The charts in this video are powered by MarketSmith

The U.S. stock market proved its resilience once again. SPY bounced near its 50-day moving average and it is back at new all-time highs. Granted, the latest new highs came with a weak market breadth but negative momentum divergences can be resolved through a sideways consolidation.

Another big week of earnings report is on the horizon. Will Shopify (SHOP) and AYX (Alteryx) continue their ascent or they will pull back like many other software names did last week? It is a big trend to watch. If there’s a rotation from momentum to value, software stocks might have a sizable pullback in the next few months just like they did in September/October of last year.

In the meantime, the mega-caps continue to advance. AMZN is close to breaking out from a 3-year long base. GOOGL is consolidating new its all-time highs.

We also talked about TSLA, AAXN, RETA, UBER, SMH, TCEHY in the show.

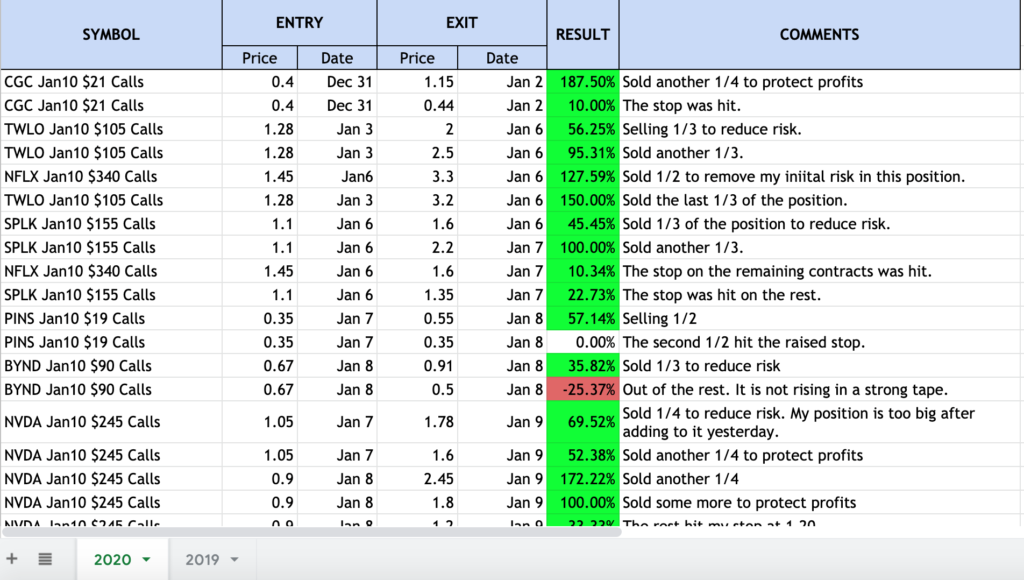

Try my new subscription service which includes a private Twitter feed with option and stock ideas, a weekly newsletter with concise market commentary and actionable swing and position trade ideas, the Momentum 50 list of market leaders and much more.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed option and stock ideas shared on my private Twitter stream and weekly email for subscribers.