MarketSmith powers the charts in this video

I published a new trading book recently. Check it out on Amazon.

We saw a significant bounce in most sectors toward the end of the week. All major indexes are now above their 10 and 20-day EMA. This might be the beginning of a new swing leg higher. This doesn’t mean that we won’t see frequent shake-outs but as long as last week’s lows hold, the bulls have the initiative. The one factor that can spoil the rally is the action interest rates. They had a major rally in February and early March, causing a selloff in equities across the board. Yields started a pullback on Friday and if they continue to decline, tech stocks are likely to benefit in the short-term.

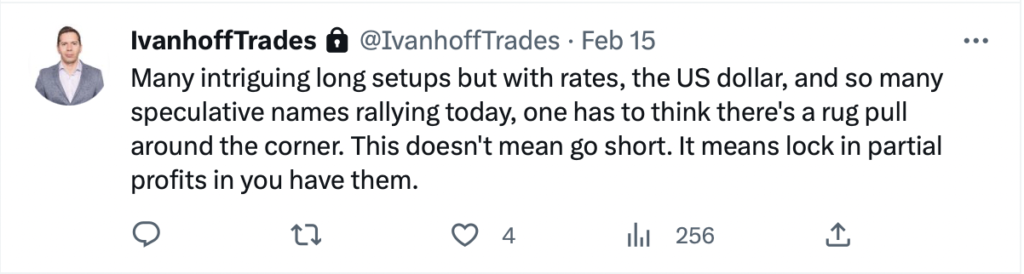

It is interesting to see a wide variety of sectors rallying last week. Basic materials led earlier in the week when interest rates were perking up. The premise was that the inflation trade is back. Then, all sectors went up on Friday when rates pulled back – tech stocks were the big leaders, especially cloud stocks. Equities going up in the face of both rising and falling interest rates is the stock market saying that there won’t be a recession this year. In the meantime, the inverted yield curve is saying there will be one. One of them will be wrong. When and when one is not important right now. We can strictly focus on the setups that the market is providing. February was very choppy and filled with many shake-outs. So far, March is off to a great start. I believe the entire year will consist of several 2-4 week strong rallies intercepted by violent 2-4-week pullbacks. This is a great environment for active traders as long as you protect most of your gains during the big pullbacks or find a way to take advantage of them.

Try my subscription service which includes a private Twitter feed with option and stock ideas, emails with concise market commentary and actionable swing, intraday, and position trade ideas, the Momentum 40 list of market leaders, and much more. See some of the recent testimonials.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed options and stock ideas shared on my private Twitter stream and emails for subscribers.

Check out my free weekly email to get an idea of the content I share with members.

Disclaimer: Everything I share is for educational and informational purposes only and it should not be considered financial advice.