Apple, the stock and the company, is everything but not typical

Most momentum stocks go through 3 main stages:

1) Earnings growth leads price growth. There is sudden acceleration in earnings growth that starts a process of repricing, but most investors are still cautious with the new name. They either don’t trust the sustainability of the story yet or haven’t heard about it. This period could continue anywhere from 6 months to 2 years. (think in terms of Hansen Natural in 2004 – 2005)

2) Price growth leads Earnings growth. At this stage the stock and its story are widely known and understood. The market projects the current levels of growth into infinity and it proactively discounts the best case scenario. This stage typically continues anywhere from 6 to 18 months. (think in terms of $MNST in 2006 – 2007 or $NFLX mid 2010 to mid 2011)

3) Either price growth and earnings growth start to go hand in hand or price growth drops below earnings growth ( as it is often the situation with ex- momentum leaders)

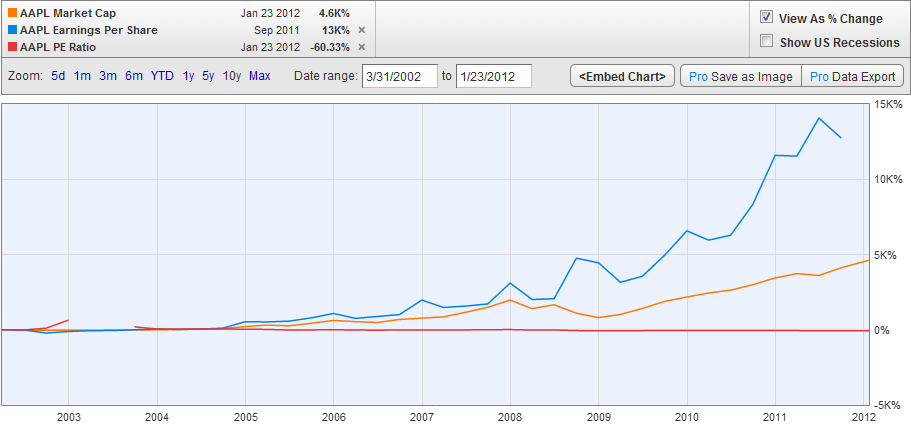

As you can see from the chart above, $AAPL is not following this pattern. While its market cap has increased 46 times for the past 10 years, its earnings per share growth has been even more impressive – 130 times. The EPS growth was offset by a 60% decline in the P/E multiple that the market is willing to pay. P/E often reflects investors’ expectations for near-term growth. As Nicholas Darvas liked to point out:

It is the anticipation of growth rather than the growth itself that leads to great profits in growth stocks. The biggest factor in stock prices is the lure of future earnings. The dream of the future is what excites people, not the reality

Walmart’s shareholders have experienced that personally. Over the past 10 years, $WMT’s EPS have more than doubled, while the market cap of the giant retailer fell 21%

The law of big numbers’ effect is commonly known and it is already discounted

For more than three years, investors have been pointing out that the gigantic size of Apple will limit the pace of its growth. Apple has proved them wrong, but Apple has been an exception. Historically, size has been an enemy of fast growth. Eventually, the naysayers will be right, but this might not matter.

Everyone and his grandmother has heard of this thesis and it is already discounted by the market in some form. How else would you explain the fact that $AAPL is trading at 15 times P/E while it is growing its earnings at 50%. The market clearly anticipates slowdown in earnings and if there is a surprise, it is likely to be on the upside.

Should Apple Pay Dividends – Not Today

There have been many discussions lately about the money hoarding by the big U.S. tech companies. The common denominator is that $AAPL and $GOOG should start paying dividends. At this point, this suggestion is ill-advised and doesn’t make any sense.

Apple’s current ROE is 41%, which means that it makes 41 cents for every $1 of its capital. Logic says that if Apple’s shareholders cannot find an investment with higher than 41% return, they should not want to get paid dividends. Apple is still using their capital wisely.

Expectations Going Forward

Over the past few quarters, it has become a tradition for $AAPL to appreciate in front of its earnings report, reflecting general expectations for positive surprise. The price action after the report hasn’t been that inspiring as “buy the rumor, sell the news” effect has dominated. I don’t expect this quarter to be any different, but anything is possible.

Disclosure: At this point of time, I don’t have a position in $AAPL