All charts in this post are powered by MarketSmith

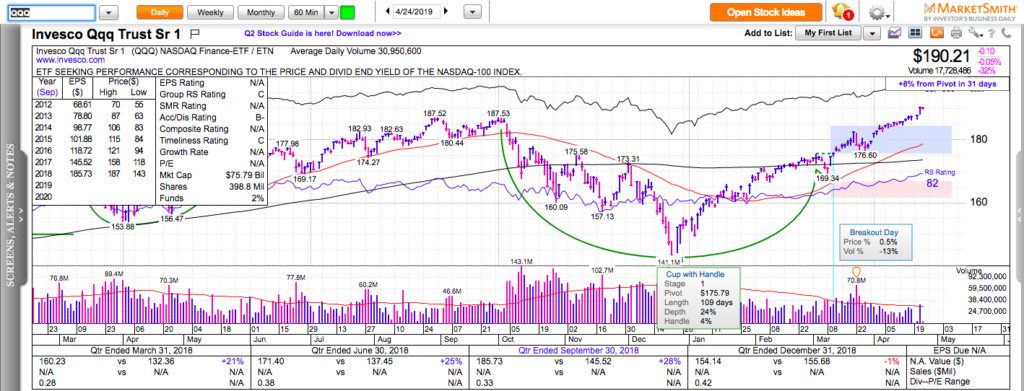

After a 24% correction in the last quarter of 2018, the Nasdaq 100 (QQQ) has fully recovered and hit new all-time highs. A new all-time high after a deep correction is not necessarily the beginning of a new bull market but here are four rules of thumb how to approach it anyway:

- The strong stocks that you want to buy on a pullback, won’t pull back to the obvious levels everyone wants them to. There’s a gap and go action across the board especially after strong earnings reports. It’s smart to develop a strategy that takes this price action into account.

- The biggest mistake you can make in a bull market is not being patient with your winners – don’t micromanage and overreact to every small fluctuation. Find one or two strong themes and try to ride them for as long as you can. Pullbacks in strong stocks are buying opportunities and excellent risk/reward setups during bull markets. Develop a way to take advantage of that.

- Some form of diversification can be helpful in a bull market. Many people forget that bull markets are low-correlation markets of stocks which mean there are good opportunities on both the long and the short side. Not all stocks rise in a bull market at the same time. While putting all your capital into just one or two stocks can help you achieve astonishing returns if you are correct, it can also lead to not making money in a bull market. You don’t need to own 500 stocks to be diversified. 7-10 are enough to do the trick.

- Bull markets often correct through sector rotations. While one leading sector pulls back 4-5%, another steps up to take its role leaving the market averages like SPY and QQQ relatively unscathed. Trying to be one step ahead of the constant sector rotation can spin your head and lead to overtrading, which can be a costly mistake. You can’t catch every single mini-rotation. Focus on making money in a couple of big trends that you have identified.

Check out my two best trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.