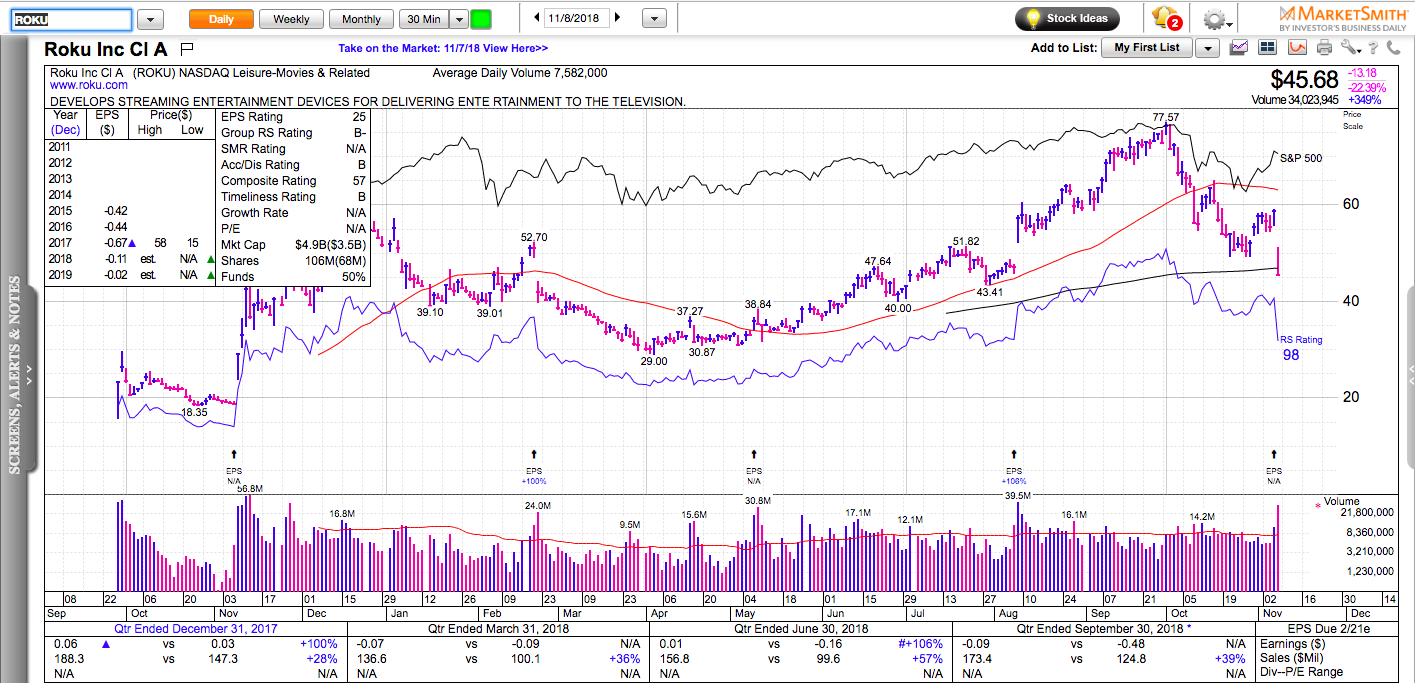

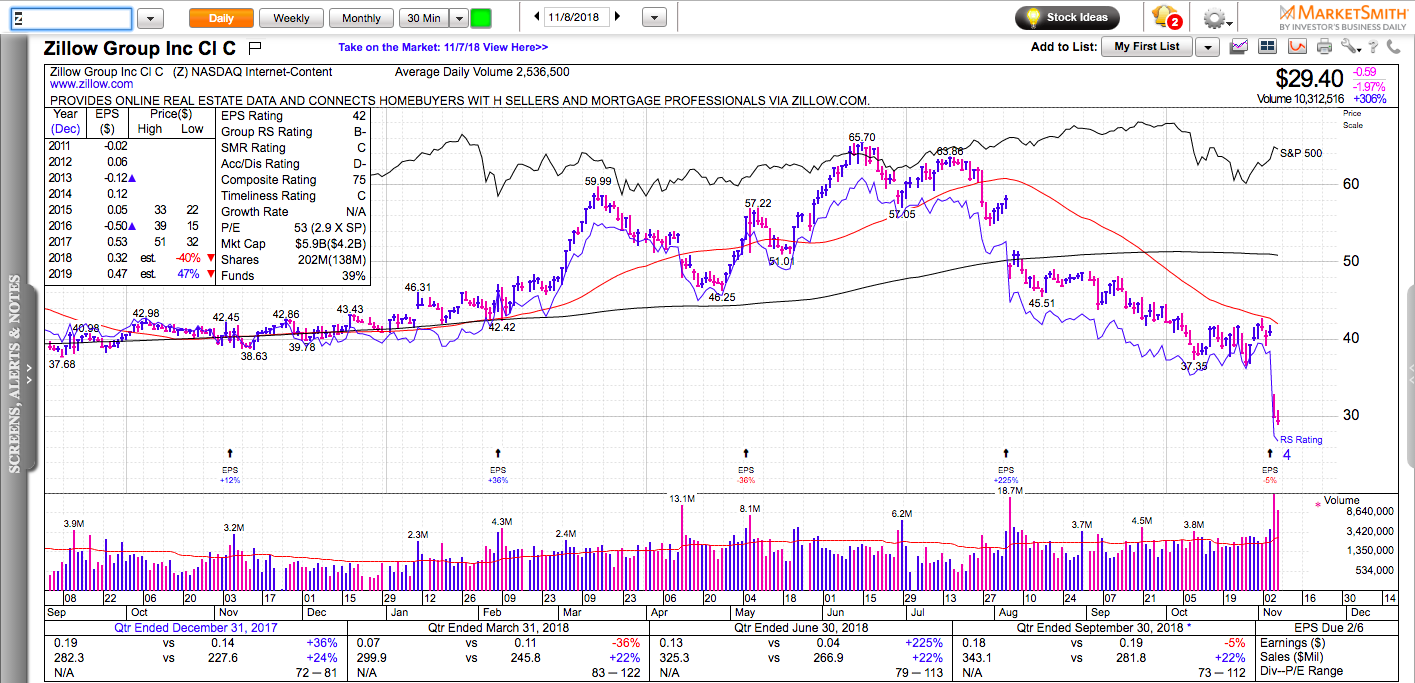

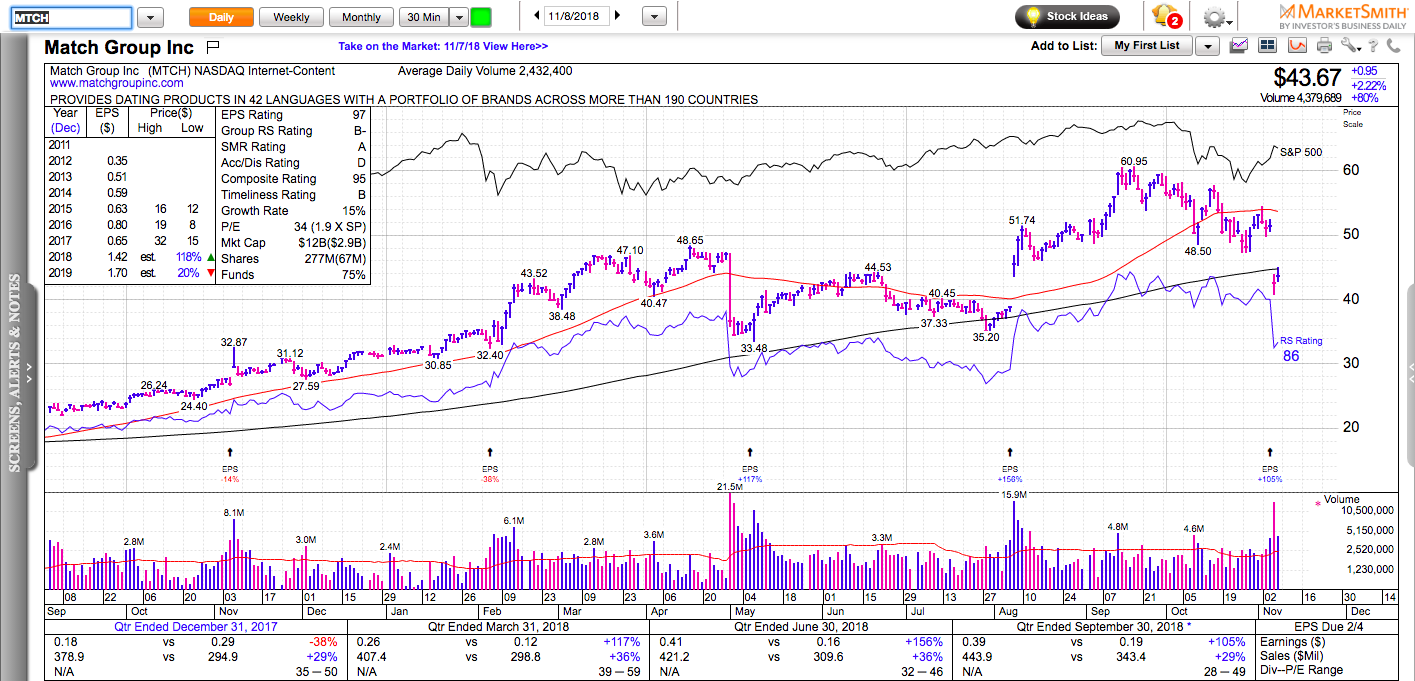

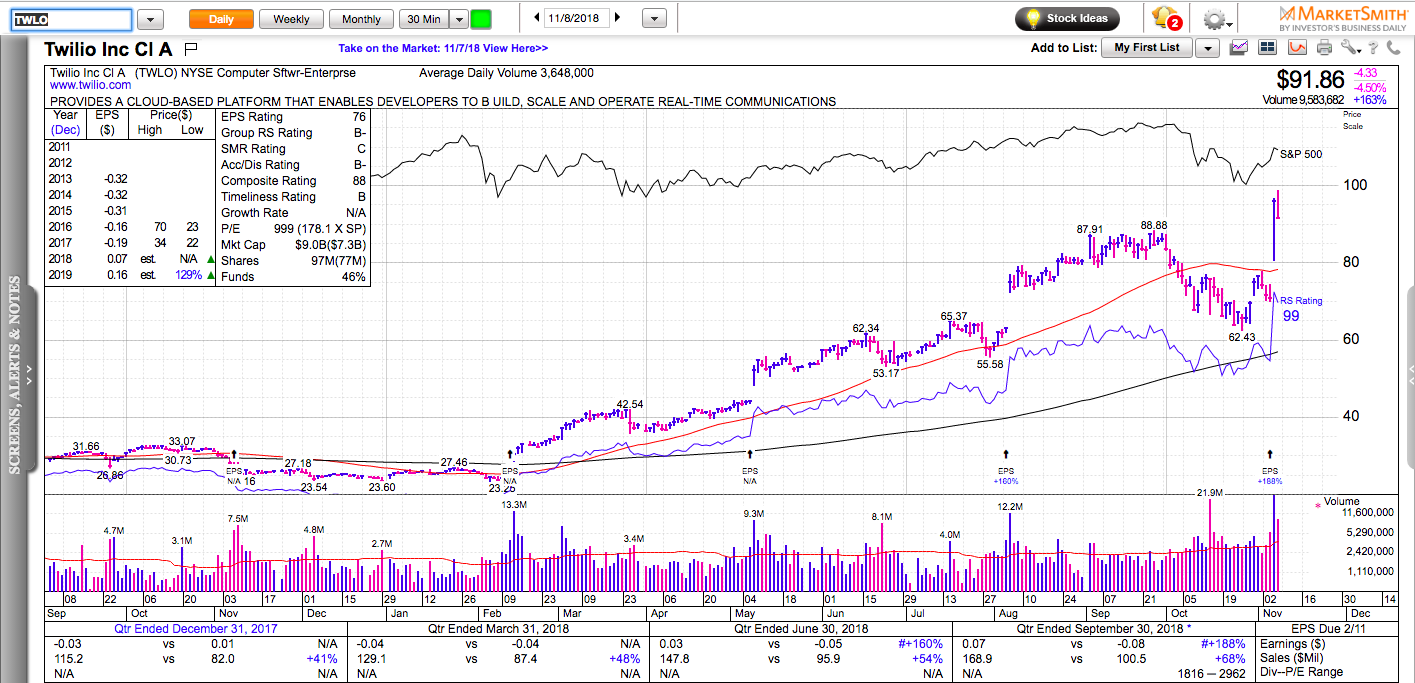

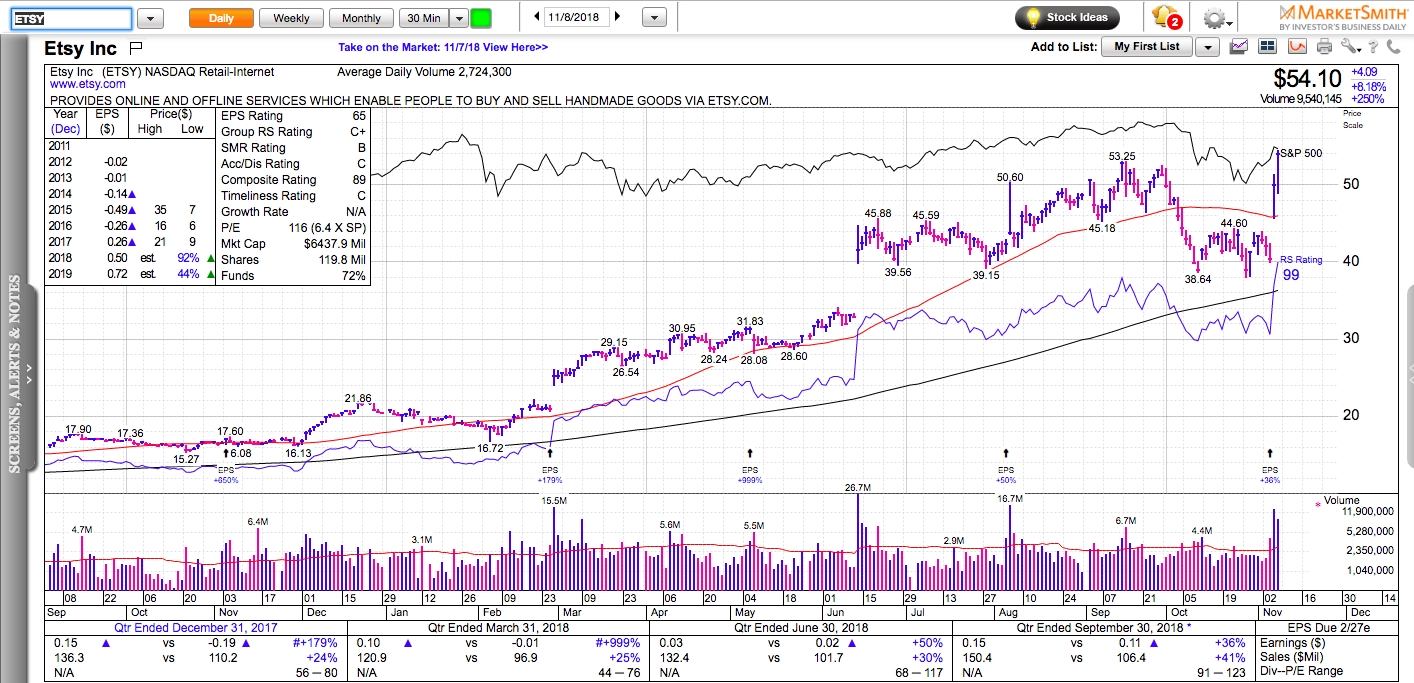

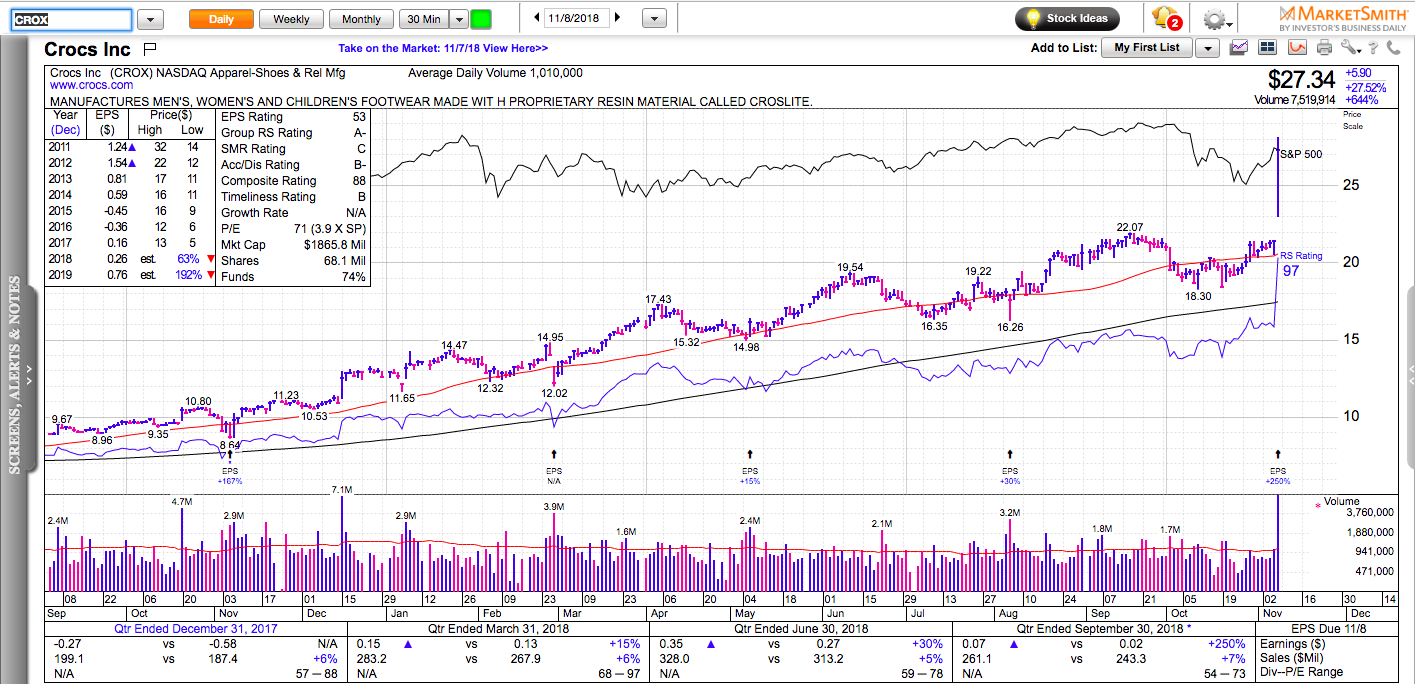

All charts on Momentum Monday are powered by MarketSmith

The post-election rally didn’t last long. Stocks are under pressure again. QQQ and SPY are at important pivotal levels. Will QQQ bottom around 165-166, make a higher low and make another attempt to close above its 50-day moving average or it will have another leg lower. Both are equally likely. With elections out of the day, the market will focus on tariff negotiations, earnings growth, and the Fed.

Semiconductors, tech, China, biotech, financials are leading to the downside. Select retailers and restaurant stocks continue to show relative strength.

Don’t forget to check out my latest book: Swing Trading with Options – How to trade big trends for big profits.