In this paper, James Montier points out the absurdity of using the Discount Cash Flows model to value financial assets. Our empirically proven inability to forecast cash flows far into the future and the extreme difficulty of defining a proper discount rate substantially limit the usefulness of the model. The author points out three alternative methods as a way to measure value. The paper is well worth the read in its entirety, but here is a quick summary of the main points:

Jim Leitner on Confirmation Bias

Humans in general are biased and look for confirmatory evidence. When someone is bullish on oil, they tend to pick the pro-oil arguments in whatever they read. Very few people train themselves to look for dis-confirming evidence.

It is very difficult to practice the latter, but you should train yourself to ask why you believe your longs might go down, not why they should go up.

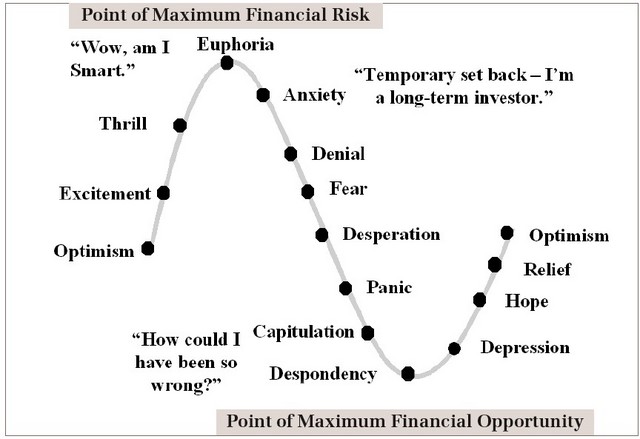

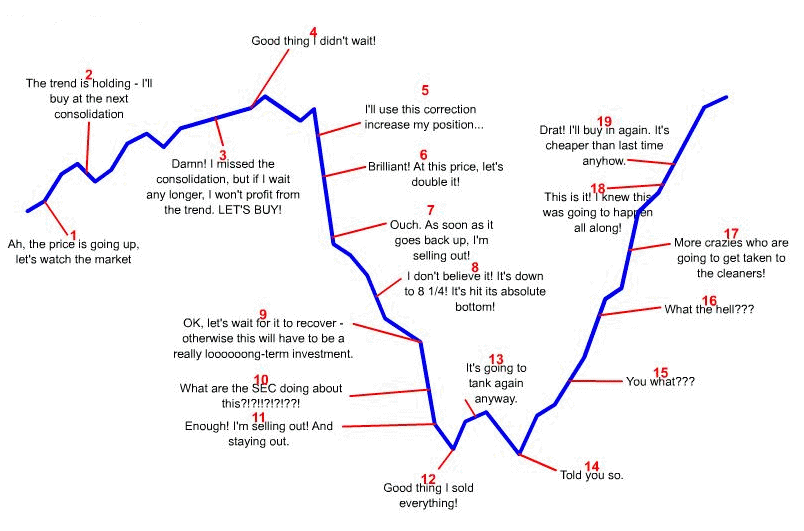

Investors’ sentiment

Barry Ritholtz has an excellent post analyzing why investors’ sentiment is always slow to change at turning points of the business cycle.