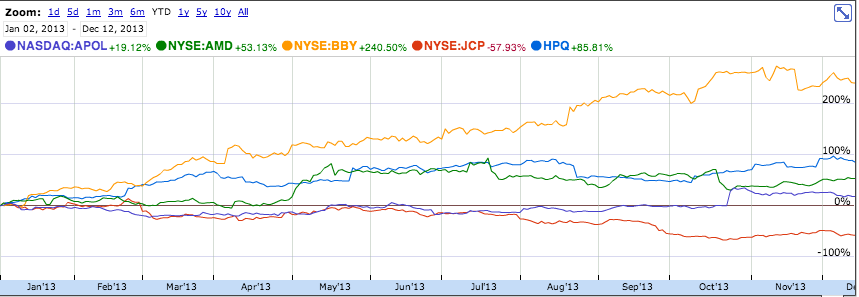

2013 has been an year of huge comebacks and massive short squeezes. Some of the most hated stocks in 2012 – NFLX, FSLR, BBY, ended up being among the best performers in 2013. Let’s take a look at the S & P 500 five best and worst performers from 2012 and how they have done in 2013 so far:

The worst S&P 500 performers in 2012 were:

$HPQ -42.7%

$JCP -42.8%

$BBY -46.5%

$AMD -55.6%

$APOL -61.2%

Here’s how they have done in 2013 so far. Aside from the continues disaster in JC Penney and the subpar performance in Apolo, the other three have had quite a comeback. The average 2013 gain of the 5 worst 2012 performance is +68%.

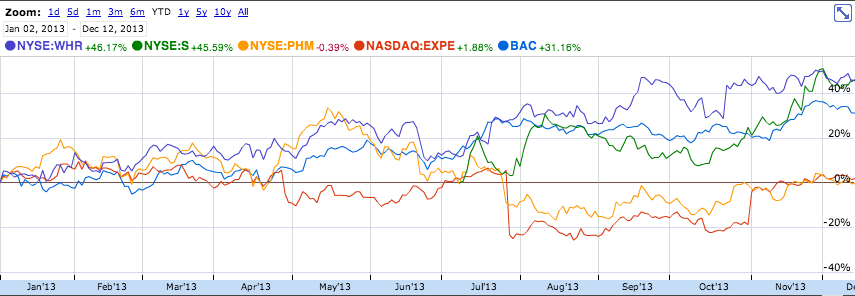

Here are the top 5 SPX performers from 2012

$BAC +109.4%

$EXPE +115.1%

$WHR +118.7%

$S +142.3%

$PHM +187.8%

How have the top 5 performers of 2012 done in 2013 so far? Their average performance so far in 2013 is 24.9%, which is about average market performance.

Here are the best 5 SPX performers for 2013 so far: NFLX, MU, BBY, DAL, PBI

And the worst 5 S &P 500 performers for 2013 so far: JCP, NEM, CLF, TDC, EW