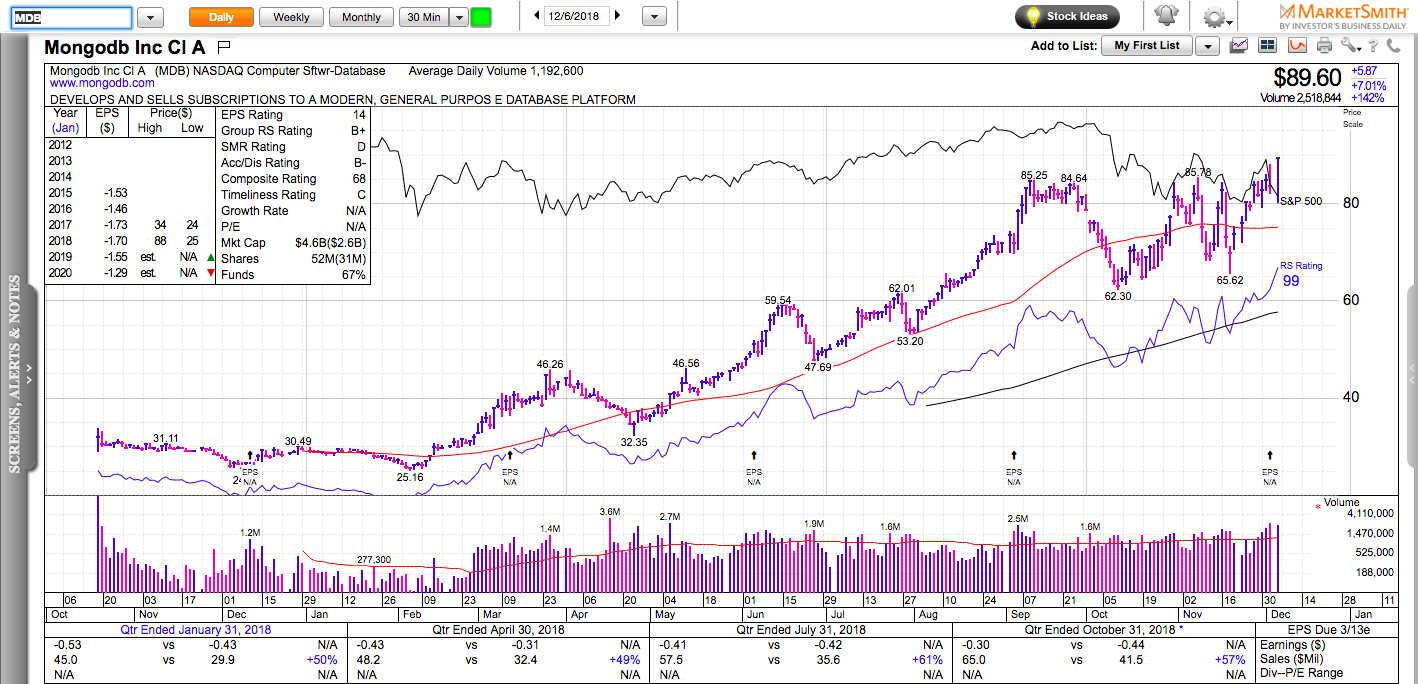

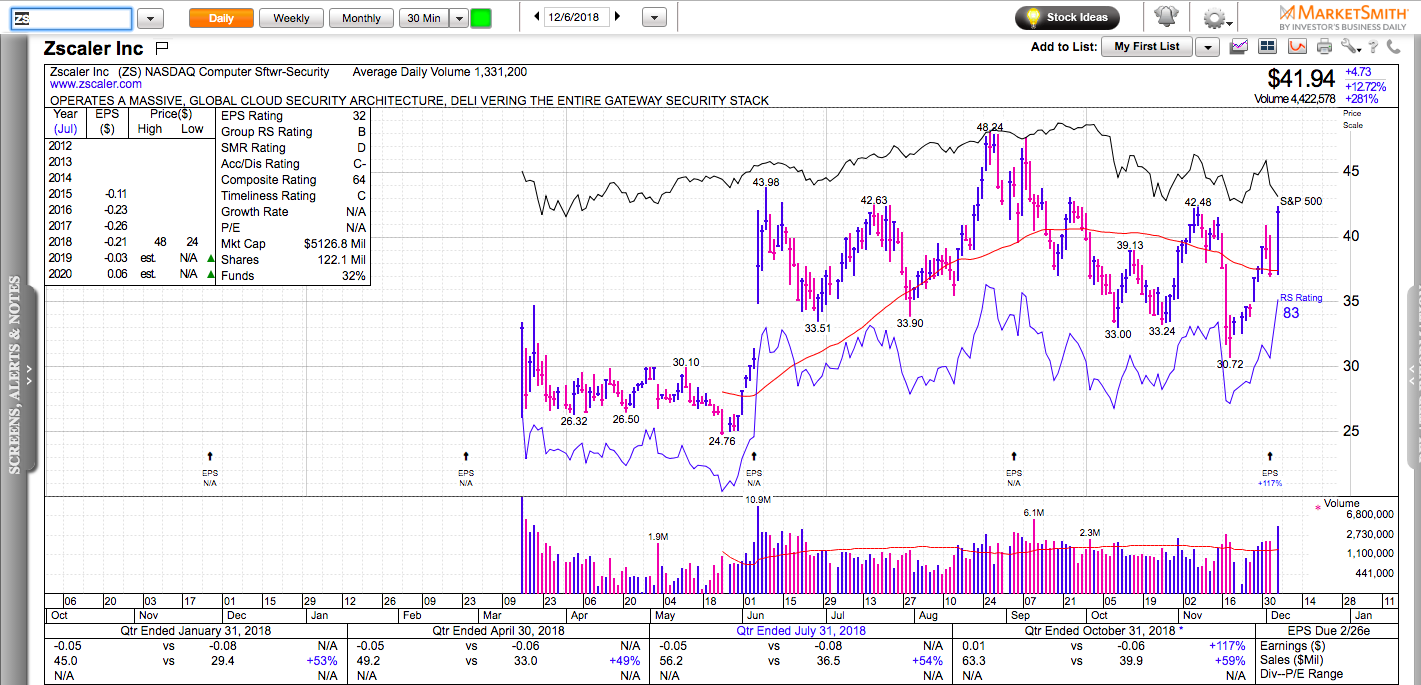

All charts on Momentum Monday are powered by MarketSmith

As active market participants, we need to be prepared for different market scenarios. Here are the two most logical developments for the rest of the year:

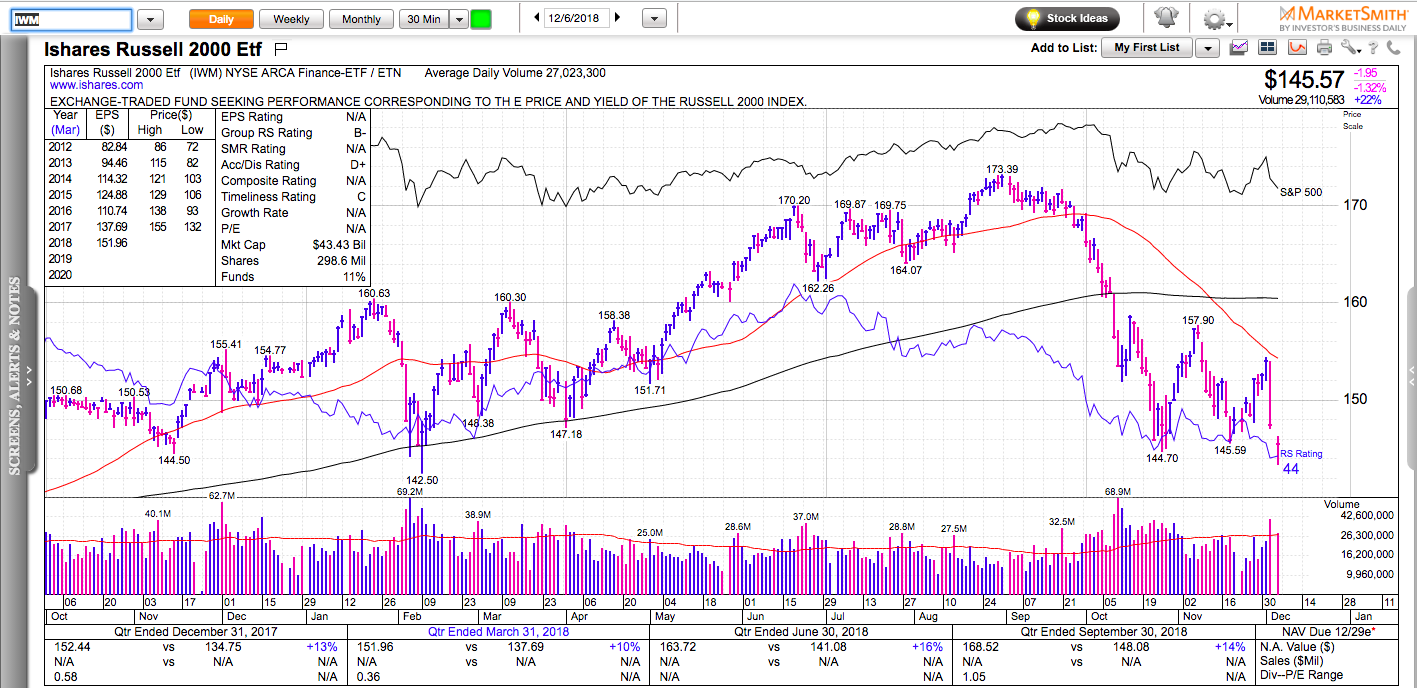

$260 is the line in the sand for the S&P 500. It has been tested numerous times this year. Buyers have consistently stepped up to defend it. If SPY loses it, we will likely see another quick leg lower and 260 is likely to become a level of resistance. Since correlations between stocks are extremely high during corrections, no sector can really be a safe place.

The bullish short-term scenario is 260 holds and the market rallies on some type of unexpected news. Another variation of this scenario is an intraday break of 260 to lure short-sellers and then a strong rally and a close above it. If this happens, the two types of stocks that you would want to own on the long side are:

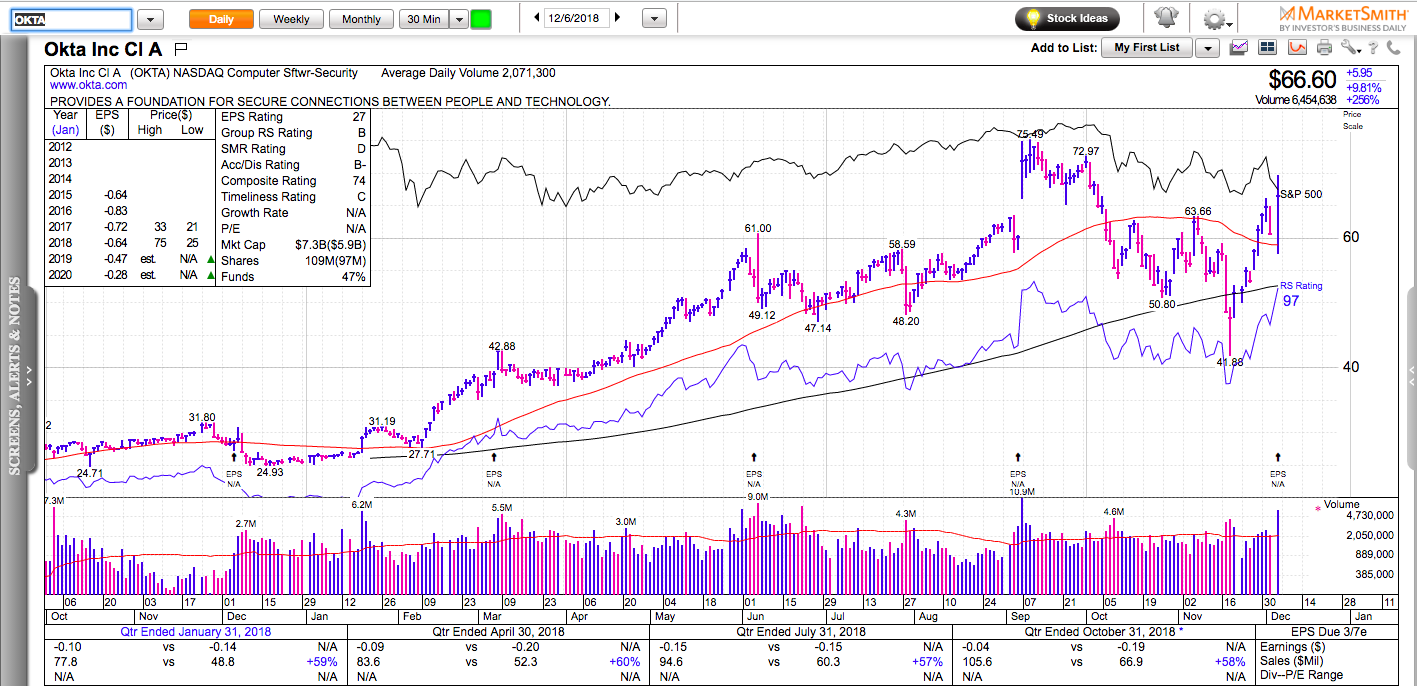

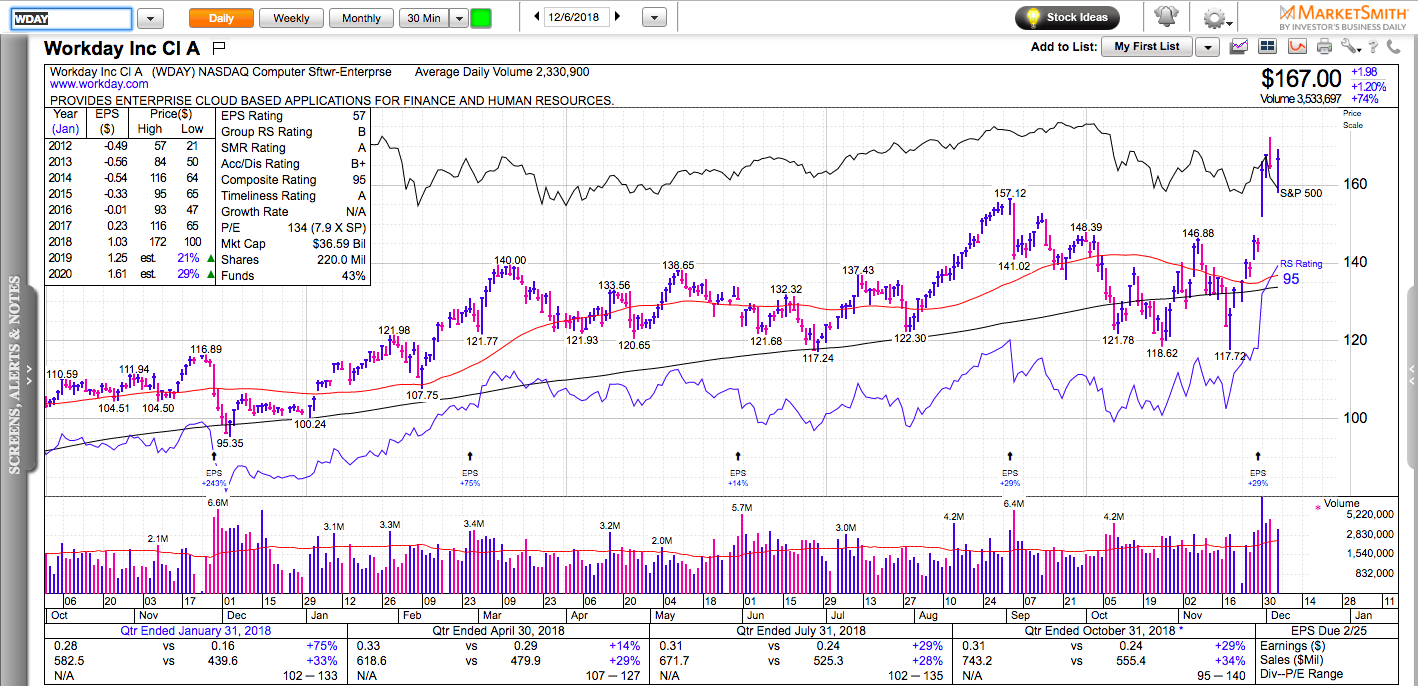

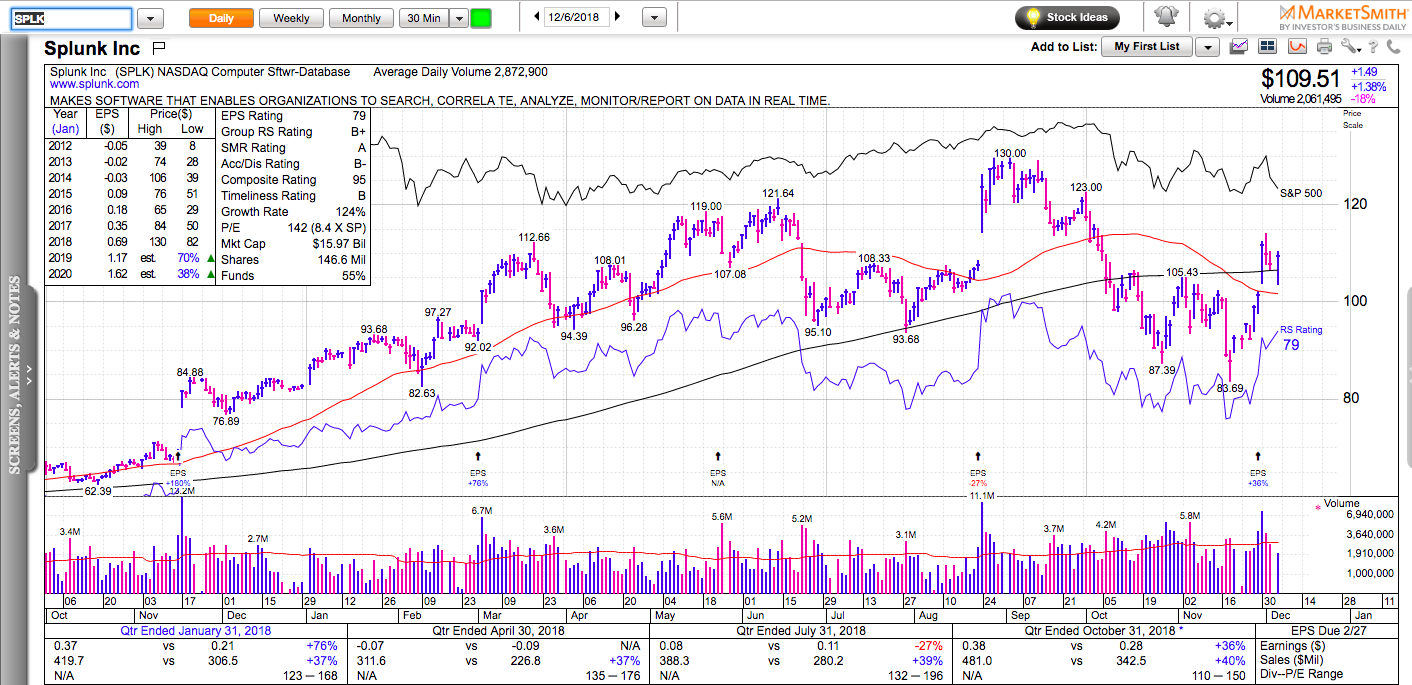

- The ones that have held the best so far – enterprise software stocks like AYX, WDAY, OKTA, SPLK, TWLO, etc.

- The ones that have been hit the worst – Chinese ADRs, high-momentum stocks that have correct 40-50% from their recent all-time highs like GRUB.

On this Momentum Monday, we also discussed the impact of the stock market on the economy and most specifically AAPL and LULU.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.