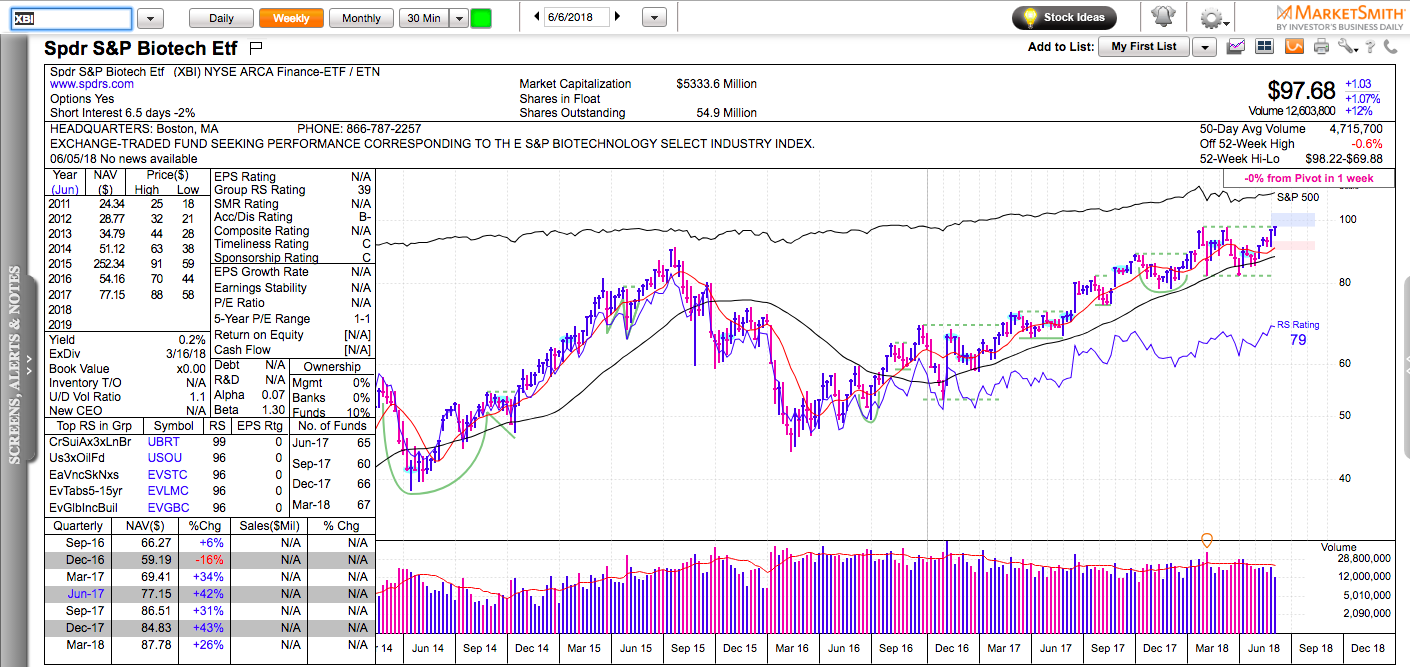

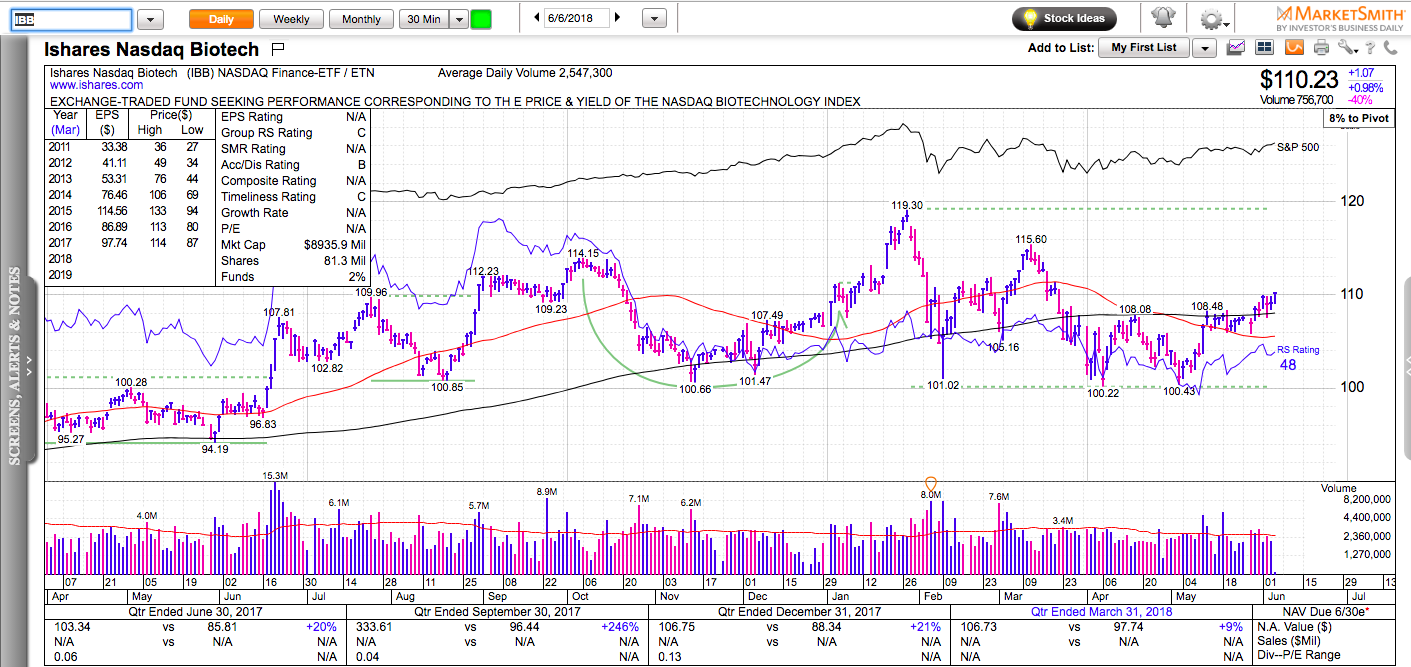

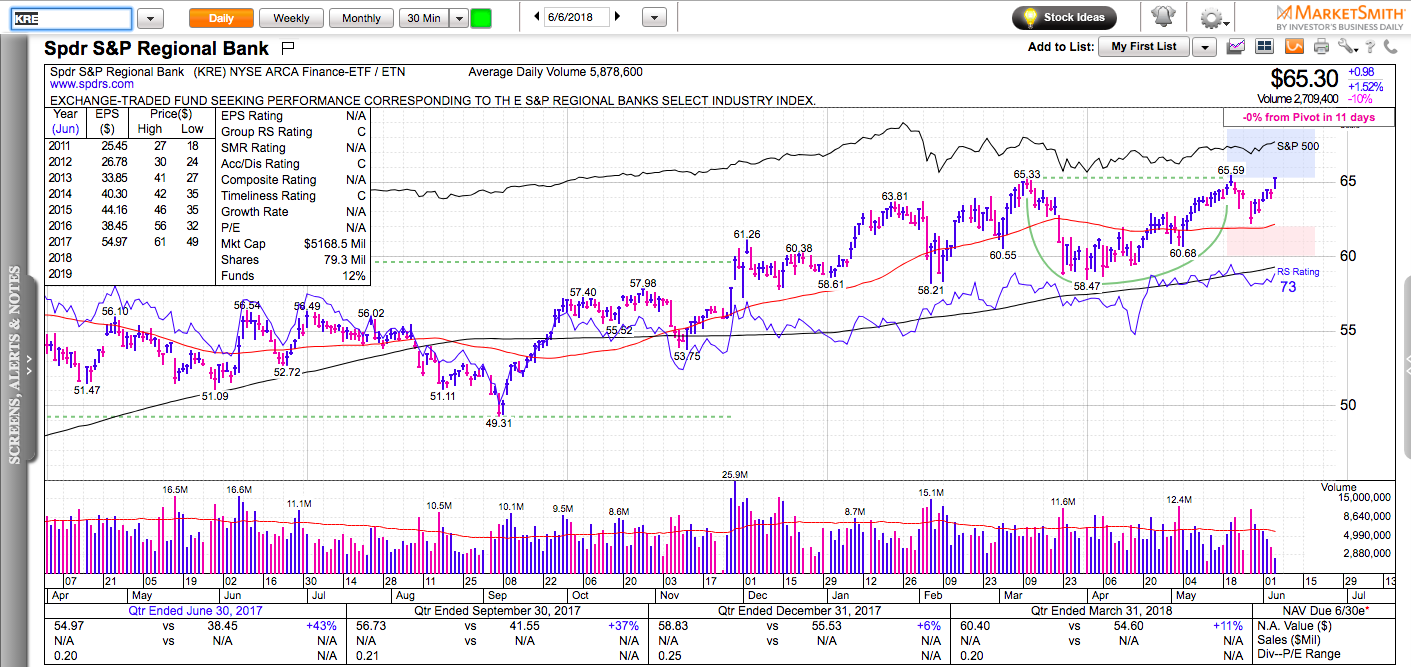

Charts in this post are powered by MarketSmith.

Even the minor dips in the major U.S. stock indexes keep getting bought. Google, Apple, Amazon, Facebook, and Netflix are at or near their all-time highs. In the meantime, emerging and most foreign markets continue to struggle below their 200-day moving averages. The divergence between U.S.and foreign stocks in 2018 has been astounding. It cannot be explained only with the strength of the U.S. Dollar, which is barely up year-to-date: +2.9%.

The IPO market is on absolute fire. It hasn’t been this hot since 2013 when we saw a bunch of biotechs doubling and tripling in a very short period of time. This time, the heroes are software stocks.

We cover the following tickers: QQQ, ETSY, MELI, EEM, EWG, TWLO, TWTR, ADSK, SFIX, etc.

Disclaimer: everything on this show is for informational and educational purposes only. The ideas presented are not recommendations to buy or sell stocks. The material presented here might not take into account your specific investment objectives. I may or I may not own some of the securities mentioned. Consult your investment advisor before acting on any of the information provided here.