All charts in this post are powered by MarketSmith

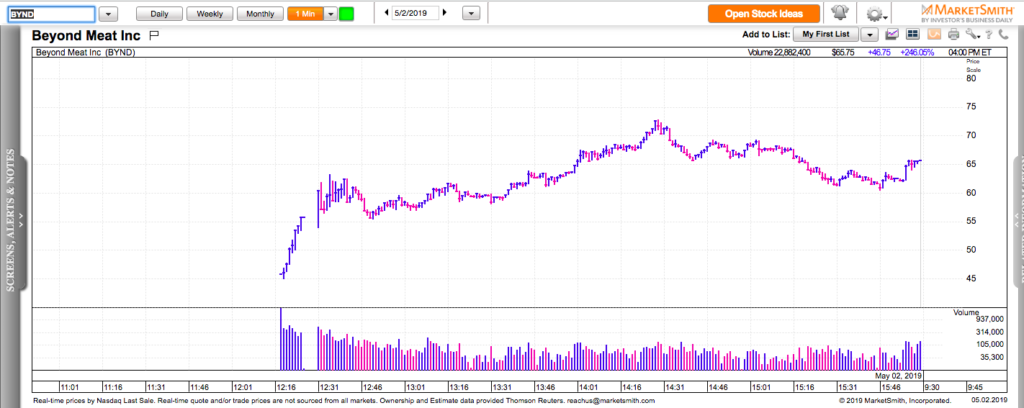

Traders are still hungry of crazy IPOs. The meat-alternative producer Beyond Meat (BYND) started trading today. Its IPO was priced at $25, it opened near $45 and it finished the day at 65 after tagging 75 intraday. A small float and a good story can make wonders for nimble traders in a bull market.

On a side note, have you seen the ingredients of BYND products? Artificial coloring, tons of chemicals, in general – generic easy to copy stuff that no health-conscious person would convert to. The market can be quite irrational in a short-term perspective and BYND can easily tag $100 but over the long-term, the market is a weighing machine and BYND is one heavy vegetarian stock that is very likely to go back below its IPO placement price of $25. I have no current position in BYND.

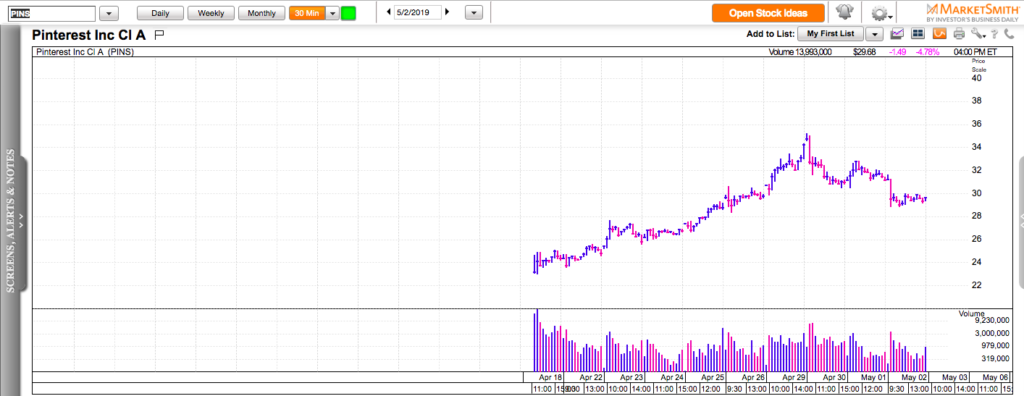

The price action in some recent IPOs has been pretty fascinating: PINS, TW, TIGR, ZM, JMIA, etc. LYFT has been the only dud among the recent public offerings. A small float can cause a lot of troubles if the stock market enters in a pullback mode. The same IPOs that double in a week or so, can drop 50% or more just as quickly.

For those who don’t know yet, a float is the actual number of shares that is currently available for trading.

Float = Shares Outstanding – Restricted Shares.

Most insiders are restricted from selling their shares in the first six months after their company goes public. This is why many new public offerings start with a float that is a small fraction of the total outstanding shares. For example, Pinterest currently has a float of 75 million shares vs 510 million outstanding shares.

Check out my two best trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.