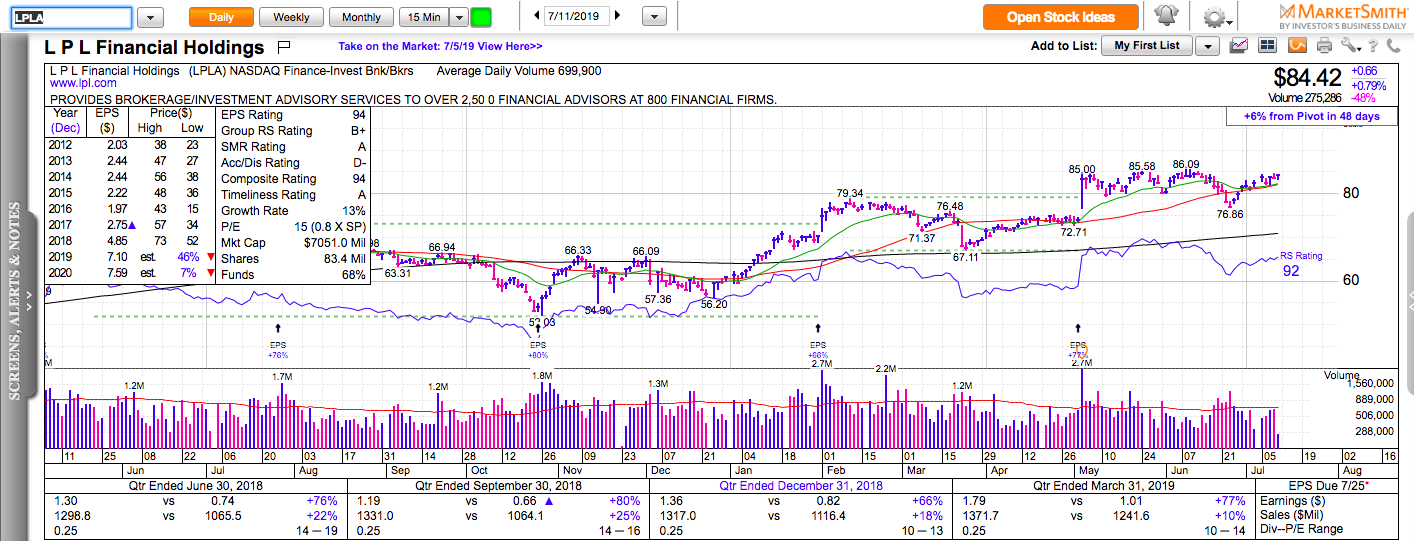

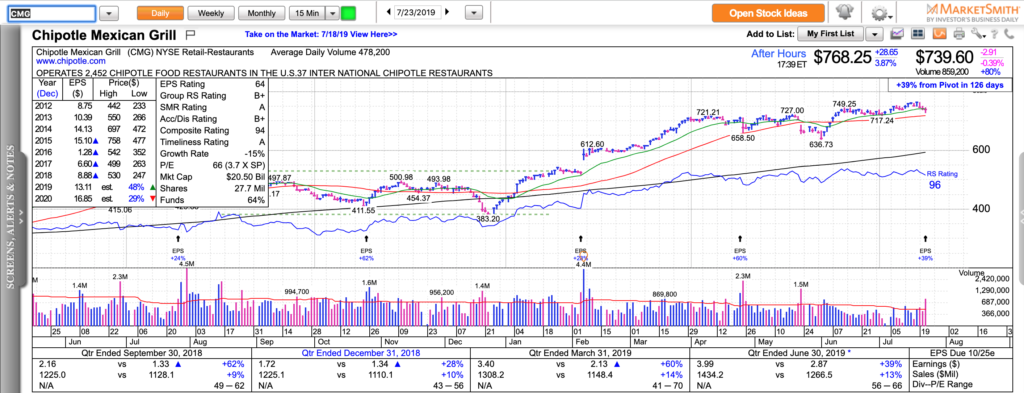

All charts in this post are powered by MarketSmith

Chipotle is trading at new all-time highs after beating earnings estimates. Some of the numbers that stand out:

10% same store growth vs 8.4% estimates

99% increase in digital sales, which now account for 18% of all sales.

39% earnings growth

13% revenue growth

20.9% operating margin

150 new restaurant openings are expected

Authorized $100 share buyback

Labor cost fell 130bps to 25.7% of sales

6.2% of CMG’s float is short which represent about 3.5 days to cover. There is a potential for a short squeeze tomorrow. CMG traded between 763 and 770 in the afterhours session. If we see a breakout above 770 near the open tomorrow, there might be a run to $800. The previous all-time highs near 760 should act as potential support.