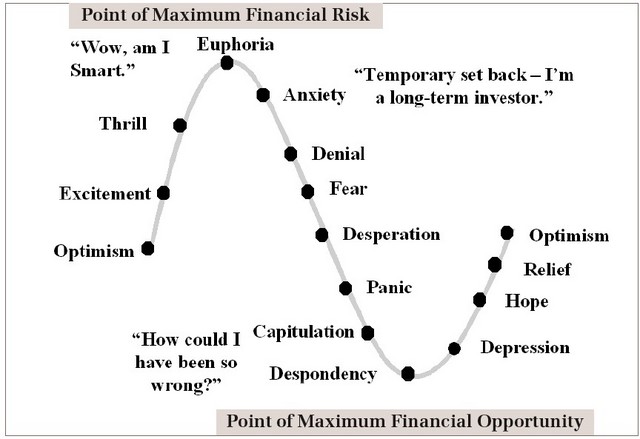

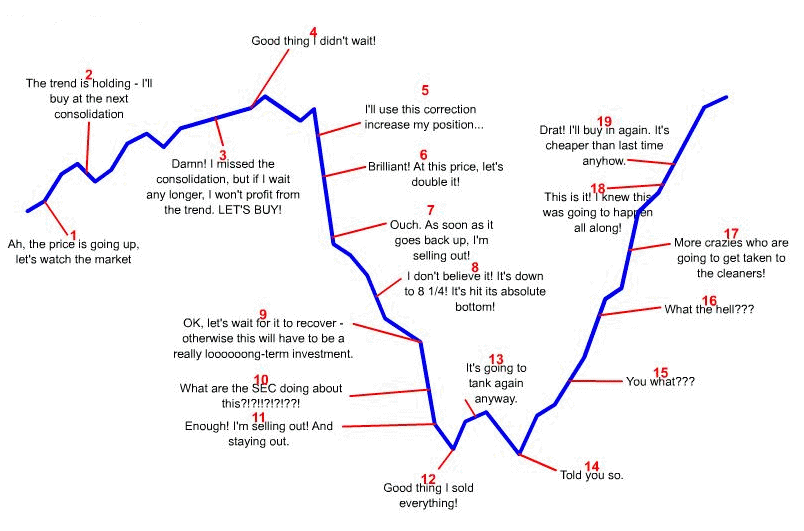

Barry Ritholtz has an excellent post analyzing why investors’ sentiment is always slow to change at turning points of the business cycle.

A Guide to Earnings Season

Each earnings season brings three waves of information from companies. The first is guidance, the second is actual earnings, and the last is an outlook. Each wave of information becomes more important than the last.

About two weeks before the end of each quarter companies begin to announce whether they will meet the expectations of analysts. This ‘confession period’, as Wall Street calls it, can help set the tone of the season.

Companies strive to beat analysts’ expectations, which means that they prefer to guide lower in order to lower expectations to a level, where they are easily beatable. On average, companies that guide earnings estimates down outnumber those that raise them three to one, according to Thomson Reuters. This is why a positive earnings guidance is rare and powerful sign of managerial confidence in the near future earnings and sales growth. There are three reasons for a company to guide higher:

1) it is a small company than wants to attract analysts’ attention, which will result in higher liquidity for its stock.

2) it would like to time a secondary offering with strong guidance

3) it is confident that despite rising street’s expectations, it can still beat them. This is very often the case.

When earnings’ season comes investors’ focus quickly changes from the guidance companies give to their actual results. The pace of earnings announcements looks like a bell curve. Less than ten percent of the companies in the S&P 500 announce in each of the first two weeks of a quarter. Then two-thirds of the companies report results in the span of three weeks. The pace then slows through the end of the quarter. (The majority of retailers report a month after the main earnings season as they close their annual books in January instead of December.)

In this flurry of results, a lot of attention will be placed on the surprise factor. This measures the extent by which a company beats analyst expectations (which very often have already been lowered numerous times by company guidance). The majority of the companies beat. This is why a surprise of one cent or two is considered no news. Sometimes a 100% earnings surprise is also no news at all if it was already discounted in the stock price. Companies that are early in their earnings expectations’ cycle have a better chance of outperforming. Their basis for comparison is still low and analysts are usually very cautious in raising estimates of companies that were neglected for quarters. This is why the so called cockroach effect exists and one strong earnings surprise often leads to a sequence of earnings surprises. For a company that had 4-5 consecutive quarters of substantial surprises is much harder to beat as analysts’ expectations eventually catch up and all potential good news is discounted by the market.

The stock market is a forward looking mechanism that constantly tries to discount changes in investors’ expectations. For this reason, company forecasts trump past successes. Even stocks with strong results can plummet if they deliver tepid outlooks with their results.

In the financial world, everyone tries to be one step ahead of everyone else. Any clue for better earnings and sales might impact expectations. Change in expectations leads to change in perceived valuation, which impacts prices. For basic material stocks such event is a change in prices of the underlying commodities futures, for retailers – changes in year/year comps or new stores opening, for semiconductors – new contract, for consumer goods producers – new distributor, for biotech companies – FDA approval or an announcement of positive preliminary results, for others – it could be change in regulation.

Speculators

The word speculator has undeservingly bad reputation. A quick look in the dictionary reveals that speculator is

- someone who makes conjectures without knowing the facts;

- someone who risks losses for the possibility of considerable gains;

- someones who anticipates price move and intend to profit from it.

Everyone involved in the financial markets is a speculator in one form or another.

Technical analysts believe that it is possible to forecast future price moves by observing current price and volume dynamics. They speculate that certain patterns are good prognosticators of future price moves. They are not interested in the stocks themselves, but in the stock market participants.

Fundamental analysts are interested in the stocks themselves and their underlying business. They assume that sooner or later the market will come to its mind and price will catch up with fundamentals. They essentially speculate that they can forecast with precision future cash flows and discount rates until eternity.

Needless to say no one has a crystal ball. There is no approach that has 100% success rate. The good news is that you don’t have to be right all the time in order to be consistently profitable. There are thousands different ways to make money in the financial markets and the core behind each method involves disciplined risk management. For some risk management involves proper diversification, for others it involves hedging and position sizing.