Williams Sonoma Inc just guided Q3 EPS at $0.26-0.30 vs consensus of $0.21. The company raised its earnings’ expectations range for FY10 from 1.39-1.48 to 1.63-1.70.

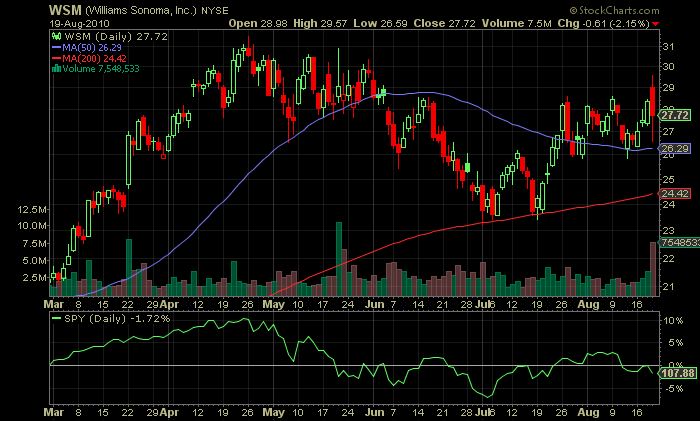

The stock tried to break out yesterday unsuccessfully. Due to general market weakness it couldn’t hold above 28.60. I like stocks that shake out weak hands just before the actual breakout.

I will be watching closely this one today for a potential entry. It has a strong recent catalyst behind its back and a 6.3 days of short interest ratio. It could offer good 1-2 days run.