October 19. 2016 marks 29 years since the so-called “Black Monday” when Dow Jones lost 22% in a single day. Coming into Black Monday, DJIA was already down 20% from its annual highs achieved in August and trading below its 200-day moving average. Paul Tudor Jones, who was one of the lucky guys to make a fortune in 1987 says that he used the 200-day MA as a sign get out and get short. He made 127% net of fees that year.

Not everyone was as fortunate as PTJ in 1987.

Stanley Druckenmiller lost a lot of money during the crash by trying to pick a market bottom.The Friday before the 1987 crash, Druckenmiller goes from net short to 130% long. Here is his conversation with Jack Schwager in The New Market Wizards’ book:

– You’ve repeatedly indicated that you give a great deal of weight to technical input. With the market in a virtual free-fall at the time, didn’t the technical perspective make you apprehensive about the trade?

– A number of technical indicators suggested that the market was oversold at that juncture. Moreover, I thought that the huge price base near the 2,200 level would provide extremely strong support— at least temporarily. I figured that even if I were dead wrong, the market would not go below the 2,200 level on Monday morning. My plan was to give the long position a half-hour on Monday morning and to get out if the market failed to bounce.

***

Another important lesson to be drawn from this interview is that if you make a mistake, respond immediately! Druckenmiller made the incredible error of shifting from short to 130 percent long on the very day before the massive October 19, 1987, stock crash, yet he finished the month with a net gain. How? When he realized he was dead wrong, he liquidated his entire long position during the first hour of trading on October 19 and actually went short. Had he been less open-minded, defending his original position when confronted with contrary evidence, or had he procrastinated to see if the market would recover, he would have suffered a tremendous loss. Instead, he actually made a small profit. The ability to accept unpleasant truths (i.e., market action or events counter to one’s position) and respond decisively and without hesitation is the mark of a great trader.

The infamous day trader, Marty Schwartz had a tough day on October 19, 1987, but he managed to cut his losses quickly:

I came in long. I have thought about it, and I would do the same thing again. Why? Because on October 16, the market fell 108 points, which, at the time, was the biggest one-day point decline in the history of the stock exchange. It looked climatic to me, and I thought that was a buying opportunity. The only problem was that it was a Friday. Usually a down Friday is followed by a down Monday.

The high in the S&P on Monday was 269. I liquidated my long position at 267.5. I was real proud of that because it is very hard to pull the trigger on a loser. I just dumped everything. I think I was long 40 contracts coming into that day, and I lost $315,000.

One of the most suicidal things you can do in trading is to keep adding to a losing position. Had I done that, I could have lost $5 million that day. It was painful, and I was bleeding, but I honored my risk points and bit the bullet.

I thought about going short, but I said to myself, “Now is not the time to worry about making money; it is the time to worry about keeping what you have made.” Whenever there is a really tough period, I try to play defense, defense, defense. I believe in protecting what you have.

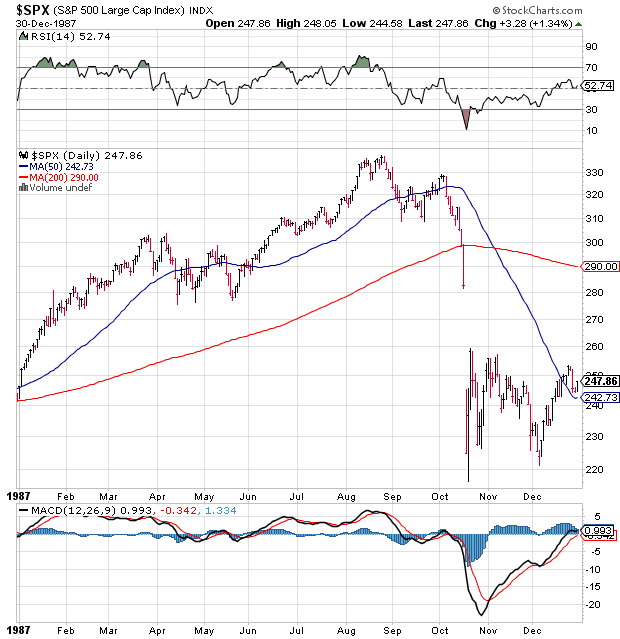

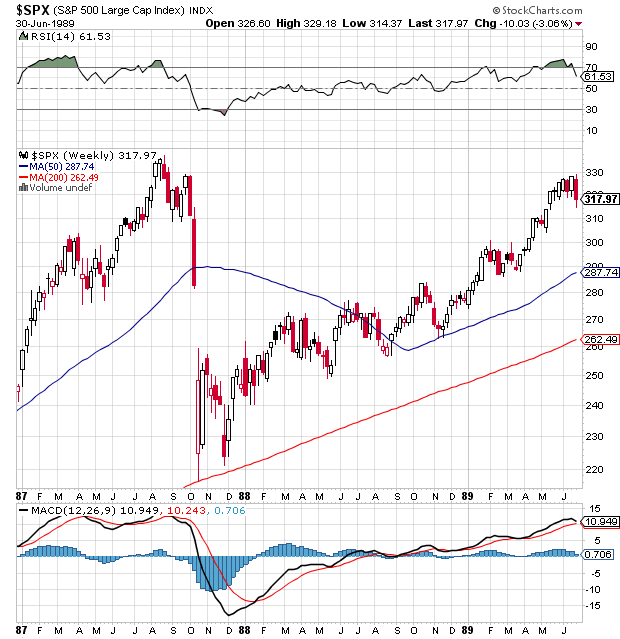

Looking at the charts above, I have a few main takeaways from 1987.

1. Crashes in stock indexes rarely happen when they are near their 52-week highs. They happen below 200-day moving averages.

2) The tape gave plenty of warning signs to decrease substantially your equity exposure. SPX made lower low below its 50dma a week before the event. People had plenty of time to raise cash or hedge their long-term long positions.

3) Any quick pullbacks of 20% or more in the general stock market are usually a good buying opportunity for long-term investors. The market took its sweet time to recover from that flash crash and I am sure that buying the right stocks made a big difference in returns.