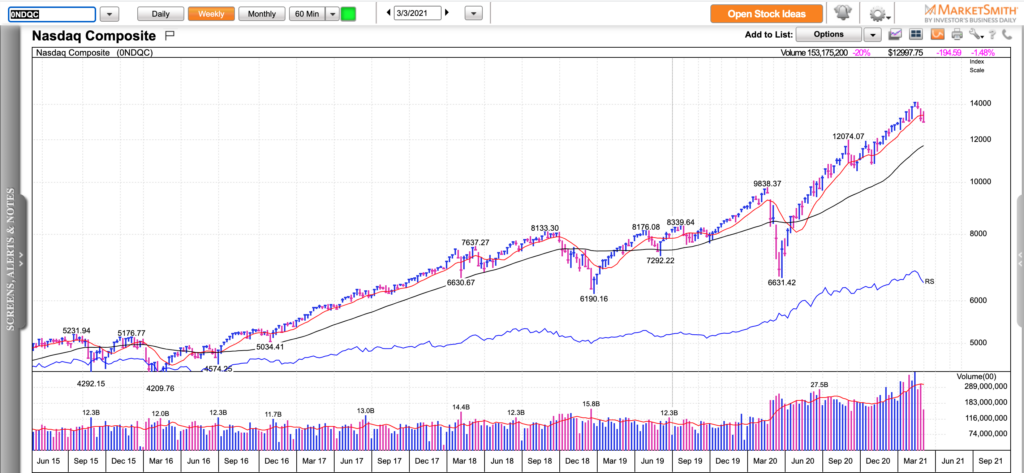

In the meantime, oil and financial stocks have had their best 4-week stretch in awhile. In fact, they are the reason why the S&P 500 is less than 3% below its all-time highs while the Nasdaq 100 has had a 10% pullback. Energy and financials have underperformed for so many years that few could believe that so many of them were hitting new 52-week highs during the week while the rest of the market was diving. Some say that the market is simply pricing in a quick economic recovery and rising interest rates are benefiting old-economy stocks while hurting new-economy stocks which have been trading at crazy high valuations. I don’t know if this narrative is just a temporary rotation or it’ll stick longer but we can’t ignore price action. I find it hard to believe that any rally can be sustained without the participation of growth stocks but the current facts are that basic material and financial stocks might be the new momentum leaders. I can’t believe I am even thinking that but once in a while there are big narrative changes in the market and we have to be open-minded for the possibilities.

I don’t know if Friday was a near-term bottom but so many stocks had major reversal candles that are a good foundation for at least 1-2 day bounce.

Try my subscription service which includes a private Twitter feed with option and stock ideas, emails with concise market commentary and actionable swing, intraday, and position trade ideas, the Momentum 40 list of market leaders, and much more. See some of the recent testimonials.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed options and stock ideas shared on my private Twitter stream and emails for subscribers.

Check out my free weekly email. to get an idea of the content I share with members.

Disclaimer: Everything I share is for educational and informational purposes only and it should not be considered financial advice.