Biotech stocks have gone parabolic over the past year, to a point that many have started calling them a bubble. Here’s the thing about sustained market trends – they always have an explanation, they always have a catalyst. In this case, I don’t refer to our natural desire to live longer and healthier in a world that is aging quickly. There is one very simple reason why healthcare stocks have become a bastion of momentum – The Affordable Healthcare Act.

Under Obamacare, there are more people with health insurance and therefore more people being able to afford expensive drugs – subsidized by the taxpayers. The system is not sustainable in the long-term, but it will boost many biotech companies’ cash flows in the next few years. The stocks market has been discounting exactly that.

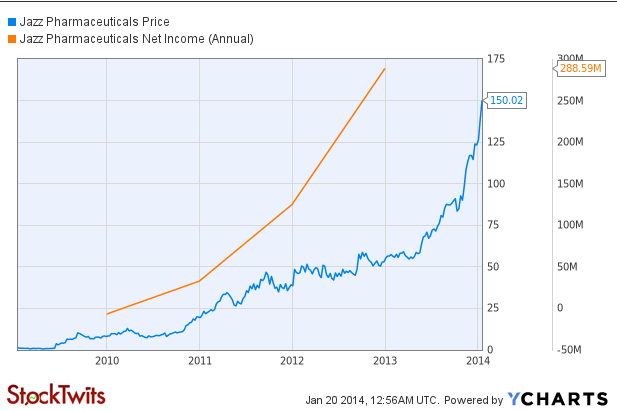

The trouble with healthcare names is that many people are afraid to touch them for anything more than a quick trade or dedicate a sizable part of their portfolios. Biotech stocks are considered too volatile, too explosive, too unpredictable. In any given year, usually the best and the worst performing stocks come from the biotech sector. From one side of the coin, you could have $JAZZ, which went from $1 in 2009 to $150 today. From another, one day you could wake up to a 50% haircut if your company’s drug does not get a FDA approval. Not all biotechs are from the same pond. $JAZZ didn’t get from $1 to 150 overnight. It has been consistently trending for 5 years. It has been consistently growing its earnings.

They say that the biggest opportunities are outside of your comfort zone and the juiciest market returns are where very few are willing to go. We all feel more comfortable investing in businesses we understand, in products we can touch, services we can experience. There is nothing wrong in that. This is the approach that helped Peter Lynch make a name for himself. The big question is, are we not missing big time on some incredible opportunities by focusing only on what we understand and can explain? Doesn’t it make sense to dedicate part of our portfolio to stocks, we like only because of the price action and nothing else? I don’t know about you, but for me it does.